Opinion

The deadline for filing tax returns is September 2nd. Our author has overcome his fears once again. A column about piles of paper, bureaucracy and the lazy side of things.

“Crazy, but somehow almost vintage,” says Sabine, who thinks that I do my tax return the way I have been doing it for 38 years: by hand. With a ballpoint pen. Without any tax software, without any advice. On paper. And she should know. After we graduated from high school, she became a tax officer. And I’ve been doing it every year for a while now – almost vintage.

I owe my personal relationship with tax returns to my mother. In 1986, I was employed as an unskilled worker in a machine tool factory for a month. I worked in the warehouse for components and at the distribution point at the end of the production hall. The four weeks of handling flanges weighing up to 50 kilograms gave me a completely new idea of work and career. The time until the first breakfast break was probably enough for that. For the rest of the year, I was a high school student. And as such, my work had made me a real Croesus: I got a whopping 952 Deutschmarks. I would have accepted without a word that 93 Deutschmarks in income tax and 8.10 Deutschmarks in church tax had been deducted from that. But my mother, a true businesswoman, did not. I was supposed to pick up a form from the tax office for something that was called the annual income tax adjustment at the time. And then hand it in there – filled in myself, please. Ouch.

Magpie distracts me from the actual task: defeating the inner bastard

In 2022, the Hessian Ministry of Finance tried to change my mind and persuade me to go digital. Again, it was about my mother. Like all property owners in Germany, my parents were required to submit a “declaration of the property tax assessment amount” for their house. “If you can credibly demonstrate that electronic submission is unreasonable, you may submit the declaration (…) in paper form. You can apply for this in writing or by telephone to the citizen service of your responsible tax office,” the letter said. Thank you very much.

Travel expenses, home office & Co: You can deduct all of this from your taxes

03:10mins

My parents would never have been able to submit such an application, let alone submit that declaration. And since I had no real interest in getting to know the citizen service of a tax office 500 kilometers away from me, there was only one option: to activate the registration for the electronic Internet system called Elster. The result: Elster takes up more time, is more confusing for me than paper, and distracts me from the actual task: to overcome my inner demon. So why wake up even more sleeping demons? Enter all the documented and sometimes laboriously pieced-together numbers into Elster? Just punch a hole, staple it, and off you go. Without any risk of “Error 401”.

