For the next three months, the agency has ordered a reduction in the rates of 0.5%. What requirements must be met to be able to access the benefit?

The General Administration of Public Revenue (AFIP)through resolution 5535, regulated the benefits in Personal Property for those taxpayers who do not have tax debts. In this way, he arranged a 0.5% reduction in the rate of the tax for the schemes in force during 2023, 2024 and 2025.

The content you want to access is exclusive for subscribers.

Meanwhile, for responsible substitute taxpayersthe AFIP reported that the rate will be 0.375%. To do so, you must have a certificate valid for the corresponding fiscal period.

How to apply for the Personal Property benefit at AFIP

In order to access the benefit, the taxpayer must have submitted and paid in full before December 31, 2023if required, the Personal Property Tax returns relating to fiscal periods 2020, 2021 and 2022.

AFIP

AFIP announced tax benefits for compliant taxpayers.

In this sense, if these requirements are met, the taxpayer must carry out the following: next steps on the AFIP website:

- Access the Registration System/Benefit for Compliant service available on the site by using the tax code with security level 3.

- Select “Personal Property Tax Benefit art. 64” if the property is a natural person or undivided estate.

- Select “Benefit for Substitute Managers art. 65” if the substitute managers are SME category.

Personal Property Tax Benefits: Tables with rates for the new tax periods

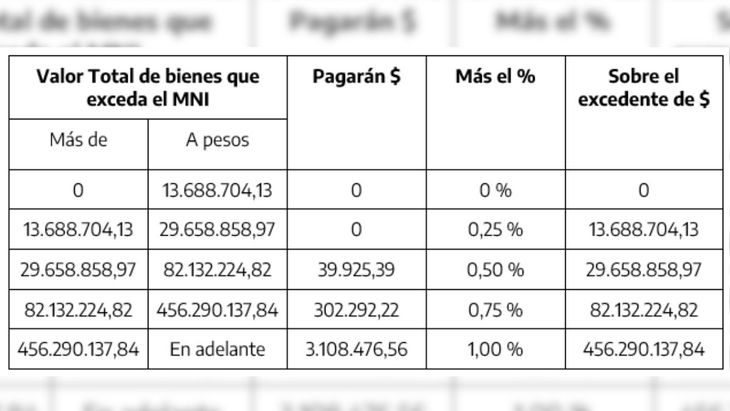

Fiscal period 2023

personal property afip2 .jpg

The table with the rates for the 2023 fiscal period.

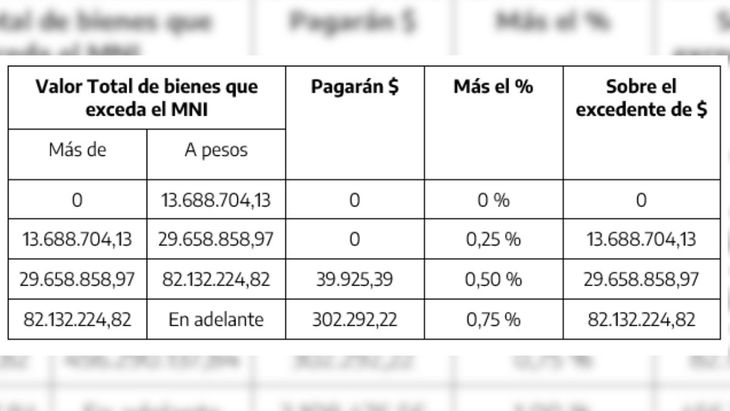

Fiscal period 2024

personal property afip .jpg

The table with the rates for the fiscal period 2024.

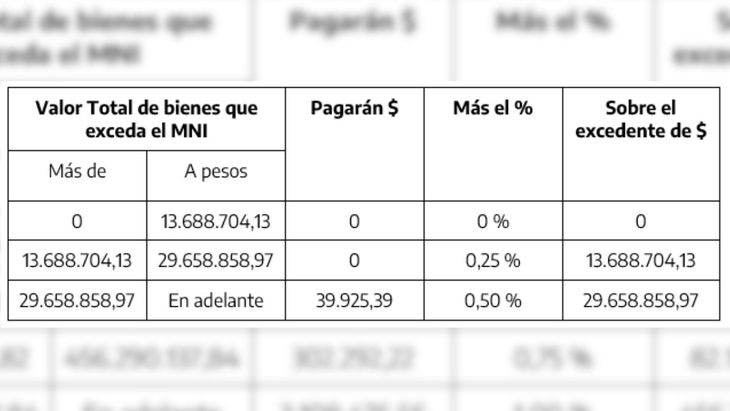

Fiscal period 2025

personal property afip.jpg

The table with the rates for the fiscal period 2025.

Income Tax 2024: how is the procedure at AFIP

The National Government regulated the reform to the Income tax established in the fiscal package. Workers who earn gross salaries of $1.8 million in the case of single workers, and $2.2 million in the case of married workers, will begin paying this tax with the salaries they receive in August.

To fill out the form, each taxpayer must follow these steps:

-

Enter the AFIP website with your tax code

-

Search for the Siradig-Worker interactive service

-

Complete all the required information on each of the tabs of the form.

-

Go to the “Deductions and Tax Allowances” section

-

Generate a preview every time data is added

-

Check the option to send to the employer once the information is completed

-

Check previously submitted forms using the option provided by the system

Source: Ambito