The Federal Public Revenue Administration (AFIP) has detailed the new deadlines for taxpayers and responsible parties.

The Federal Public Revenue Administration (AFIP) announced this Friday the extension of the maturities for sworn statements and payment of the balance of taxes to the Earnings, Personal Property and ID cardcorresponding to the fiscal year 2023.

The content you want to access is exclusive for subscribers.

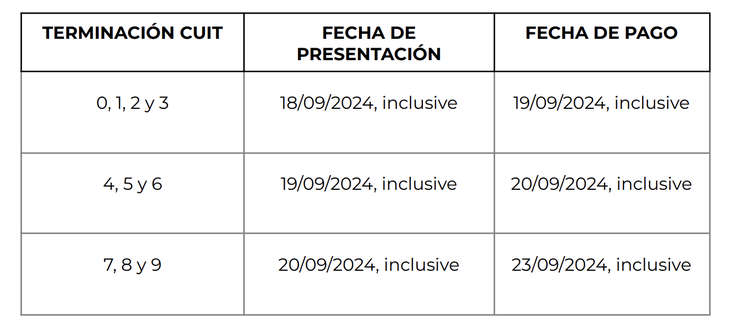

In order to facilitate compliance with tax obligations for taxpayers and responsible parties, the agency issued General Resolution No. 5550/24. Below, They indicated the dates until which these obligations may be fulfilled exceptionally:

Screenshot 2024-08-16 at 22.43.16.png

Maturity calendar for August and September 2024

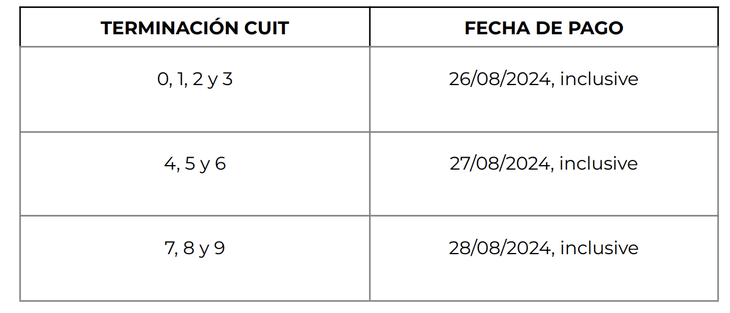

In accordance with the provisions of the Government, they communicated the payment schedule on the Special income from amounts on account for income and personal property taxes (40% based on the calculation of advances for the 2023 fiscal period) – RG 5548/24.

Screenshot 2024-08-16 at 22.48.50.png

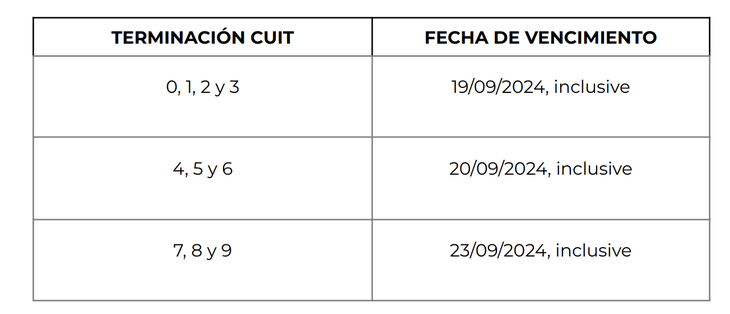

Declaration of adhesion and initial payment of the Special Regime for Income Tax on Personal Property (REIBP)

For subjects who did not adhere to the Asset Regularization Regime.

Screenshot 2024-08-16 at 22.43.55.png

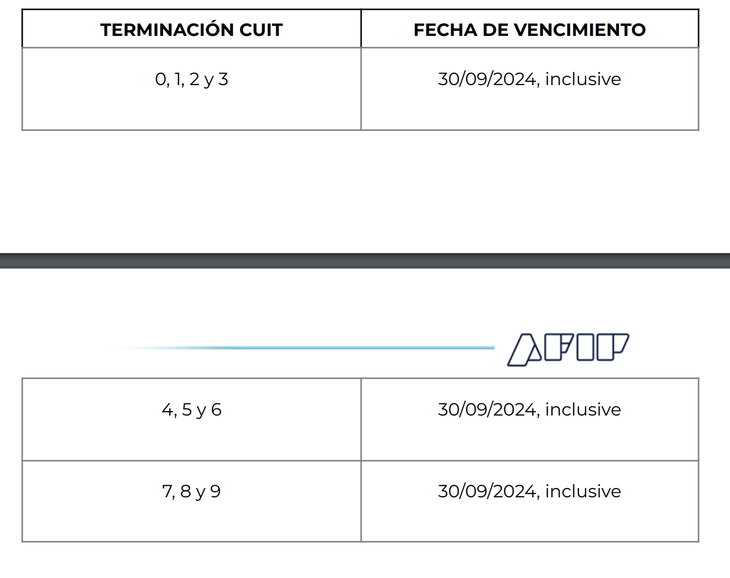

Affidavit and payment of the balance of the Special Regime of Income Tax on Personal Property (REIBP)

For subjects who did not adhere to the Asset Regularization Regime.

Screenshot 2024-08-16 at 22.44.17.png

AFIP EXTENDED THE DUE DATE OF BS, GANANCIAS AND CEDULAR.pdf

Source: Ambito