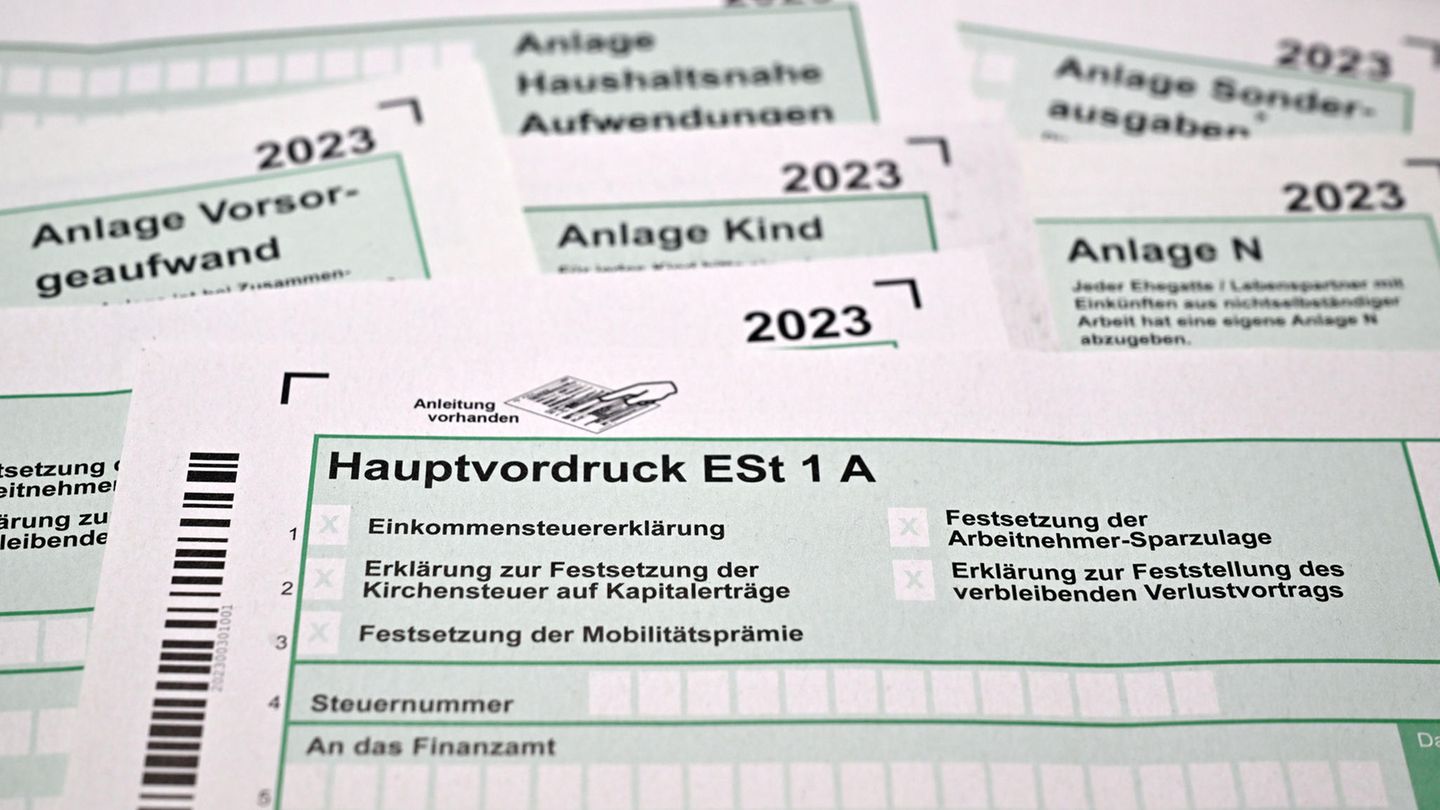

A stumbling block of German bureaucracy: tax return forms

And so this year, too, I let my gaze wander over the shelf in the tax office where all those greenish forms are displayed. A real eye-catcher of German bureaucracy. In terms of language, design, content. From a human perspective, one can really only advise not to touch any of it. Better to go to the income tax assistance association. Or to a tax consultant’s office. Or maybe some tax software? You can do anything.

But I still have the ambition to understand a little bit how my contribution to the financing of the community in Germany works – and every year politicians come up with something new that I can then discover. These poisonous greenish sheets of paper always look different in at least one small place. Line 48 is suddenly 49. For example. So it is only of limited use to make a copy of the completed work for the next year with the idea of saving time. Wrong line, wrong number – too dangerous.

With blues in my ears I step into action

But sometimes changes in the world lead to new complications. For the 2023 tax year, the KAP form seems to be particularly in demand. At least in the north of Hamburg. It is out of stock when I pick up the forms from the tax office. Many people may be like me: the sharp rise in interest rates last year pushed my credits above the exemption limit of 1,000 euros per person. My bank therefore automatically paid capital gains tax to the tax authorities. Unfortunate, but solvable: take a quick breath, listen to some blues music for comfort, and off we go. I print out the KAP from the internet and fill it out. Fortunately, my bank sent instructions with all the necessary numbers.

The AV form, originally created for the “Riester pension”, is also quick to complete. After I eventually realized that I could find the number for line 6 called “income subject to contributions as defined by the domestic statutory pension insurance” in the annual “social insurance report” according to “§25 DEÜV” that my employer sends me, which had previously seemed rather pointless, under “compensation in euros”… brilliant. I’ve been doing this since 2007. Annual net return on average: five percent. Before taxes. That’s pretty decent for a mixture of shares and interest-bearing securities with a guaranteed payout of all payments.

The top class is Annex N. The battle of papers. The life of the previous year flashes before your eyes again: I bought specialist books, took further training there, prepared for a seminar with a colleague and ate pasta while doing so. Calculate 70 percent of the bill for the catering. In accordance with Sections 4 and 9 of the Income Tax Act. Enter the fee from the University of Münster, where I was able to be a guest lecturer on the side. Don’t forget the union contributions. And so on and so forth.

Last year, around 26 percent of all tax returns were submitted on paper. Not a small amount, I think. In 1987, I got 101.10 D-Marks back this way. So, everything. Fantastic.

Source: Stern