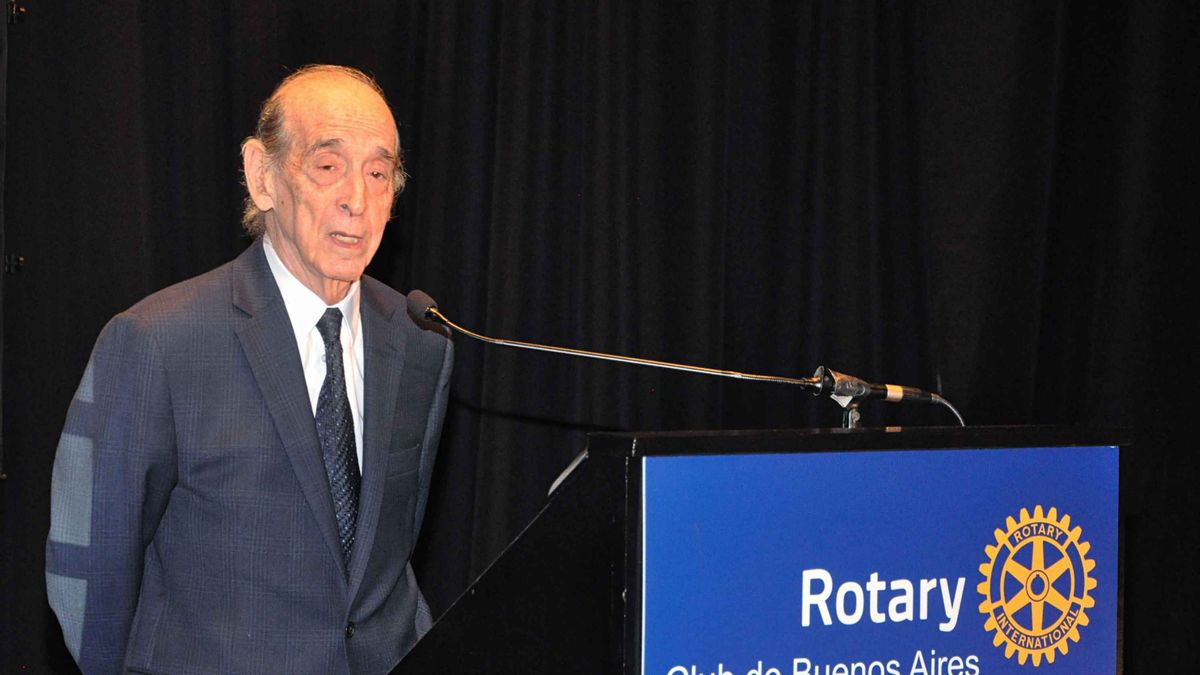

“Most economists believe that the currency should be devalued. I don’t think so.” I think that if we devalue, bye, the whole program is over, (Javier) Milei is over, everything is over,” the economist said Ricardo Arriazu at a luncheon offered this Wednesday by the Rotary Club. He then warned that “We must be sure that they cannot twist the government’s arm,” but he maintained that “My calculations say that if things are done right, they can’t twist his arm.”

Referring to how inflation is eliminated, he said that Argentina has a bimonetary economy where the peso is used for small transactions (paying taxes, salaries and measuring inflation) and “everything else is governed by the dollar, which is the true unit of account in most transactions.” Hence, he considers that To combat inflation, it is not enough to stop issuing pesos. It is necessary to “stabilize the dollar” and to this end he justified the intervention of the Government by buying and selling foreign currency. He refuted that this was something “artificial” as long as it was done without a fiscal deficit.

He explained that the current program is of the type of the sixties, when the former minister Adalbert Krieger Vasena arranged an exchange rate jump and then the dollar remained relatively stable. “And that relatively stable is the key to the programthat’s what everyone complains about, but that’s the key to the program, because If I move that 2% (of the official “crawling”) all prices go up. The rates that are in dollars automatically go up and then the companies will say that they raised my costs and they immediately go up, entering into what I call the merry-go-round of relative prices”.

He said that last year there was a perception that the official exchange rate was behind and the same with tariffs and salaries. But since the economy only sets relative prices, he asked “if everything is behind, what (is the price) that is ahead?” He explained that What people call backwardness is in relation to “their aspiration, which is their maximum historical relative price, but the sum of the aspirations is three times the GDP, which is an impossibility.

He immediately added, “but they try, everyone tries to have that relative price, so it starts with the exchange rate, then come the tariffs, then come the salaries, then come the companies and then the economist appears and says: they delayed the exchange rate! We have to devalue again and If we do that, everyone will go back to getting on the relative price merry-go-round.”

He acknowledged that maintaining the scheme “It is hard, but clearly there is no other alternative, but the program has to be consistent because otherwise everything goes up in smoke”.

Stocks

Consulted by Scope Regarding the exchange controls, Arriazu clarified that he is an absolute opponent of restrictions, and is in favour of an absolutely free market with a single stable exchange rate. However, he recalled that the government received negative reserves for 11 billion dollars and debts for imports for 40 billion dollars. He considered that, under these conditions, releasing the exchange controls would have led to hyperinflation. Thus, he said that “As much as I hate the cepo, it could not be lifted and still cannot be.” In this regard, he considered that what needs to be done is “raising it little by little, every day a measure and they are taking them”.

As for his forecasts, he said that last December his calculation was that, if the Government did things right, inflation would be 140% this year (against 250% predicted by the International Monetary Fund and 240% by the consensus of economists). His latest estimate predicts inflation of 120% by 2024.

Noting that activity bottomed out in March and consumption in June, he said that “turned around” and expects expansion in the coming months.

His calculations show that, if everything goes well, the Central Bank could accumulate 6 billion dollars in the coming months, from which the country risk should decrease.

Poor

“We are poor in a country that could be rich,” said Arriazu. He pointed out that since 1980 Argentina has had 20 years of recession, which is the most volatile in the world. Since then, it has grown “at a miserable 1.8% annually, barely above the population” and in the last twelve years the product per capita has fallen.

To avoid external crises, he said that what must be done is “not to spend more or issue more.” He calculated that this alone would raise Argentina’s growth rate to 3.5% per year, but that this policy would encourage investments, which would give an additional boost. Thus, “Argentina could grow at 3.8% per year without doing anything, just by being prudent”

He also pointed out the country’s energy potential, which has resources equivalent to 13 times the GDP, compared to Norway, which only has 2 times, and its mining, agricultural and knowledge industry potential.

Faced with the prospect of losing another opportunity, the economist believes the risk lies more in politics and a lack of “common sense.”

Source: Ambito