The same scene is repeated throughout the country. Branches are practically empty, except on days when there are promotions with bank cards or some fintech. In supermarkets, the decline in sales levels is worsening month by month and week by week. And it works as a thermometer of both the social crisis and the difficulties that the economy faces in getting out of it. recession. According to sector data updated until August 18, to which Ámbito was able to access, The collapse in consumption has worsened in recent days and reached 22.6% year-on-year in the accumulated month.

The sequence of the last few months revealed by the consultancy Scentiawhich specializes in mass consumption, had already set off alarm bells: in June, sales in supermarkets and neighborhood self-service stores fell 12.4% year-on-year; in July, the decline accelerated to 16.1%. In the large chains, the year-on-year decline last month was 16.6%.

As reported by this media, The first days of August had already shown a deepening of the deterioration in supermarket sales: By the 11th, the loss had increased to 18.7%. But the situation collapsed completely the following week. “The month has already started badly, but From the 10th or 12th it stopped completely. People don’t have a penny in their pockets,” said a source in the sector. In numbers, this meant that consumption in large stores collapsed 27.6% year-on-year in the week from August 12 to 18according to the numbers he accessed Scope.

image.png

These are the numbers provided by the supermarket companies themselves with a national scope, which are collected by the consultancy firm Scentia for its monthly report. The updated information has data from all the large chains, except one. But a source in the sector who monitors this data on a daily basis explained that, when the data from the missing chain is incorporated, the total percentage will move at most one percentage point up or down. So far, The cumulative total for the first 18 days of August shows a year-on-year drop of 22.6%, i.e. 6 points more than in JulyIn durable products, the cumulative decline is even stronger: supermarkets sold 33.5% fewer household appliances than in the same period in August 2023.

It is true that, in part, the deepening of the fall is due to the fact that, month by month, The year-on-year comparison is made against a higher base. In the second half of 2023, within the framework of the electoral process, the previous Government promoted a series of measures to support income. In fact, it is expected that the deterioration will worsen even more from next month since in September Since last year, the law came into effect Buy without VAT, the tax refund program for debit card purchases, which generated a considerable shift in consumption from local stores (where the plan had little impact) to large supermarket chains.

In any case, the consumer crisis of the Milei era has a depth with few precedents in history. An important source in the supermarket sector told Ámbito that “Unlike in 2002, when consumption shifted from chain supermarkets to Chinese-made self-service stores,” there is no sign of a shift to other channels now sales. In July, for example, there was a 15.5% year-on-year drop in the independent self-service stores surveyed by Scentia.

In wholesalersThe situation is not very different either: INDEC reported a 14.5% year-on-year drop in June (the latest available data) and, in recent weeks, there have been a number of developments that show that the deterioration in sales has not stopped. On the one hand, Diarco and other wholesale chains have started accepting purchases in dollars (even with small or damaged bills) at a rate higher than that of the blue dollar to try to attract middle-class families to their stores who are forced to burn through their savings to make ends meet. On the other hand, the Dutch-owned firm Makro has put up for sale the 24 branches it has in Argentina.

