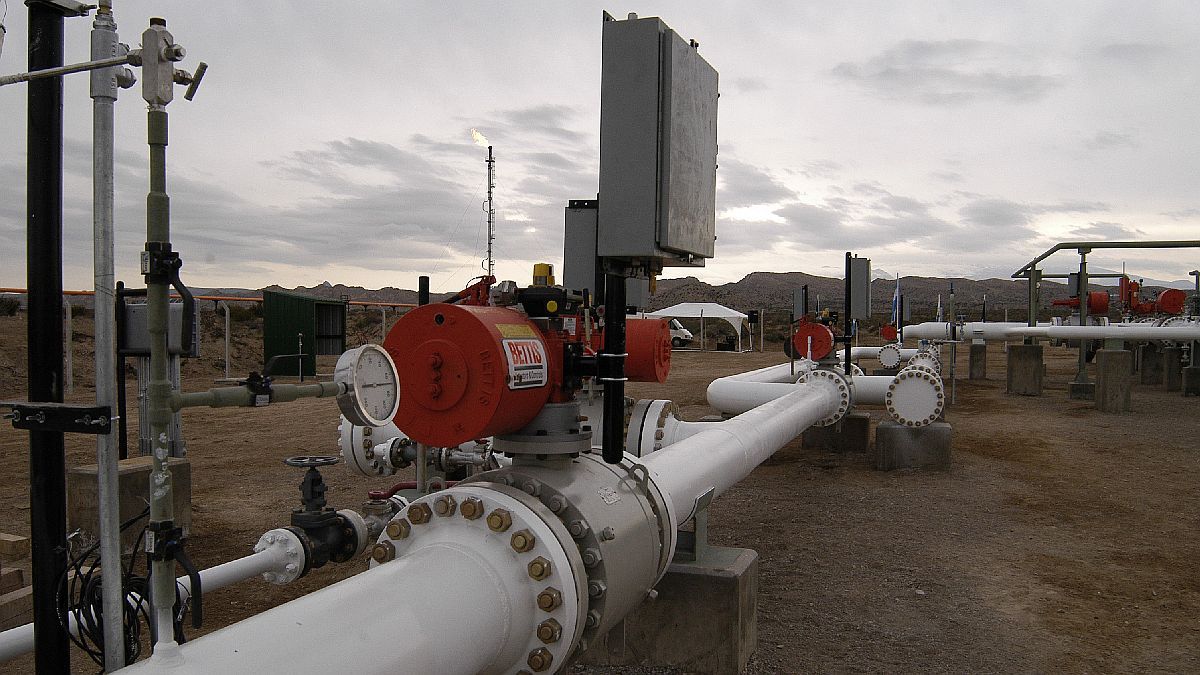

The Treasury will assume the cost of maintaining the subsidies, so the electricity generators and natural gas producers that participated in the Gas AR Plan will receive “compensation.”

The Treasury bought the central bank dollar bonds for almost US$50 billion to the Central Bank (BCRA) with a settlement date of Tuesday. These titles will be kept in the Treasury Department dependent on the Ministry of Economy to be delivered by companies that adhered to the Gas.AR Plan program. This was resolved by the Joint Resolution 43/2024 published in the Official Gazette.

The content you want to access is exclusive for subscribers.

According to the standard, The electric generators and natural gas producers that participated in the AR Gas Plan During 2020-2024 they will receive compensation from the Energy Secretariat resulting from the Price Billed to the Natural Gas Distribution Licensees and/or Sub-distributors and the Price Offered by the awarded producer, with an adjustment factor for the seasonal period.

In this regard, a decision had been made Interim Payment Scheme – 85% of the compensation for each monthly period – and will be paid through the delivery of AE38 bonds. In another paragraph it is clarified that the Treasury Department and the Finance Department were authorized to carry out operations of management of liabilities. These operations “may include the restructuring of public debt”, the purchase, sale and/or exchange of financial instruments, such as bonds or shares, currency pairs, interest rates or securities; options on financial instruments and any other financial transaction customary in derivatives markets.

At what price is the AE38 purchased?

The purchase of the AE38 is for an original nominal value of almost US$50,000 million, at a price of $55,800 for US$100, which implies an effective value of $27,470,074,392 to be paid to the BCRA with settlement date July 30, 2024, as carried out today by the Treasury.

In this context, it can be said that it is the The Treasury is responsible for the debt, not only with the companies, but also with the Wholesale Electricity Market Management Company (CAMMESA).), to maintain subsidies to households and not set prices that do not fully reflect the costs of the system.

Source: Ambito