On the first day of trading in the Treasury bill that replaced the BCRA repurchase agreements, the entities had purchased $10.85 billion. As of July 30, they held $10.38 billion.

Almost two weeks after its launch, The new Liquidity Fiscal Letters (LEFI) show considerable fluctuations in the stock in the hands of financial institutions. In any case, with official data consolidated until July 30, the instrument that replaced the passive repurchase agreements of the Central Bank – within the framework of the so-called “phase 2” of the economic program – for the moment leaves a gap expansionary monetary balance: the thing is, Since its debut, the banks have accumulated a write-off of more than $450 billion.

The content you want to access is exclusive for subscribers.

In practice, the daily variations in the balance of LEFI in the portfolio of financial institutions reflect a kind of “seesaw”. A movement that is similar to that shown by the remunerated liabilities of the BCRA on a day-to-day basis. In fact, the purchase-sale operations carried out every day by the Central Bank and the banks imply a Liquidity management practically equivalent to that with the passessomething that was planned in the very design of the new monetary scheme.

The LEFI They were issued by the Treasury on July 17, then exchanged with the BCRA and finally on Monday the 22nd of that same month operations with these bills began between the entity chaired by Santiago Bausili and the banks. On the day of its debut, financial institutions bought $10.85 billion from the Central Bankan amount that involved the collection of all the pesos that were placed in passive transfers the previous Friday (the last day of validity of that instrument).

Since then, there has been a constant variation in the stock of LEFI in banks’ portfolios. It grew over the next three rounds to reach $11.92 billion (the entities bought more letters), but then began a downward spiral: banks began to dismantle their LEFI holdings and on July 30 (last official data available) there were $10.38 billion left. Thus, Since its debut, these operations have resulted in a monetary expansion of $464,884 million.

Why did banks withdraw LEFI positions? For the same reasons for which they might have needed to unwind swaps at the time: to meet the outflow of deposits from their clients, for temporary liquidity needs or other types of operations.

Monetary expansion in the new scheme

LEFIs are part of the new monetary scheme launched by the Government within the framework of what it called “phase 2”. The objective was to carry out the final migration of the remunerated debt of the Central Bank to the Treasury in order to end the endogenous issuance that represented the payment of the interest on the passive repurchase agreements by the BCRA.

Now, the monetary regulation instrument is a bill issued by the Treasury, which is responsible for paying the interest from a greater fiscal adjustment. The rate is still set by the BCRA and the monetary authority is the one that operates them daily through the purchase and sale it carries out with the banks as a mechanism to manage the liquidity of the system.

Beyond the fact that it allowed the end of endogenous issuance for the payment of interest on the repo, this change did not imply that the expansion of the amount of money stopped. in the economy. As mentioned, it grew by more than $450 billion in this period.

image.png

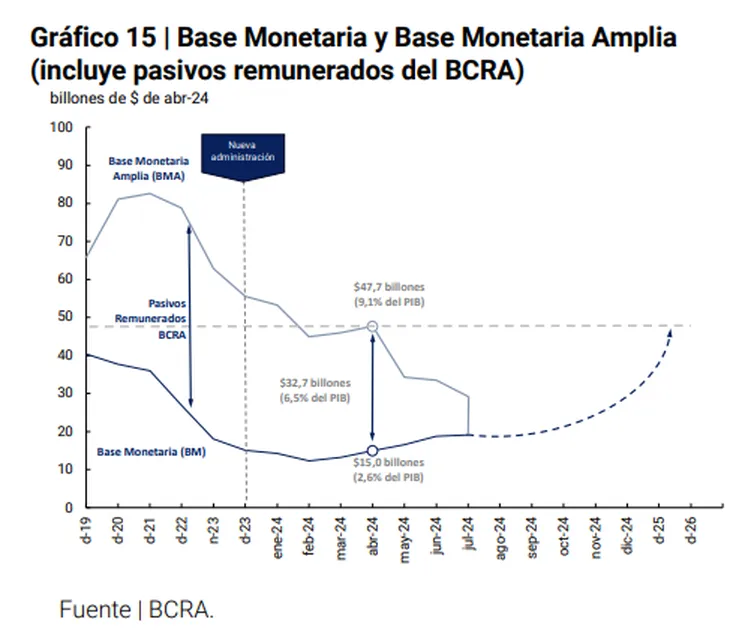

With everything, This is provided for in the economic team’s planIn a recent report, the BCRA noted that it set a ceiling for the broad monetary base at the level existing on April 30 ($47.7 trillion) which is much higher than the current level of the monetary base ($20.65 trillion). And it noted that it expects that there will be a process of remonetization of the economy.

At the time, economist Salvador Vitelli, from Romano Group, analyzed the projections of the BCRA and calculated that, based on the current level of the monetary base (without considering the Treasury deposits in the Central Bank as part of the broad monetary base), the economic team foresees a remonetization of the economy of 176% in real terms by December 2026.

Source: Ambito