The staff recruitment In May 2024 (last known data), measured by the entry rate – the relationship between new employees and the staff at the beginning of the month – it stands at 1.4%, a low value in historical terms.

Only in the midst of the crisis in May 2002 (1.2%), and in May 2020 due to the influence of the pandemic (0.4%), the incorporations were at a lower level than the current one. In year-on-year terms, the entry rate contracted by 0.7 percentage points, as reflected in the report. “Labor Indicators Survey (EIL)”an official report prepared by the Ministry of Human Capital.

The exit rate -disengagements in relation to the initial staff- also shows a fall in relation to last month and the same month of the previous year (1.7%). The behavior of the incorporations and disengagements of personnel observed in this month of May 2024 is usual in contexts of falling economic activity.

The adjustment in the employment level is mainly due to the reduction in staff additions; the disengagements, whether due to resignations or dismissals, are secondary explanatory factors of the decline in private registered employment.

employment11.png

The adjustment in the employment level is mainly due to the reduction in staff additions.

Employment: the expectations of companies

The net expectations of companies regarding the hiring of personnel for the next three months are at 0%, a value below that of April (0.4%); that is to say, despite the recessionary context, a positive trend is foreseen. scenario without change in terms of employment. This indicator arises from the difference between the proportion of companies that expect to increase their staffing levels and those that expect to decrease them: 4.2% of companies declare that they will make changes to their staffing levels in the next three months (2.1% expect to increase staffing levels and 2.1% estimate that they will reduce them).

Suspensions

He percentage of suspended employment —measured by companies that apply suspensions and the number of suspensions per hundred workers— It is slightly lower than last month and continues to show lower values than those of the years prior to the pandemic.

After having reached a historical high of 8.8% in May 2020, the proportion of furloughed workers fell to remain at low levels fluctuating around 0.3% until September 2023. However, From October 2023, a gradual increase is observed, reaching 0.7% in May 2024. Despite this increase, the incidence of suspensions continues to show values similar to those observed in the years prior to the pandemic.

In July 2020, the highest percentage of companies applying suspensions was recorded (19.4%), while in May 2024 this percentage was only 5.5%. Although this figure is low compared to the years before the pandemic, a slight increase has been observed over the last five months.

Layoffs

To analyse dismissals, the dismissal rate is used, which is calculated by considering unjustified dismissals, the end of the probationary period and the completion of work (in the case of Construction) as a percentage of total employment at the end of the previous month. Dismissals with cause and the expiration of fixed-term contracts are excluded from this concept.

In May 2024, a slight decrease in the rate of dismissals compared to the previous month and stands at 0.5%. In the annual comparison, the incidence of unjustified dismissals is similar to that of May 2023, although, like suspensions, it remains at low values in relation to the historical series.

In which sectors is there a greater contraction of employment?

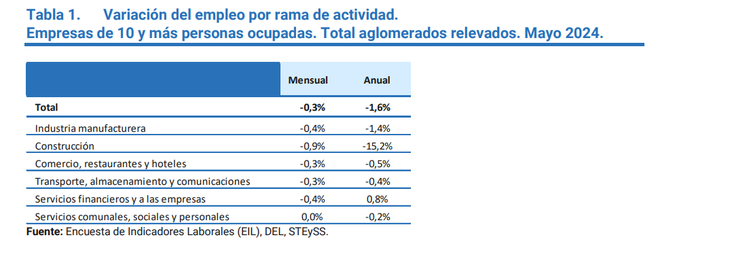

During the month of May, a contraction in the level of employment is observed in almost all sectors of activity with different levels of intensity: the Manufacturing and financial services to companies record a fall of 0.4%; while Transport, storage and communications and Commerce, restaurants and hotels show a decrease of 0.3%. Although all these sectors show contraction, in all cases they are less than those verified last month.

For its part, employment in the sector of Construction continues to show the greatest reduction (0.9%) although it also showed a slowdown in the decline compared to previous months. Since August 2023, when job losses in the sector began, it has accumulated an annual reduction of 16.4%.

The only sector in which No decline in employment is observed in Communal, social and personal serviceswhere staffing remained constant. In the annual comparison, in addition to Construction (-15.2%), there was a notable decline in Manufacturing (-1.4%) and Trade (-0.5%). The rest of the sectors continued with lower negative variations, except for Financial Services and companies with a positive variation (0.8%).

employment1.png

Source: Ambito