One of the major Wall Street banks has revised its inflation expectations and positively assessed the decline in this indicator. It also estimated the dollar for 2025.

The latest report from Morgan Stanleyrevised downwards the inflation forecast and improved the expectation of economic growth for next year in Argentina. The new figure is less than 30% and is a significant difference from the IMF forecast of 45%.

The content you want to access is exclusive for subscribers.

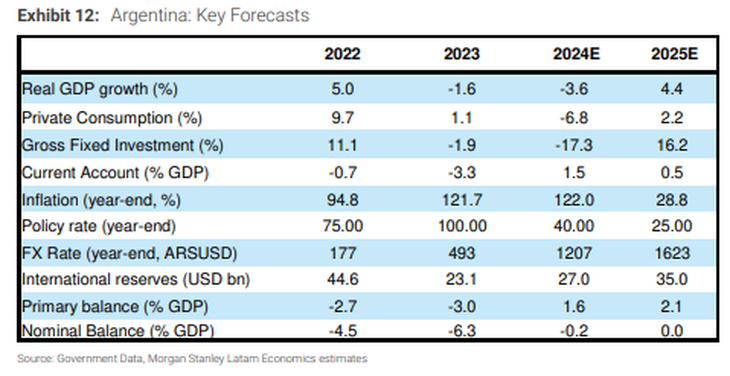

According to the report update “Key Economic Forecast”, Next year, the accumulated inflation in our country will be 28.8%. The forecast improves projections compared to last March’s report, when Morgan Stanley predicted a CPI of 31.6%. In addition, according to the forecast update, Argentina’s GDP will grow next year by 4.4% vs. 3.6% estimated in the previous measurement.

On the other hand, the financial giant modified its projections for the end of the current economic year for Argentina: Accumulated inflation in 2024 will be 122% vs. 207.7% estimated last March. That estimate, however, is above the objectives that the Minister of Economy, Luis Caputo, anticipated to the representatives of different stock exchange agencies, to whom he assured not only that the inflation of this month will be at its lowest level so far this year –which forecasts an index of around 3.7%– but in September the CPI would fluctuate between 0% and 1%, which is well below the Morgan Stanley estimate.

morgan1.png

Morgan Stanley’s inflation forecast for inflation and the dollar

Another correction made by Morgan Stanley indicates that GDP will fall by -3.6% by the end of 2024. The same agent’s report had indicated in March that the economy would fall by -3.3%, which means that expectations worsened.

What Morgan Stanley said about the dollar

Finally, Morgan Stanley forecast the price of the dollar. For 2024, he estimated an official exchange rate of $1207 pesosin line with the official 2% devaluation planned by the government itselfMeanwhile, for 2025, he estimated the official dollar at $1,623 pesos.

What Morgan Stanley said about Caputo’s plan

Morgan Stanley analyzed the new monetary policy and provided a view that is at odds with the market consensus regarding the exchange rate lag and inflation. According to the bank, an adjustment of the official exchange rate at this stage of the program means risking the disinflation process. “We are not in favor of a exchange rate adjustment at this stage “The cost-benefit ratio may not be attractive as the flames of inflation may be reignited,” the agency said.

He paper He also highlighted the migration of debt from the Central Bank to the Treasury and the fact that from now on, interest must be paid with a fiscal surplus. “This is clearly positive”he assured.

Source: Ambito