They know that The word of economic policy makers in Argentina is very devalued and therefore they understand that to gain credibility they have to show concrete and rapid results. But the reality is that Despite some good numbers, the lack of credibility persists which relates to the conditions under which such results are achieved.

Although 2024 can formally end well, there are unresolved problems that are being postponed until 2025. In the case of public accounts, several analysts are beginning to warn that The July financial surplus was achieved because the Government is now borrowing with bonds that capitalize interest and by July it had already managed to avoid paying $1.253 billion, which increased the debt.

This is data from the Congressional Budget Office (CBO). In July the Government added this amount to the public debt corresponding to the Capitalizable Letters (Lecaps), which have become the preferred instrument to replace adjustable debt, such as CER or dollar linked bonds.

The consultants’ view

The consultant Eco Go argues in a report that “given the way new Treasury debt instruments are issued, the interest bill does not increase”. “In fact, the Interest fell 30% In real terms and in the year to date, interest decreased by 5%. In GDP points the interest bill remains at 1.8%, well below the 3.4% of GDP recorded in 2019, when the Treasury debt stock was almost US$50 billion lower than the current one,” says the firm that directs Marina Dal Poggetto.

The question that remains is what would have been the impact on public accounts if the interest had been paid. It is worth remembering that in July Minister Luis Caputo had to report the first deficit of the year. The financial deficit was $600.253 billion. There was a primary surplus of $908.253 billion.

opc-interests-lecaps.png

Economists of the Encounter Foundation They point out that “during the period in which the interests are reinvested, the national government does not have to pay a single peso as interest.” “This is how The minister (Luis Caputo) artificially reduces interest payments on the debt and was able to show a financial surplus during the first months of the year,” they say from the group of technicians who are grouped behind former Economy Minister Sergio Massa.

“If we computed the implicit interest of the Lecaps that the Government is hiding, the interest burden of The debt would increase by approximately $1.7 trillion for the April-July period,” the report says.

The work adds that “as a consequence, The accumulated financial result becomes negative by $818 billion versus the positive $834 billion reported by the Treasury Department.”

The seasonality of the second half of the year

iaraf-accumulated.seven-months.jpeg

Like the The second half of the year is seasonally the year of greater budget execution and tax revenues tend to decline, the economic team is likely to begin to “consume” some of the surplus of more which it achieved in the first seven months of the year, to close balanced, even deepening mechanisms that allow it to accrue expenses in 2024 to pay them in 2025.

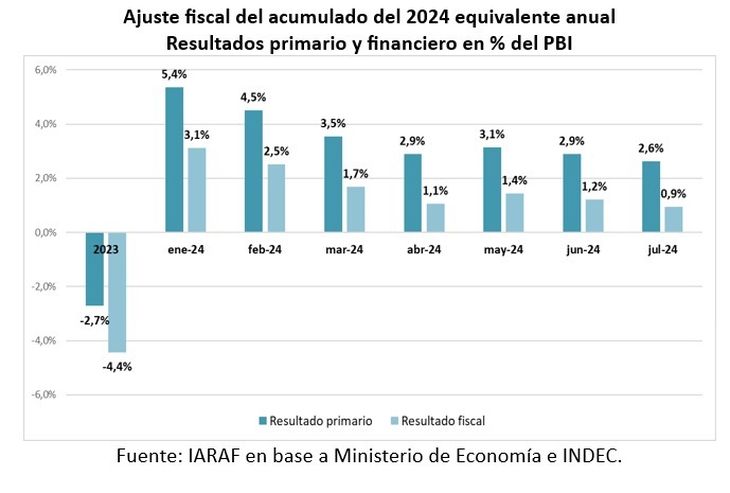

According to the Argentine Institute of Fiscal Analysis (IARAF), The fiscal adjustment for the first 7 months of the year was equivalent, in annual terms, to 5.3 percentage points of GDP, that is, 0.9 percentage points above the 4.4 points needed to eliminate the fiscal deficit. This is only an annual projection that refers to the current structure of income and expenditure of the State. It is likely to vary in the remainder of the period until December.

The annual improvement, the report notes, “This would mean going from a primary deficit of 2.7% of GDP in 2023 to a surplus of 2.6% of GDP in 2024.” Annualized interest expenditure is 1.7% of GDP. Therefore, The annualized financial result is positive at 0.9% of GDP, while last year it was negative at 4.4% of GDP.

The surplus is here to stay

Finance Secretary Pablo Quirno He raised this Tuesday, at the closing of the Colloquium of the Center for Research on the Development of Insurance (CIDeS) 2024, that the “The Government is creating the conditions for the private sector to developsince it is the only generator of wealth in the economy.”

In this regard, Quirno stressed that since the beginning of President Javier Milei’s administration, “the underlying problem that Argentina has, which is the fiscal deficit, was addressed.”

The official also referred to “the lack of credibility of the words of the economic policy maker in Argentina” and assured that “The only way to gain credibility is with results.”

For this reason, the Secretary of Finance stated that “Fiscal balance in Argentina is here to stay because it is the first non-negotiable principle that we have in the Government”“This path is what has allowed us to reduce inflation much faster than expected,” he added.

Source: Ambito