With reserves in the red and an economic team eager for foreign currency to try to sustain its exchange rate scheme, developments on the external front are playing a key role. The focus is, above all, on two variables: the Brazilian real and international soybean priceswho have been kicking against the official goals in recent times. These daysthe Brazilian currency reversed its falls and brought some relief to the pressures on the gap would change. But the oilseed deepened its decline and added new headaches due to the need to rebuild the Central Bank’s coffers.

The soyArgentina’s main export commodity, continues to fall in the Chicago market. This week the collapse accelerated following the publication of the latest report from the United States Department of Agriculture (USDA), which raised the prospects of a super harvest in that country now estimated at 124.9 million tons, which would represent a historic record. The higher world supply dragged the price down.

This Tuesday, the oilseed future for August fell another 2.33% to US$363The September contract was trading below US$350 (AU$348). This is the lowest level, measured in real terms, since 2006.

Seen in perspective, the skid is considerable. Soybean prices have fallen by 8% compared to last monthwhile its derivatives (oil and flour) have lost more than 10% in the same period. So far this year, the collapse is close to 30%, according to data from the Buenos Aires Grain Exchange.

image.png

For the Government, the problem is becoming increasingly important. With negative reserves of around US$6 billion, Luis Caputo needs to stop the bleeding in the BCRA’s coffers to try to convince the market that his roadmap is sustainableMaintaining the current exchange rate scheme, the 2% monthly crawling peg and closing the gap to, at some point, open the exchange rate controls without a devaluation leap, appears to be an uphill challenge without foreign currency in the Central Bank.

In times of seasonality always unfavorable for the flow of dollars, eyes turn to the 50% of the harvest has not yet been marketed. Soybeans at these levels threaten the income of those dollars. For now, in recent days the pace of liquidation has slowed with producers accustomed to sitting on their grains as a safeguard of value in times of uncertainty.

In this context, The agro-industrial sector demands a reduction in withholdings from the Government. Gustavo Idigoraspresident of CIARA-CEC, said that if that were to happen, US$5 billion could be received in the coming months. But the economic team is reluctant to accept that possibility given the priority of maintaining fiscal balance (as Javier Milei already said in his speech at the Rural Society).

Beyond short-term needs, doubts also arise for next year in light of projections that point to a less than encouraging scenario in terms of international prices.

“There are data that continue to favor greater supply in soybeans while demand fails to recover. I think that no country can become a thriving economy in a sustainable way over time because of the prices of a harvest. However, it can help us get out of this faster and that is where it hits us,” he told Andrés Reschini’s scopefrom F2 Financial Solutions.

For now, in the first seven months of 2024, the settlement of foreign currency from the cereal-oilseed sector was US$13.64 billion, according to CIARA-CEC, the chamber that groups the large agro-exporters. The figure is below the more than US$16 billion that marks the average of the last five years.

The dollar and the real

In this context, there has been some relief on the external front in recent days. The real’s ratethe currency of Argentina’s main trading partner, It was another factor that had played against us throughout the year.: Between the end of 2023 and August 2, the dollar in Brazil had accumulated an increase of 18% to reach 5.73 reais.

image.png

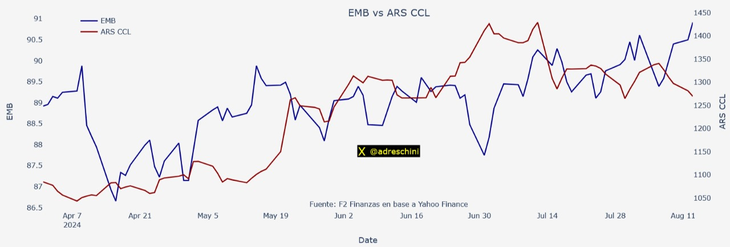

However, Following the shock experienced by global markets on Monday last week, there was a renewed flow of capital towards emerging countries in the face of the apparent dissipation of the recessionary scenario that was looming in the United States. From that day until today, the real and other emerging currencies showed some recovery. For example, The dollar in Brazil fell 4.9% in that period.

This recovery of emerging currencies, and in particular the real, brought relief to the price of financial dollars in Argentinaquotes that since last month have been intervened with direct sale of reserves by the BCRA. This Tuesday, for example, the cash settlement rate (CCL) and the MEP fell to $1,266.98 and $1,272.49, respectively, and the gap with the wholesale exchange rate dropped to around 35%. Before the start of the interventions by the Central Bank, the exchange rate spread was around 60%.

In this regard, Reschini noted: “What we are seeing is greater interest in emerging markets. These flows would be strengthening the currencies of these countries and we look at Brazil because of the closeness of the commercial link.. If the market continues to see a rate cut by the FED, interest in emerging markets will continue and that seems to be the market view. If inflation fears in the US are revived and the chances of high rates remaining increase, the real may weaken again, but for the market this scenario is less likely for now.”

Ultimately, what happens in the coming days will be key on a local exchange front that still appears to have an open scenario.

Source: Ambito