Following the reinstatement of the Income Tax to the fourth category included in the Fiscal Package, some 800,000 workers began to pay taxes again. After a short time, The non-taxable minimum will rise to approximately $2 million for a single employee without children.

This is what the consulting firm estimated Focus Market, specialized in consumer issues, based on data latest inflation figures for July and projections for price developments in August.

The Law establishes a Extraordinary update in September of the salary scales, which will take as a reference the variation in the Consumer Price Index (CPI) between June and August.

As reported by the According to the National Institute of Statistics and Census (INDEC), prices rose 4.6% in June, while in July they grew 4%. According to private estimates, in August would rise another 4%, so the current non-taxable minimum of $1.8 million for a single employee would be $2,036,000 gross. Meanwhile, for a married with two children, The current MNI of $2,340,000 will be located from September in about $2,647,000.

Afip-Monotributo-Earnings-Tax-

Ignacio Petunchi

The Focus Market consultancy firm states that “the non-taxable minimum for a single worker without children in September will increase to $2,177,780, for a single worker with 2 children $2,407,020 and for a married worker with 2 children it will increase to $2,750,880.”

As explained to Scope the owner of the consultancy firm, Damian Di Pacethis estimate is based on the calculations of the Market Expectations Survey (REM) for June, July and August, which projected 4.6% for the previous month and the current one. But the analyst considers that after the 4% in July “It is very likely that August will give a similar figure.” It should be remembered that, generally, the REM is projecting inflation rates at least half a point higher than what occurs in reality.

It should be noted that, Starting in 2025, tax scales and deductions will be updated by inflation and semi-annually.This year, there will be an extraordinary update in September due to the price evolution of June, July and August, to prevent inflation from causing a gap.

“With the old regime, The scales were not updated, so every month the salaries increased, quickly reaching the non-taxable minimum, and were affected by the 27% tax. Now, this tax falls on assets in a progressive manner, with rates ranging from 5% to 35%, the more you earn, the more you contribute”Di Pace notes in a report.

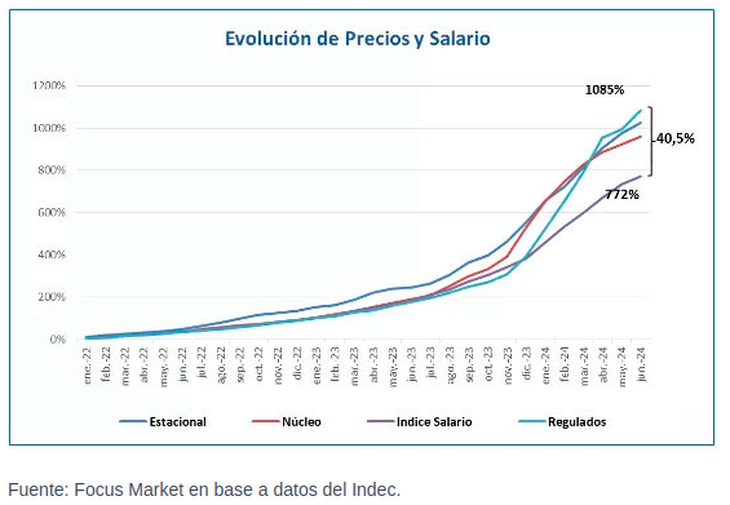

focus-salaries-cpi.png

Salaries losing out to inflation

The report of Focus Market recalls that, after an extended period in which wages were losing out to the CPI“In recent months, wages have begun to outpace monthly inflation.”

“However, starting in August, the Income Tax begins to be paid and Those who will be affected will see a reduction in their income,” warns the consultancy.

In this way, the salary increase that employees in this group achieve through collective bargaining agreements will not be translated into an improvement in consumption. According to the consultancy, “the weight in Household spending on price variations in public and private services reduces room for manoeuvre for the acquisition of goods in the same quantity.”

The study warns that, Since November 2022, salaries have increased by 772%while regulated prices (rates) grew by 1,085%exposing a gap of 40.5% currently between regulated prices and wages. In the case of Food and beverages rose 1,066% with a gap of 38%.

Source: Ambito