There is consensus in the market that The government will be short of dollars this year and it is not yet clear where they will come from. Official data indicate that In June, for the first time this year, there was a current account deficit and that result spread by July. Some US$1 billion would have been missing.

Far from the virtuosity of the “twin surpluses” that existed in Argentina after the brutal adjustment due to the exit from convertibility, today the The external sector is becoming different from the fiscal sector, Although it is considered that budgetary order is a necessary condition for regulating the competitiveness of the exchange rate and the flow of foreign currency.

In In June the Government had a fiscal surplus of $488.569 billion, which, after discounting the payment of interest, implied a financial surplus of $238,189 million. Then, In July, it had a primary favorable balance of $908,253 millionand a first financial deficit of $600.957 million then appeared.

When reporting data, Last week, the Government acknowledged that it had “kicked” the payment of Christmas bonuses, which it usually does before the end of June, for July, from which it can be inferred that, strictly speaking, If I had not done that, I would have had a financial deficit in June as well.

The June exchange rate balance is turning around

The balance of the current account of the foreign exchange balance was US$2.96 billion in favor in December 2023. In January, US$1.7 billion, in February, US$1.5 billion, in March, US$1.6 billion, in April, US$1.8 billion and in May, US$1.16 billion. In June, It became negative by US$233 million and is estimated to be US$1,000 in July, according to the consultancy Equilibra.

This is because, starting in June, the monthly flow of imports began to be paid at 100%, after the scheme created by the Government of four 25% installments, which had begun in February, was advanced.

current-account-exchange.png

This deficit is expected to deepen because the Government He again rethought the payment of imports in two payments of 50% monthly, which means that payments from the four-installment scheme will overlap with those from the two-installment scheme.

In addition, the value of soybeans has been plummeting due to super harvests in the United States and Brazil, which discourages producers from selling their exports, who in turn perceive that the exchange rate is out of date.

Doubts persist over the flow of dollars

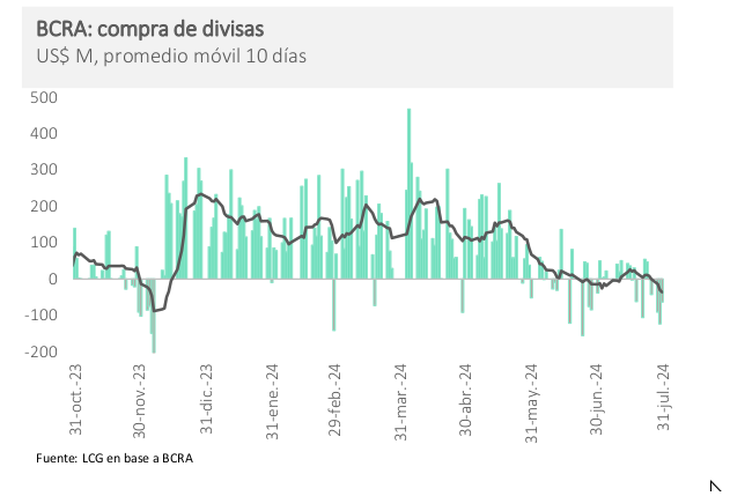

The consultant Labor, Capital & Growth (LCG) notes that “doubts persist as to whether the flow of dollar inflow will be enough to cover this year’s outflow.

“In Bopreales alone, payments totaling US$1.1 billion remain pending until the end of the year. between capital and interest. Added to this is the payment to the IMF net of disbursements of US$640 million,” it says in a report.

buy-reserves-bcra.png

LCG further states that It is expected that the energy trade balance will turn positive, after months of deficit, “starting in August or September,” but indicates that if this is the case should be sustained in an economy with depressed economic activity. “A rebound would reactivate imports, putting pressure on dollar accounts,” the study says.

In this regard, LCG adds that “this adds pressure to the decisions to make import payments more flexible (from four to two installments) and to intervene in the CCL/MEP with the aim of reducing the gap with respect to the official rate.”

“The goal agreed with the IMF involves the accumulation of US$8.7 billion by September 30,” The report states that, as of a few weeks ago, the government had managed to raise US$7 billion.

The report highlights that if the government fails to convince the market that parallel dollars have to be at a lower level, it has three options left:

- Spending the few dollars to keep the gap at bay (LGC considers this “ill-advised”).

- Release the caps so that the depreciation “is done by the market” (risky in a volatile world).

- Devalue the official rate while maintaining the exchange rate restriction. In this way, the gap may persist (it has to go against official rhetoric).

Source: Ambito