VW’s profits collapsed in the first half of the year. The core brand is primarily responsible. Things are expected to improve in the rest of the year.

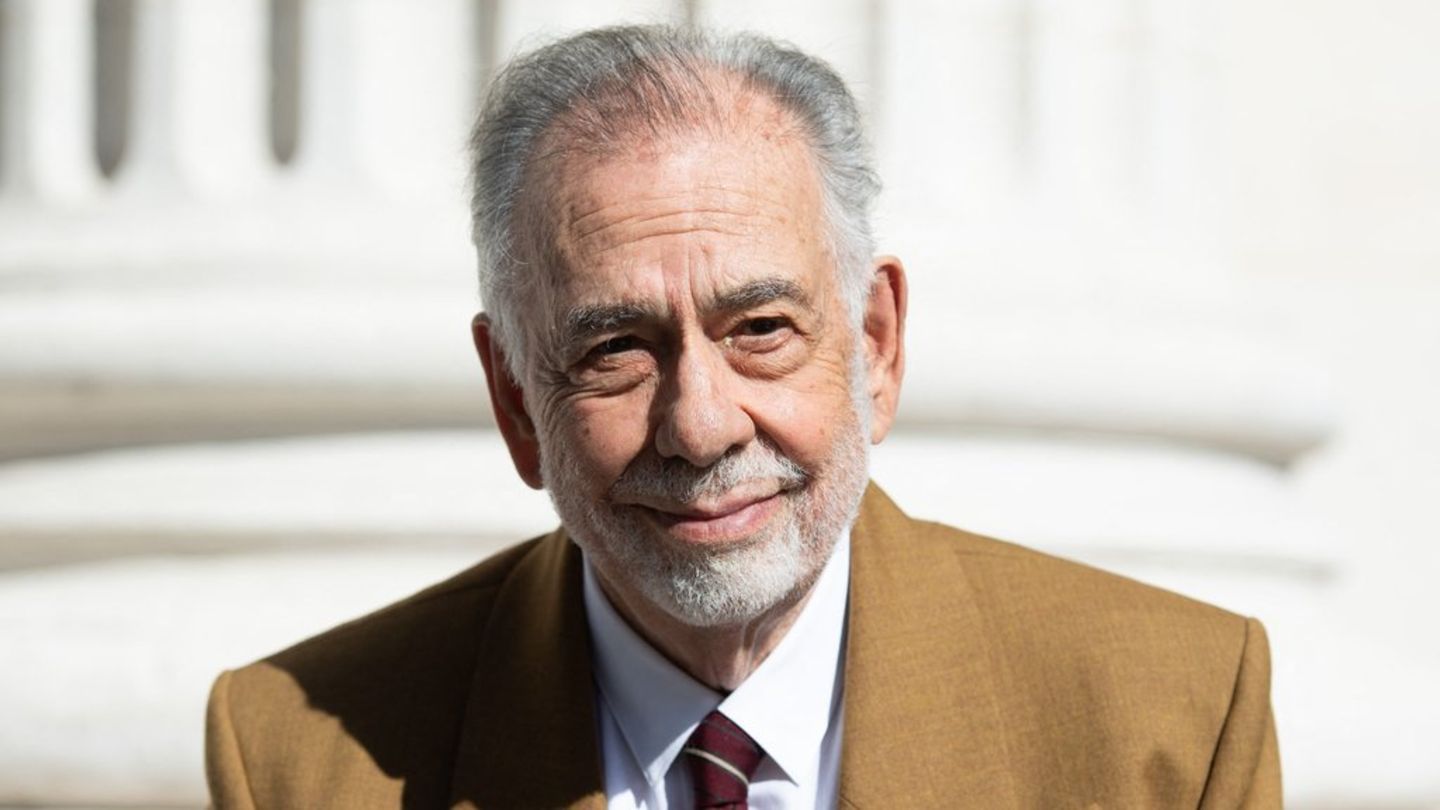

After a weak first half of the year, Europe’s largest carmaker Volkswagen wants to pick up speed again in the second half of the year. Thanks to numerous new models, he expects noticeably better business in the rest of the year, said CEO Oliver Blume at the presentation of the half-year results in Wolfsburg. “Especially in the fourth quarter.” He therefore expressed confidence that he would be able to achieve the annual targets that were lowered just three weeks ago. However, the environment remains “challenging”.

In the first half of the year, VW suffered from weak demand for new cars. Business is particularly weak in China, where the VW Group sells a good third of all cars. Sales shrank by 2.4 percent to 4.3 million vehicles, but turnover increased by 1.6 percent to 159 billion euros thanks to good revenue from financial services. “But what counts in the end is the result,” said CFO Arno Antlitz. And profit after tax fell by 14 percent to 8.5 billion euros. “That is too little for our needs and is well below our potential.”

Core brand Volkswagen remains a problem child

The result was spoiled above all by the already low-profit core brand Volkswagen, whose operating profit shrank by 41 percent. The main reason for this was the costs of the ongoing staff cuts there. The group has set aside 900 million euros for severance payments of up to 474,000 euros per employee, half of which has already been firmly earmarked. In the long term, this expenditure will pay off, said Blume. The recently launched efficiency programs must now be implemented consistently. “Now it’s about costs, costs and costs. Above all for the Volkswagen brand, but also for all other brands.”

Just three weeks ago, the group cut its targets for the year as a whole. Instead of 7.0 to 7.5 percent of sales, the Volkswagen Group is now expected to retain only 6.5 to 7.0 percent of sales as operating profit, meaning that 6.50 to 7.00 euros in profit will remain for every 100 euros in sales. In addition to the reduction in personnel at the core brand, the main reason for this is the possible closure of the Audi plant in Brussels, which could cost the group 1.3 billion euros in the current quarter.

Factories reduce production

Due to weak demand, especially for electric cars, the company has also reduced production at other locations. Wolfsburg, Emden, Zwickau and Audi in Ingolstadt and Neckarsulm have reduced capacity by a quarter and eliminated expensive night shifts. In the remaining two shifts, production can now be carried out much more cheaply, said Antlitz.

In the second half of the year, Blume expects the car market in Western Europe to pick up again slightly. In China, where VW has struggled so far, especially with the booming electric cars market, things will remain difficult in the second half of the year. “We’re struggling in China this year.” Last year, VW had to give up market leadership there to BYD.

Threatening fines due to CO2 fleet target

However, Blume hopes that the greatest effect in Europe will come from the numerous new models that the group plans to launch by the end of the year, including many electric cars. Blume hopes that this will also increase the electric share in the group. In the first half of the year, the group delivered only 317,200 electric models worldwide, 4,400 fewer than in the same period in 2023. That was less than eight percent of all deliveries. For the year as a whole, it is expected to be nine to ten percent.

Blume hopes that this will also help the company to achieve the EU’s stricter CO2 fleet target next year, which calls for a 15 percent reduction in CO2 emissions. “There is still a gap to be closed,” Blume admits. He wants to avoid any fines that will be due if the target is missed. “Every euro paid in fines is a euro poorly invested.” However, it is not yet possible to estimate whether the hoped-for ramp-up in e-mobility will ultimately be enough to achieve the target. “We have to wait and see how the market reacts.”

Because of the weak demand for electric cars, VW now has to think about a possible extension for the combustion engine models, admitted Blume. “We see the ramp-up of electromobility in Europe a little later.” Therefore, flexibility must be increased and the lifespan of the existing models may be extended. It may even be possible to launch a new combustion engine model. However, Blume did not provide any details when asked.

Source: Stern