Even several of them come from study centers whose way of seeing economic reality is not far from that of the main figures of the economic team, headed by the minister Luis Caputo.

Such is the case of the Institute for Argentine Social Development (IDESA) which in its latest work assures something similar to another report published a few weeks ago by the Institute for Economic Research on the Argentine and Latin American Reality (IERAL)the business school of the Mediterranean Foundation.

“Arguing that the law on pension mobility conspires against fiscal balance, the president reacted emphatically against Congress,” the report says.

retirement-idea.png

In this sense, the work adds that “with a cooler head, one would realize that The law, by consolidating the liquidation of pensions suffered since 2017, is an unprecedented opportunity to make the fiscal surplus sustainable.”

The report states that the Decree of Urgent Need (DNU) 274/24 which provided that, starting in April, pension payments will be adjusted monthly according to the inflation rate of two months ago, consolidated a loss of purchasing power that in real terms fell 35% between 2017 and 2023. “In addition, for the month of January 2024, the DNU set an adjustment of 12.5% when inflation for that month was 20.6%,” says the work of the consulting firm headed by economist Jorge Colina.

On the other hand, he says that The mobility law mandates that pensions must be adjusted to the shortfall to reach 20.6% of January, that is, 7.2%.

In addition, it established that the minimum pension will have a guarantee equivalent to the adult Total Basic Basket (CBT) equivalent and that once a year pensions will be adjusted by 50% of the growth in real wages, if it has grown.

The report of IDESA details that “the 7.2% increase in all pensions implies an increase in pension expenditure of around 0.32% of GDP” and, on the other hand, the guarantee of the CBT “implies an increase of approximately 0.08% of GDP.”

He also recalls that “the Government is granting discretionary a $70,000 bonus to those receiving the lowest salaries, which represents an expenditure of approximately 0.7% of GDP.”

“This implies that, By redesigning the bonus, the increases established by law can be compensated. That is to say, it is possible to apply the law without causing an unbalanced impact on public accounts,” the report concludes.

The study states that “there are many retirees and pensioners who receive the bonus having other sources of income, whether they are pension, work-related, family-related or from asset income” that “do not live only on retirement or the minimum pension”.

The study considers that in the long term the law “has positive impacts in favor of the sustainability of fiscal balance.”

Retirements: consolidated liquidation

For the report, “The formula validated by law is more legally robust that the precariousness that underlies a DNU”. “Secondly, because it is validates the liquefaction of pension expenditure which occurred between 2017 and 2023,” the report states.

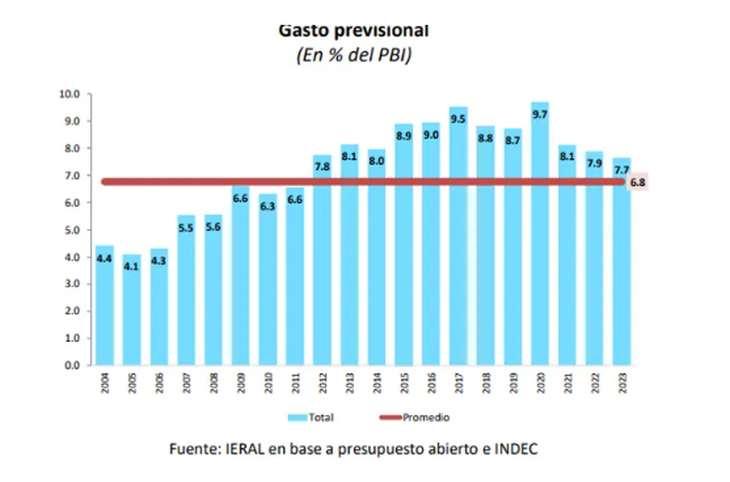

The consultancy firm estimated that “it is a structural reduction of more than a third in pension spending which contributes decisively to the ordering of public accounts.”

Retirements: the opinion of IERAL

retirements-ieral.png

Focusing also on the weakness of the Decree 274 as an instrument to organize the pension system, IERAL points out that the law “is legally more solid.”

“From the point of view of the Financial sustainability helps to avoid the generation of lawsuits which, beyond the fact that public accounting does not record them as such, operate as a liability that erodes the solvency of public finances,” indicates a report prepared when the project was still in parliamentary process.

IREAL maintains that “The project requires an increase in spending that can be offset through a simple decree that better focuses the bonus.”

“In this way, the project allows us to consolidate a level of pension spending that, from a historical perspective and international comparison, appears to be more sustainable,” he concludes.

What are the numbers according to the OPC?

The Congressional Budget Office (CBO) prepared a fiscal impact study of the approved project. He states that:

- This would represent an additional expense in retirement and pensions of between 0.44% of GDP, if the $70,000 bonuses for lower-income retirees continue to be paid until the end of the year. If these were discontinued, this added cost would be equivalent to 0.74% of GDP.

- By 2025, depending on the possible scenarios to be applied, the fiscal impact would be between 0.69% and 0.80% of GDP in the case of continuity of the current bonds. Compared to the application of DNU 274/24 without $70,000 bonds, the incremental impact is estimated between 1.14% and 1.25%.

- The certified debts with provinces that did not transfer their pension funds amount to 703,353 million pesos (current), an amount equivalent to 0.13% of GDP.

Source: Ambito