He The Government promised that it will return the PAIS tax rate on imports to 7.5%, the level it had before this same administration raised it to the current 17.5% last December. Luis Caputo has already announced that the measure will be implemented in September and there is growing expectation. One of the concerns shared by analysts and economic agents is whether there will be sufficient compensation to offset the fiscal and exchange rate impact of this measure. This is because, while the economic team aims to relaunch the relatively stagnant slowdown of the inflationincubates further deterioration in the Reservations and the collection.

The official plan is focused on a central objective: to show a path of inflation that slows down, even to the detriment of the ordering of other variables. macroeconomic. The equation is on track to repeat itself with the rollback of the PAIS tax. Especially if one takes into account that the economic team quietly reaffirms that the reduction of the rate will not be accompanied by a modification of the pace of depreciation of the official exchange rate. This Wednesday, at the Council of Americas, Javier Milei again denied the possibility of a devaluation, as requested by some economists and many sectors of the business community.

If the measure is implemented without an equivalent devaluationthe effective exchange rate governing imports will be reduced. Although the measure would be implemented in September, if today’s values are taken, The import dollar will fall from the current $1.107 (wholesaler $942 plus 17.5% PAIS tax) a $1,013 (wholesaler plus 7.5%).

This will bring about a series of effects: on the one hand, will reduce some pressure on the prices of imported products; on the other hand, Payment for purchases abroad through the official exchange market is expected to increase in times of suffocation for the reserves. In addition to the obvious fiscal impact which will bring about the decision to give up part of the tax that most helped to cushion the collapse in revenue triggered by the recession.

Ultimately, this illustrates the ambush that the Government’s program is going through. Luis Caputo wants the market to buy his roadmap (that inflation and the devaluation rate converge close to 0% monthly and that the gap closes downwards) to achieve a decrease in country risk. But, in that path, he maintains an exchange rate anchor policy that has already eaten up almost all of the mega-devaluation of December and economic agents see that this problem materializing in the red of the Reservations and in a stocks whose expiration date seems to be moving further and further away.

PAIS tax and inflation

The INDEC data for July, published this Wednesday, reflected the resistance to the downside of core inflation (which excludes regulated and seasonal prices), Despite the collapse in consumptionThis component of the CPI reached 3.7% in May, repeated the same figure in June and accelerated slightly to 3.8% last month, far from the 3.2% projected by the BCRA, according to presentations made in the United States and Colombia by the vice president of the monetary authority, Vladimir Werning.

In a recent report, the SBS Group noted that the first week of August showed high-frequency data that show an acceleration in prices. And that, while there are seasonal factors that influence the beginning of the month, there are also inertial components.

In this context, The economic team hopes that the rollback of the PAIS tax rate will make a contribution starting in September to breaking through that resistant floor. Precisely for the ninth or tenth month of the year, Caputo predicted a monthly inflation rate that would start with a 1, according to what the minister himself told the representatives of stock exchange companies with whom he met weeks ago at the Treasury. Today it seems difficult for that to happen.

How much will the reduction of the PAIS tax contribute? According to Martin Kalosdirector of the consulting firm Epyca, The lowering of the import exchange rate would reduce the CPI by 0.7 percentage points. It would be “a minor impact” since the effect “will probably spread over a couple of months”the economist told Scope“Although it would obviously help to keep it at moderately high levels,” he added.

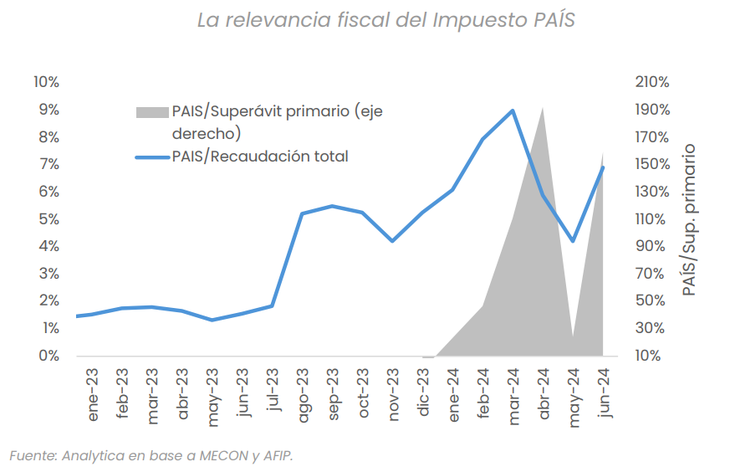

“Reducing the PAIS tax is a good measure, without a doubt. What is at stake is whether the timing of the decision is correct,” the consultancy warned in a report for its clients. Analyticachaired by Ricardo Delgado.

image.png

The cost in reservations and collection

“The reduction of the PAIS tax It is a measure of great impact, not only because of the loss of revenue from the PAIS tax and the corresponding deterioration of the fiscal result that it implies, but above all due to the loss of foreign currency that it will generate“, he told this media Diego Fernandezgroup economist GERESand highlighted the effect that the lower cost of imports will have in a context in which the effect of the December devaluation has already been diluted.

The point is not minor. The net reserves have been significantly reduced in the last month and Today they are negative in a magnitude that varies according to the methodology used to measure them: almost US$3.5 billion, according to GERES’ calculation; US$5.181 billion, according to Analytica; and more than US$6.4 billion, for Eco Go. In this context, Fernández pointed out that “The measure would add serious additional pressures towards a devaluation of the official exchange rate.”

Kalos explained that, if the fixed monthly devaluation rate is maintained and a compensatory devaluation is not made, this would lead to “a greater import because the importing dollar would become cheaper, although this will also depend on internal demand.” And he pointed out that there could be a greater demand in the MULC due to the shifting of part of what is currently paid via CCL dollar “and that will require more reservationsas long as there are no other factors that widen the gap again, which is a risk that does exist.”

Some economists estimate that this reduction in prices could lead to an increase in demand for official dollars for imports of around US$1 billion per monthIn this context, and concerned about the possible increased competition from cheaper imported products, the industry is trying to negotiate alternatives with the Government to ensure that the measure does not generate a flood of goods manufactured abroad.

Analytica highlighted that The measure will come “in a month where seasonality is negative for the world of dollars”. And he stated that in the last decade (excluding the pandemic year and the soybean dollar years) September was the month with the lowest trade balance in the goods balance. “To further complicate the negative seasonality, soybean, corn and wheat prices continue with a negative trend that is sustained in the September futures prices,” he emphasized. A combination that the Government is betting will be cushioned by a relief in energy imports, once winter is over.

image.png

But that is not the only drawback. “On its own, the reduction of the PAIS tax is a revenue collection problem,” said Kalos. Analytica He put numbers on it: this tribute accounted for half of the primary surplus in the first half of the year and 9% of the total income of the National Public Sector. The consultancy firm estimated that the retroduction of the tax rate will result in $1.5 trillion in lower revenues between September and December, and that this fall would be offset only by 40% by the reimposition of Income Tax to the fourth category (which would contribute $0.6 billion). It remains to be seen how much the money laundering and the moratorium will contribute.

Yet, Claudio CapraruloAnalytica’s chief executive, told Scope that the Government is in a position to sustain this measure without compensating it with an equivalent devaluation, but at the cost of losing more reserves and revenue. And he summarized: “The objective is to indicate that they continue to slowly dismantle the restrictions and continue to lower inflation, forcing to the limit the balances that, among other things, have a backbone in the strong recession.”

Source: Ambito