Consumption, income and inflation: the CPI slowdown is not enough

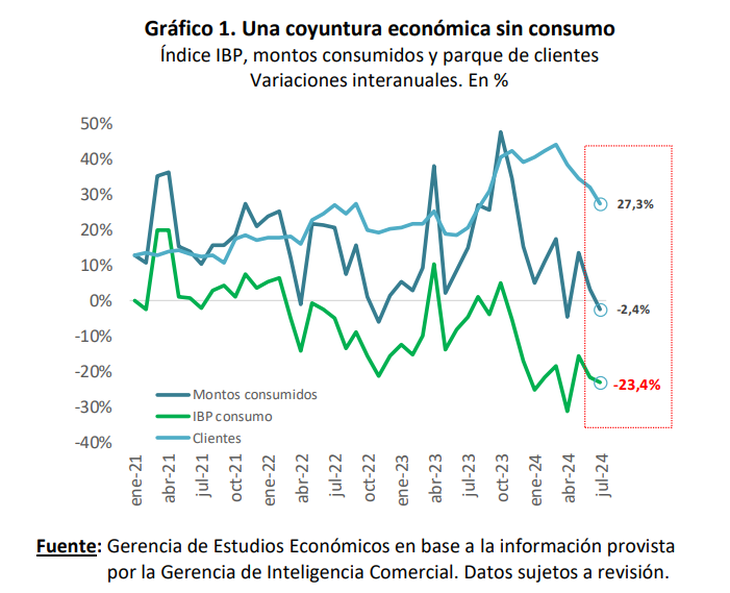

There are other measurements that show not only that consumption has not found a bottom but that the falls have deepened in recent months. This is the case of Provincial Bank of Consumption Index (IBP Consumo), which records the average spending made by the entity’s clients using credit and debit cards and the digital wallet Cuenta DNI, and deflates it by the INDEC CPI. In May, the year-on-year decline had slowed to 15.7%, but from then on it chained two months of acceleration of the collapse: 20.8% in June and, as announced last week, 23.4% in July.

image.png

Perhaps the only estimate that goes against this trend is the one published this Monday by the Argentine Chamber of Commerce and Services (CAC). Its Consumption Indicator, which also includes items outside mass consumption, showed a year-on-year drop of 5.6% in July and a monthly rebound of 1.8%.

Consumption: the reasons for a recovery that does not appear

Consumption represents around two thirds of GDP and, therefore, its reactivation becomes vital to leave behind the recessionary scenario. The Government says that the deceleration of inflation and the timid rebound of real wages in the formal private sector in recent months (which also fails to compensate for what was lost at the beginning of the Milei era) should begin to be reflected in sales, a view shared by Econviews (Miguel Kiguel’s consultancy) which pointed out that “it is likely that we will see a slow but sustained recovery in consumption.” But, for now, that seems far from being reflected in sales figures. Why is this?

A report from the Economic Studies Department of the Provincial Bank He answered that question with two elements. On the one hand, he pointed out that In consumption, “the wage bill is more relevant than purchasing power”. Thus, the 6.6% recovery of real wages in the registered sector measured by INDEC between March and June leaves the cumulative total for the first seven months of the mandate still 9.2% below November 2023 and, in addition, coincides with a destruction of almost 50,000 registered jobs (-0.4%) between March and May, which ends up “neutralizing the impact of the recovery of real wages on consumption.”

On the other hand, the report reflects in numbers how the sharp rate increases (electricity, gas, water, transportation) and other essential services (Internet, telephony) disrupted the real consumption basket of households, ate up any rebound in wages against the CPI and ultimately They left households with less purchasing power to face the purchase of goods both basic and durable baskets.

“The 8.5% increase in real wages of registered private workers between March and June turns into a 4% drop when we replace the General Price Level with the basket of non-elastic public and private services (Housing, Transport and Communication). As a result, the reconfiguration of the relative price scheme prolongs the decline in activity: the recession is not only due to macro factors, but also to micro issues,” said the study by Banco Provincia.

In this regard, the Observatory of Rates and Subsidies of the IIEP institute of the UBA and CONICET estimated that in August the basket of public services (electricity, gas, water and transportation) for an average household in the AMBA reached $144,433 per month, without subsidies. This is almost double that of March ($76,484) and 380% more than in December ($30,105).

The result of all this deterioration is evident in the figures for two central foods in the basic basket: meat consumption fell 14.1% year-on-year in the first seven months of 2024 and is the lowest since 1998, according to CICCRA; dairy consumption sank 17.3% year-on-year in the first half of the year (16.2% for fluid milk and 30% for powdered milk), according to the Institute for Argentine Agroindustrial Development, which estimated that the year will close at the lowest level in history.

Source: Ambito