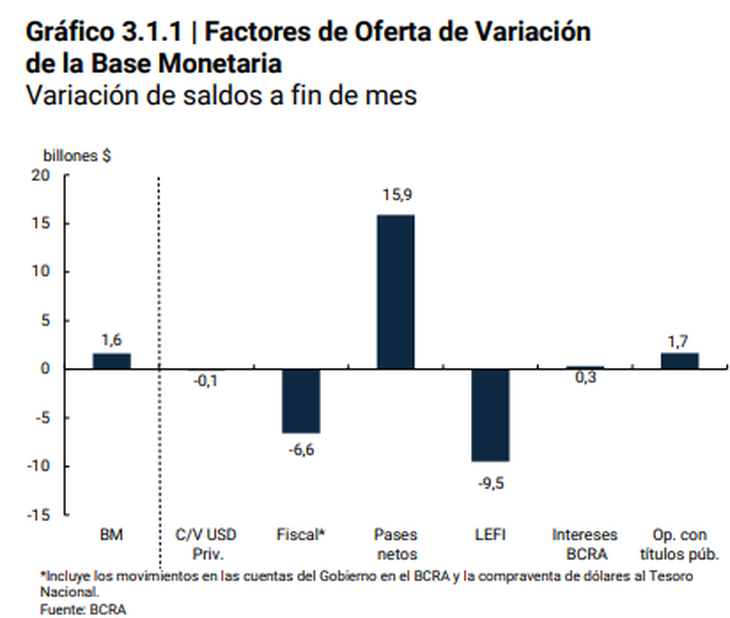

The monetary base grew in July for the fourth consecutive month in real terms. It happened at a time when the economic team launched the so-called “Phase 2” of the economic program, which he characterized as “zero emissions” and that still generates doubts in the market. The expansion of the amount of money poured into the economy was $1.64 trillion between the end of June and the last day of July or $3.32 trillion if the average for each month is taken. The dismantling of the passive transfers first and the new Fiscal Liquidity Letters (LEFI) later, added to the execution of puts, were the main factors that explained these figures.

Beyond having announced the closing of the four emission taps during the last month (financing to the Treasury, the interest on remunerated liabilities of the Central Bank, most of the insurance on public securities that the BCRA had granted to banks and even the purchase of reserves), the truth is that the Monetary Framework published by the entity that he presides over Santiago Bausili he left a wide scope for expansion of the money supply based on the limit set for the monetary base. Thus, the proposed scheme did not completely dispel the uncertainty of analysts and economic agents about the future of the program.

image.png

For now, the monetary base continued to rise last month. According to data published by the BCRAgrew 8.1% in nominal terms if measured from end to end (4% real) or 18.2% if the July average is compared to the June average (13.8% real). The entity specified in its Monthly Monetary Report that The base increased 10.6% monthly at constant prices and without seasonality.

The close of the month showed a balance of $21.8 trillion for this monetary aggregate, which includes the bills and coins held by the public and financial institutions plus the deposits that banks have in the Central Bank. Thus, it still has a expansion margin of almost $26 billion compared to the $47.7 billion ceiling set by the Central Bank (based on the level of the broad monetary base in force as of April 30). In this way, The monetary base was at 3.8% of GDP, a historically low level compared to the average of recent decades. Compared to the same month in 2023, a real contraction of 2.7% was still recorded.

The factors of monetary expansion

How can we explain the monetary expansion in July? Mainly, due to the the dismantling of the banks’ holdings of interest-bearing liabilities earlier this month and LEFI (the Treasury bill that replaced passive repos) during the last few days. “In total, there was an injection of $6.7 billion through this channel,” said the consulting firm LCG in a report.

image.png

In addition, there was a execution of puts by Banco Macro at the beginning of the month for approximately $2 billion, before the BCRA carried out an operation to cancel these insurances on public securities in which the banks agreed to sell 74.4% of the puts they had in their possession. Today, there are still insurances for the equivalent of a little more than $3 billion of Treasury bonds, which represent a kind of latent debt for the Central Bank that, if the entity holding them executes them, must be faced with monetary issuance.

“The most notable factors in the contraction include 1) the purchase of foreign currency by the Treasury to pay the Bonares and Globales debt ($3.5 billion), 2) the deposit in the BCRA accounts of the surplus generated by the placement of debt ($3 billion) and 3) the selling position of the BCRA in the MLC, absorbing $0.1 billion,” LCG added.

The Central Bank’s report noted that monetary expansion corresponded to a recovery in demand for money, although from historically low levelssomething that was linked to the slowdown in inflation and “some improvement in the leading activity indicators”, despite the fact that the recessionary scenario has not dissipated.

Thus, the broad monetary aggregate, private M3 (which includes money in circulation held by the public and deposits in pesos of the non-financial private sector, both demand and term), showed a monthly increase of 5.5% at constant prices and adjusted for seasonality. However, in the year-on-year comparison, this aggregate registered a sharp decline of 29.3%.

Among the components of money demand, the BCRA highlighted that, in July, the means of payment “slowed down the growth observed in the previous two months, but remunerated instruments reversed the trend of the previous month and experienced a strong expansion.” Remunerated demand deposits increased in real terms by 14% without seasonality, due to the Increase in the assets of Money Market Mutual Fundsthe main holders of this type of deposit. Meanwhile, fixed-term deposits in the private sector rose 3.6%, driven by placements by legal entities in the face of a slight rise in the rates offered by banks.

Furthermore, still at a historic low, last month loans in pesos to the private sector increased by $4.4 trillion, which implied a seasonally adjusted monthly expansion of 12.7% at constant prices. “Thus, they have accumulated four consecutive months of growth and are in real terms 32.8% above the minimum recorded in January 2023,” the BCRA said.

Doubts about the BCRA’s monetary plan

That being the case, the new monetary framework reported by the BCRA after a succession of measures that were announced in a disorderly manner by Javier Milei and Luis Caputo did not provide clarity to economic agents. “It is ambiguous, we believe intentionally,” said the consulting firm 1816The President and the minister spoke of ending all issuance “in line with the President’s idea of ’endogenous dollarization’,” said the consultancy, but the Central Bank in its Monetary Framework set the goal of having the monetary base grow to $47.7 trillion by 2026 “without it being very clear through which issuance channel,” said 1816.

“This is a sum that could be covered by the dismantling of LEFI in response to the increased demand for credit and even by the dismantling of a portion of the amounts that the Treasury has placed in the BCRA. These numbers confirm that the decision to rescue $2.5 billion, injected by the monetization of the trade surplus during May and June, through sales of dollars in the CCL market served as an excuse to attack the exchange rate gap that had soared to levels of 60%,” LCG considered.

Beyond that, the firm founded by Martín Lousteau and directed by Javier Okseniuk maintained that “The limit imposed on the monetary base (BM) is a difficult goal to understand: very lax for the short term, very hard for the medium term”. He added: “Once the self-imposed limit on the BM is reached, we will see how the BCRA will resolve the contradiction that arises between zero issuance and a credit growth target (with associated endogenous issuance) and recomposition of the currency in circulation. New announcements may be required, but this time we hope that they will be more consistent.”

For its part, 1816 stated that the announcement suggests that “there has not yet been a complete definition by the authorities regarding the future monetary regime,” which could imply the need for a “balance between what Milei always proposed (dollarization) and what the technicians of the Fund Staff should demand,” which in its last report spoke of a more traditional currency competition without the disappearance of the peso. “If the market had doubts about monetary policy for 2025, these were not answered by the new BCRA framework”he concluded.

Source: Ambito