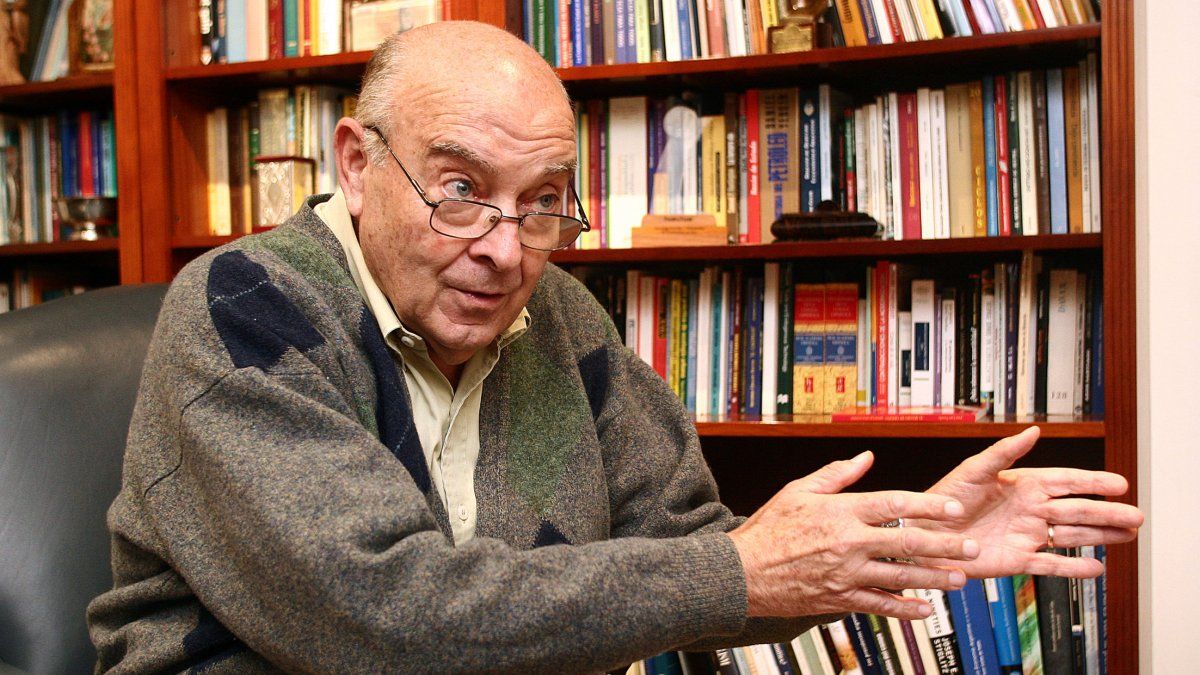

The current exchange rate scheme may be “unsustainable,” warned former Economy Minister Domingo Cavallo, who criticized that “The latest decisions and statements by both the economic team and President Milei himself do not demonstrate any urgency in eliminating exchange controls.” and they do not seem concerned about increasing reserves, a necessary condition to eliminate the risks of default that are still reflected in the magnitude of the country risk rate.”

While he highlighted the “good news” of recent weeks regarding the evolution of inflation, he also warned about the side effects of the stabilization policy carried out by the Minister of Economy, Luis Caputo.

These effects, says Cavallo, raise doubts about its sustainability: “The widening gap between the implicit exchange rate (CCL) and the official exchange rate (which many observers interpret as an indicator of excessive appreciation in real terms) and the worsening of the recession.”

The former Minister of Economy said that, for the moment, to address the widening gap “the Government has reassured the markets by assuring them that it will eliminate the remaining sources of monetary expansion, including those related to the purchase of foreign currency by the Central Bank.”

In order to address the worsening recession, Cavallo said that “the government hopes that disinflation itself will increase the real income of workers and retirees and generate a recovery in consumption.”

“At the same time, it is actively trying to convince real investors to announce and start implementing projects that qualify for the recently approved incentive regime for large investments,” he stressed.

July inflation

Analyzing what happened in July, he noted that “Early indicators suggest that inflation continued to decline.” “This is what emerges from observing the evolution of the indices prepared by PriceStats, which in general has anticipated the trend well, but in general underestimated the INDEC inflation index,” he said.

On the other hand, he said that after the devaluation of the official exchange rate in December, “the Government’s decision to maintain the controlled devaluation of 2% per month as a nominal anchor to align price expectations led to a gradual but relentless appreciation of the trade-weighted real exchange rate.” “Such an assessment now raises questions about its long-term sustainability.”he stressed.

He said that after reaching a gap of 15% in March/April, “the implicit exchange rate (CCL) depreciated again, widening the gap to around 50% in the first days of July. Although this gap fell in the following weeks and is still relatively low compared to the peaks seen under the previous administration, it clearly represents a change in market sentiment regarding the perceived risk of the exchange rate, partly linked to the monetary strategy to digest the excess debt of the BCRA.”

Cavallo warned that “One of the most obvious weaknesses of the current anti-inflationary programme is its effect on aggregate demand, or at least on consumption.”

“Leading activity indices suggest that recovery is not yet in sight. Both June activity-related tax collection and automobile production (ADEFA) suggested a continuation of the previous sharp decline in activity. The annual growth rate of activity-related taxes fell to -19.6% annually, even after taking a three-month moving average to smooth the time series,” he analyzed.

In this regard, he said that “the Government believes that the recession was inevitable, given the enormous fiscal effort necessary to achieve the reduction of the inflation rate.”

“As President Milei had anticipated during the election campaign, the recession and its social consequences do not seem to have affected his popularity yet. Polls show the same percentage of support he received in the elections, but it will be difficult to maintain this support if there are no clear signs of economic recovery soon,” he said.

Economic recovery

As for the recovery, he said that “the economic team is confident that the decrease in inflation will allow the recovery of real wages paid by the private sector and will also improve the purchasing power of pensions.” “If this happens, consumption should increase and, given that the level of use of installed capacity in industry is very low, the supply of consumer goods could increase without the recovery feeding back into inflation,” he added.

He also noted that “the Government is also working hard to convince potential investors in activities based on the abundance of natural resources (mining, hydrocarbons, forestry) to decide and initiate investment projects within the framework of the recently approved regime of incentives for large investments (RIGI) by Congress as part of the Bases law.”

“However, for these reactivation mechanisms to begin to work, it would be important to clarify the process of eliminating restrictions that currently affect both foreign trade transactions and those of the capital account of the balance of payments,” he explained.

Source: Ambito