Central Bank Vice President Vladimir Werning spoke to investors at the US Business Council. What did he say about the next phases of the economic program?

The Government is seeking to convince the market of its roadmap for a transition to a new monetary regime, which, in the meantime, involves maintaining the current exchange rate scheme, which many analysts consider unsustainable. And it is calling on national and foreign businessmen to inject capital into the country, despite the doubts prevailing in the business world. Embarking on this train, the vice president of the Central Bank, Vladimir Werning, spoke to American investors on the guidelines of the official plan and assured: “The economy has overcome the crisis.”

The content you want to access is exclusive for subscribers.

Werning performed last Friday at the US Business Council a presentation in English entitled “The Argentine stabilization program: moving from controlled demolition to economic reconstruction,” in which he listed the measures implemented so far and outlined the Guidelines of the economic team for the next phases of the economic plan which aims to lead to the aforementioned currency competition. There, He insisted that the opening of the exchange rate controls will be done in a “prudent” manner.

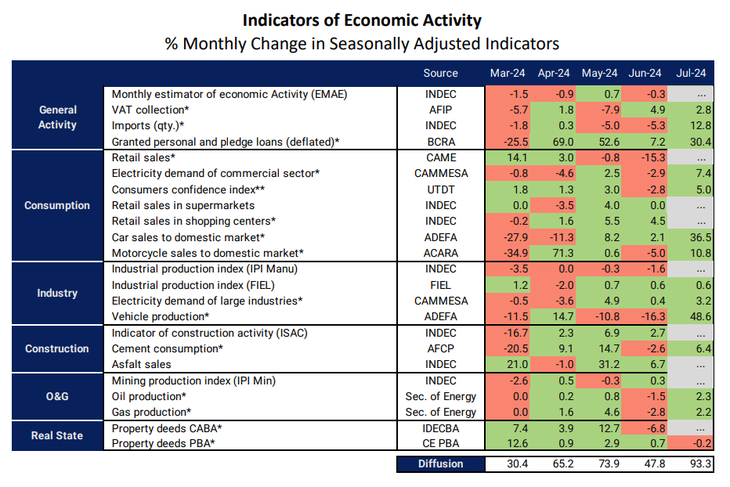

In the presentation of his report, the official referred to the dynamics of the recession and stated that according to the BCRA’s leading indicator “the economy turned around” and showed a high frequency data board of July which, he considered, “show very clear signs of improvement”The statement is supported by some sector variables but does not take into account some indicators that show a continuation of the deterioration: according to Scentia, mass consumption fell 16.1% year-on-year last month and, as anticipated by Ámbito, so far in August supermarket sales have fallen 22.6%.

The Werning dashboard estimates, for July, monthly increases without seasonality in VAT collection (2.8%), imported quantities (12.8%), personal and secured loans (30.4%), electricity demand from the commercial sector (7.4%), car sales for the domestic market (36.5%), motorcycle registrations (10.8%), industrial production of FIEL (0.6%), cement shipments (6.4%) and oil and gas production (2.3% and 2.2%), among others.

image.png

The phases of the program, the dollar and the currency controls

The economist began his presentation with a review of the legacy and stated that there was an “imminent risk of financial death.” “The collapse of the demand for money was too close to rest easy,” he added.

In this context, he argued that the Government decided to “apply a shock therapy “led by the public sector.” He then listed the phases of the economic programme implemented, which had already been defined by Minister Luis Caputo and the president of the BCRA, Santiago Bausili, but on which he added some determinations.

He said that phase 1 consisted of the implementation of an “immediate fiscal exit strategy” (the strong adjustment of the first semester), that phase 2 (the one we are currently going through) involves the “establishment of an orthodox monetary framework” and that The upcoming phase 3 will be the “transition towards currency competition and the prudent lifting of exchange controls.”

The message coincides with the statements of Caputo and Javier Milei aimed at trying Contain market anxieties regarding the opening of the cepoThe Government believes that the conditions are not yet met and that it will only do so when there are no risks of exchange rate shocks. The Minister of Economy assures that they aim to remove exchange rate restrictions without a devaluation jump, since the unification of the exchange rate will occur through a downward convergence of the parallel dollars, something that the vast majority of economists do not trust (even more so in a context of negative net reserves).

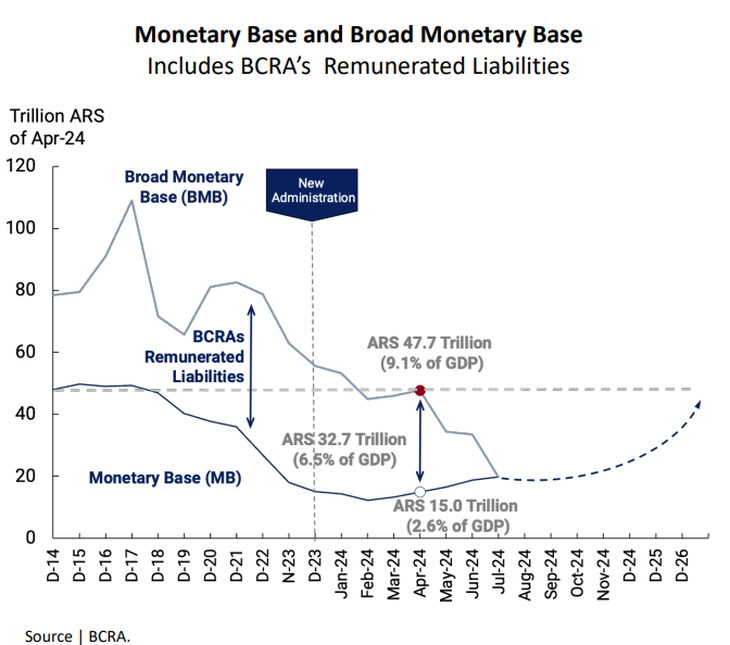

In fact, days ago, Milei added a new condition prior to the opening of capital controls. He said that before doing so the monetary base must be matched with the broad monetary basethat is, the excess liquidity materialized today in the LEFI stock held by banks and in the Government’s deposits in the BCRA should disappear. In this sense, Werning again showed American investors a graph from the BCRA indicating that the entity expects this to happen only in 2027.. For this reason, some analysts interpreted it as a sign of continuity of the restrictions until that moment.

image.png

However, the vice president of the Central He stressed that the monetary authority will seek to relax exchange controls “prudently” as “the exchange rate gap decreases”. In this regard, he listed other preconditions set by the economic team: he stated that the closing of “all the money supply taps” was achieved; that the shorter installments for the payment of imports and the extension of the export blend dollar “are reducing the debt of importers”; that “the monetary markets must be normalized” before relaxing the restrictions through “a significant revaluation of the peso and real interest rates without triggering systemic risk”; and normalizing the goods markets.

Call to the business community

Despite the languor of consumption, the Government is trying to convince businessmen to invest, something that it has not been able to achieve at the moment. In this sense, Werning’s presentation stated that it is necessary “promote a private sector-led recovery of economic growth.”

In this context, the official pointed out that there is “a process of microeconomic reform underway”, which basically consists of deregulating the economy. This is one of the points that he considers important to boost private investment. Another is money laundering. He also stressed that the economic team aims to achieve a remonetization that consists of mobilizing the dollars that Argentines have in their mattresses.

Finally, he stressed that, although the State does not have access to international debt markets, “solid corporate balance sheets maintain fluid access to external financing” for companies.

Source: Ambito