Despite the acceleration of the City’s consumer price index of Buenos Aires (IPCBA) to 5.1% in July, The economic team expects that the national inflation rate, which INDEC will announce this Wednesday, will be below 4% and it will be the lowest of the year. At a conference held in Colombia, the vice president of the Central Bank, Vladimir Werningreaffirmed that the entity’s forecast remains at 3.7% for the general CPI and detailed the foreign exchange income projections for the coming years that excite the Government.

Werning participated this Friday in the XIX Annual Conference of Economic Studies of the Latin American Reserve Fund (FLAR) in Cartagena, an event that brings together economic authorities, academics, senior researchers from central banks and finance ministries, and representatives of international financial organizations. There, he spoke about the Argentine economic situation and the plan implemented by the current administration, in a presentation he titled “Argentine stabilization program: reversing the terminal phase of fiscal dominance over monetary policy.”

The official showed a graph in which confirmed the projection of price increases for July which had already been announced in a presentation to investors in New York: 3.7% general inflationwhich would imply returning to the path of deceleration after the increase in electricity and gas prices in June led to a rise to 4.6% (May had given 4.2%).

image.png

If confirmed, it will be the lowest figure of the year, in line with what Luis Caputo He told the representatives of stock exchange companies a couple of weeks ago, when he received them at the Treasury Palace.

July inflation: CABA and private estimates

Furthermore, in that case, it would destroy the concerns that arose after it was announced last Thursday that inflation in Buenos Aires accelerated from 4.8% in June to 5.1% in JulyAlthough these measurements are made with different methodologies, consumption baskets and weights, the fact that goods prices rose in CABA (a figure that has greater weight in the National CPI than in the Buenos Aires one) had raised some question marks.

For now, The consulting firms predict that the INDEC figure will be around 4%Some firms estimate it slightly below (Analytica, Libertad y Progreso, Ferreres) and others slightly above (C&T Asociados, ACM, CESO).

Likewise, the figure that Werning showed reflects that the BCRA projects that the Core CPI (which does not include seasonal or regulated prices) will fall to 3.2% in July, after reaching 3.7% in both May and June.

Inflation and relative price adjustment

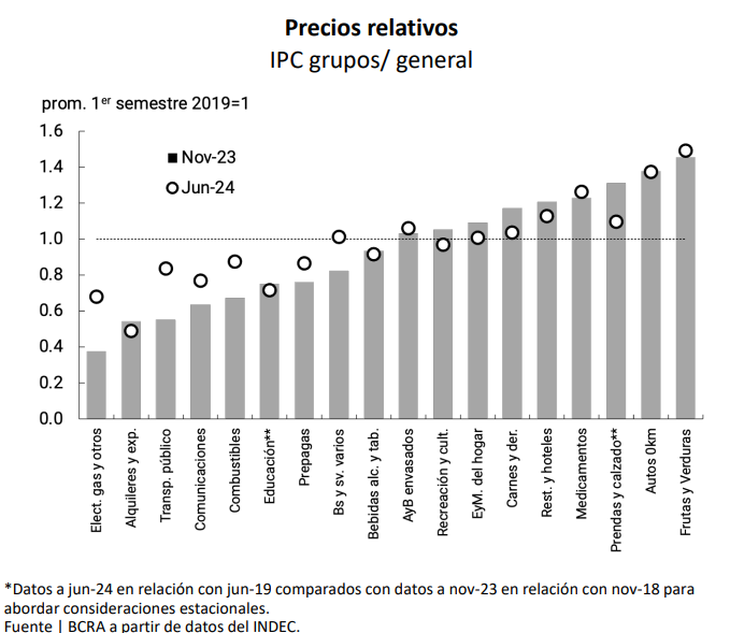

The vice president of the monetary authority also displayed a graph that seeks to demonstrate that the slowdown in inflation experienced this year (after the mega-devaluation in December caused by the current administration caused the National CPI to shoot up to 25.5%) It occurred together with a process of readjustment of relative prices.

This is a point questioned by various analysts since throughout 2024 Caputo decided to postpone rate increases on several occasions to prioritize lowering inflation.

The table compares the gap between the price levels of 18 items in effect in November 2023 and June 2024 compared to the levels of those sectors in the first half of 2019, which the BCRA has determined to be the equilibrium level to which they should be moving.

image.png

Yes ok Several of the “lagging” relative prices rose and shortened their distance from the target level, some of the prices that were already “leading” before the change of government They moved away from the equilibrium value but upwards.

Among the first is located “Electricity, gas and others”which was the most backward in November 2023, had already halved its distance from the 2019 level by June, after the last rate increase. Also the transport public (the collective in the AMBA rose 600% this year), Communications (the Government completely deregulated the sector and there are increases above the general inflation) and prepaid (first liberalized, then intervened and finally liberalized again).

Among those that were already above their equilibrium price and have moved further away are: fruits and vegetables, brand new cars, medicines and packaged foods and drinks. Three of these areas are very sensitive to the pockets of lower-income sectors.

Meanwhile, recreation and culture, home equipment and maintenance, and various goods and services were practically aligned with the “balance” level.

Dollars: energy is hope

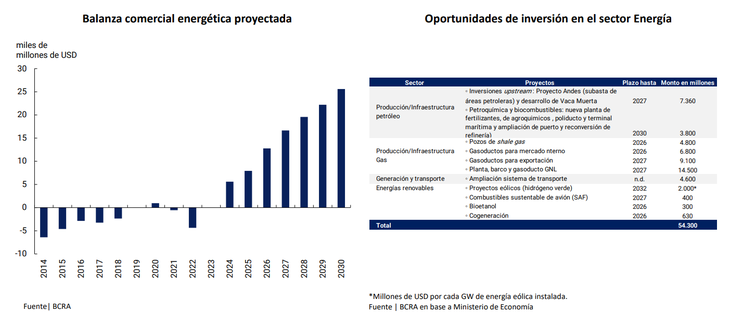

After claiming the “zero emission” monetary program launched within the framework of the so-called “phase 2” and anticipating that it projects a rebound in consumption and demand for money, Werning said that “energy and mining will drive structural change in the balance of payments”In the short term, marked by the red in net reserves and the slowdown in foreign currency purchases by the BCRA, which overshadow the outlook for the official exchange rate plan, expectations in the medium and long term are based on these sectors.

image.png

In particular, the official presented the prospects for the energy trade balance. After having reached equilibrium in 2023 with the construction of the Néstor Kirchner gas pipeline, The Central Bank aims for a surplus of more than US$5 billion this year. From then on, it projects an upward ladder until exceeding US$100 million. US$25 billion by 2030.

In addition, Werning showed a table in which he sizes the “Investment opportunities in the Energy sector” which are placed at a total of US$54.3 billion. This includes LNG projects (US$14.5 billion until 2027), upstream investments in Vaca Muerta and other areas (US$7.36 billion until 2027), gas pipelines for export (US$9.1 billion until 2027), gas pipelines for the domestic market (US$6.8 billion until 2026) and shale gas wells (US$4.8 billion until 2026), among others.

Source: Ambito