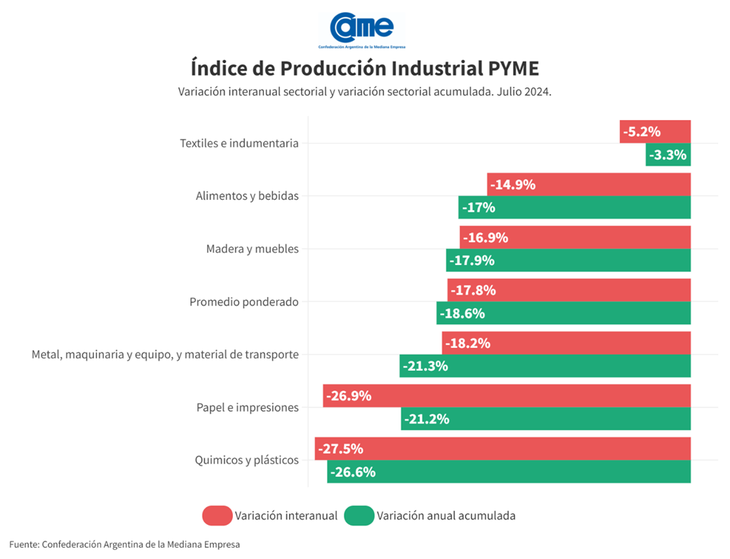

The manufacturing activity of SMEs fell 17.8% annually in July and accumulated a contraction of 18.6% in the seven months of the year compared to the same period in 2023. In the seasonally adjusted monthly comparison, production fell 1.8%. SMEs worked in July with 60.6% of their installed capacity (in June it had been 60.1%). According to the Argentine Confederation of Medium-sized Enterprises (CAME), he 19.3% of small and medium-sized enterprises had difficulties paying salaries.

It is the eighth consecutive month of decline (counting December), in a market where prices have stabilized but The loss of purchasing power continues to affect domestic demand. This situation is aggravated by difficulties in accessing financing and high operating costs, which puts many SMEs in a difficult situation with narrow profit margins.

unnamed (4).png

The results emerge from the SME Industrial Production Index (IPIP) prepared by CAMEwith a sample that reached 414 SME industries at the federal level.

The analysis item by item

The six manufacturing sectors in the SME segment experienced sharp declines in the annual comparison, with the most affected being “Chemicals and plastics” (-27.5%), “Paper and printing” (-26.9%) and “Metal, machinery and equipment” (-18.2%).

In the year-to-date, The largest decline was in “Chemicals and plastics” (-26.6%), followed by “Metal, machinery and equipment” (-21.3%) and “Paper and printing” (-21.2%).

unnamed (5).png

1. Food and drinks

The sector registered annual declines of 14.9% at constant prices in July and 2.6% monthly. For the seven months of the year, it has accumulated a 17% annual decline. Industries operated at 61.6% of their installed capacity, very low levels for a sector that has traditionally been more resilient to economic fluctuations. Companies are producing well below their potential. This affects their profitability and requires greater efforts to maintain staff and investments.

2. Textiles and clothing

Production fell 5.2% year-on-year in July and 4% compared to June in the non-seasonally adjusted measurement. For the seven months of the year, it has accumulated a fall of 3.3%. Industries operated at 60.9% of their installed capacity, well below the average for the first half of the year, when the figure was 70%. 24.5% of companies in the sector reported problems paying salaries during the month.

3. Wood and furniture

In July, the sector shrank by 16.9% year-on-year at constant prices and by 1.5% in the seasonally adjusted monthly comparison. In the period from January to July, activity fell by 17.9% compared to the same months last year.

During the month, industries operated at 60.9% of their installed capacity, far from the levels of the first half of the year, where it was up 14 points. With such low activity levels, 19.2% of companies had problems paying salaries.

4. Metal, machinery and equipment, and transportation material

The sector had an annual contraction of 18.2% in July at constant prices and 0.5% in the seasonally adjusted monthly comparison. In these seven months of the year have accumulated a drop of 21.3% compared to the same months in 2023. Industries operated at 59.1% of their installed capacity and 14.6% of respondents had problems paying salaries.

5. Chemicals and plastics

In July, the sector experienced a significant contraction of 27.5% annually at constant prices and 2.2% in the seasonally adjusted monthly comparison. For the seven months of the year, production has accumulated a a drop of 26.6% compared to the same months in 2023. During this month, industries operated at 60.5% of their installed capacity, while 19.4% of companies had problems paying salaries.

6. Paper and prints

Activity fell by 26.9% year-on-year at constant prices, but showed a 0.2% increase in the seasonally adjusted monthly comparison. It is the only sector that grew in the month. In the seven months of the year, the sector has accumulated a fall of 21.2% compared to the same months of last year.

Companies operated at 62.8% of their installed capacity and 13.7% had problems paying salaries in July. Beyond the general decline in demand, The sector is facing a structural decline due to increasing digitalization.

Source: Ambito