The promise of achieving a convergence between inflation and the official exchange rate of around 2% per month seems increasingly distant because the market estimates a stagnation in the decline of inflation in August, which prevents the Government from being able to show in September, as the Minister of Economy had suggested, Luis Caputoa monthly convergence between inflation and the dollar controlled by the Central Bank (BCRA) at that level.

It happens that different private measurements show resistance in the third week of August, which suggests that the Consumer Price Index (CPI) This month’s rate could be around 4%, although still far from the crawling peg stipulated by the Central Bank for the exchange rate since December. The initial forecast of a coincidence at 2% per month, followed by a gradual reduction to 1% and then nominal stabilization, had been raised by President Javier Milei and his team as a precondition for lifting exchange controls.

Measurements of the city

“According to the data from Wednesday, August 21, the third week of the month closed with a 0.3% increase in food and beverages. This represents an acceleration of 0.4 percentage points compared to the previous week, which had shown a deflation of 0.1%. Thus, the average monthly increase stands at 2.1%, while the end-to-end measurement in the same period remains stable at 2%,” according to the latest report from the LCG consultancy.

For its part, the latest report from Econviews He notes: “A week ago we were moderately optimistic, but current data lead us to expect an increase of 4%, perhaps with a few additional tenths of a percentage point. Although there could be a smaller seasonal price increase in August, regulated prices could increase. The dynamics of core inflation do not show significant improvements. Our most likely forecast is 4%.”

LCG.png

“The number of products with an increase decreased by 5 percentage points in one week, reaching 25% of the revised basket, but the fall was more pronounced in products with falling prices, plummeting 12 points (to 11% of the total),” according to LCG. Meanwhile, Analytica The report said that “during the third week of August, food and beverage prices changed by 0.8% on a weekly basis.” “This brings the four-week average to 2.8%. For the overall price level, we project a monthly increase of 3.8% for August,” they said.

“The categories with the largest increases in the average of the last four weeks include other foods (+4.5%), meat and derivatives (+4.2%) and oils and fats (+4.1%). On the other hand, the categories that have seen price falls are fish and seafood (-3.0%) and fruit (-7.5%),” they concluded.

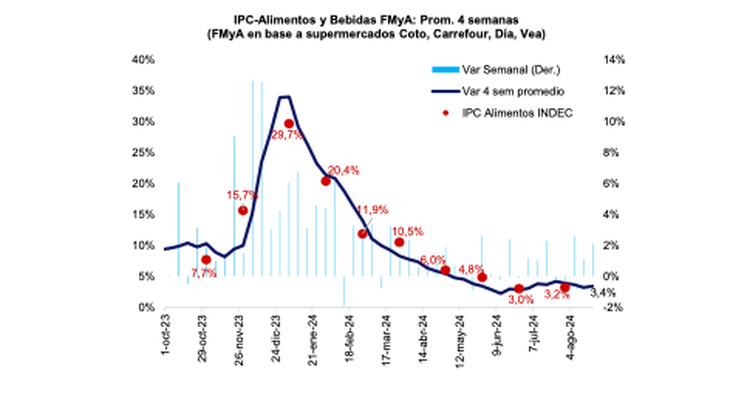

The FMyA consultancy, led by Fernando Marull, stated that “inflation this month turned out to be more complicated than expected.” “In food, the month began with a strong increase that could have been seasonal, but the third week did not show a decrease in the trend of increases greater than 1% weekly, averaging 3.4% monthly. Core inflation between May and July remained stable at levels of 3.7%/3.8%, and it does not seem that it will drop much in August. With a core inflation of 3.5% and regulated prices at 5%, we have raised our inflation projection for August to 3.8%, and we do not rule out that it could reach 4%,” they estimated.

Crawling peg and inflation

With this level of persistence, FMyA already considers it unlikely that the goal of equalizing inflation and the exchange rate at 2% per month will be achieved, even with the tax reduction expected for September. “In September, with the reduction of the PAIS Tax by 10 points (which would imply a reduction of 0.7 points in wholesale inflation), we estimate that inflation could fall to 3% per month, which is significant, but still far from the 1% that the Government predicted, or even the 2% crawling peg,” they added. “For the rest of the year, it is most likely that exchange controls will be eliminated in 2024 – although this is not what the market believes – and we expect inflation in 2024 to close at 133%,” they concluded.

FYMA.png

President Javier Milei recently referred to the evolution of inflation, suggesting that “true Argentine macro inflation” would actually have a rate of 5% per year. He argued that inflation should be adjusted to exclude “imported” inflation resulting from the 2% monthly crawling peg and inflation in dollars. Thus, he concluded that, instead of 4% per month, “Argentine inflation” would be 1.6% (discounting 2 points of depreciation and 0.4 points of price increases in the US), a number that, when annualized, would be 20% per year.

Source: Ambito