Signs of an imminent rate cut

The US Treasury yield curve is on the verge of inverting, suggesting the possibility of an imminent rate cut by the Federal Reserve. Unlike other periods when an inversion of the curve was associated with a high probability of recession, this does not currently appear to be the case.This disinvestment carries a high probability of recession“, says a report by Delphos Investment which studies the safest instrument in the world, as US Treasury bonds are known.

Treasuries- Delphos.jpeg

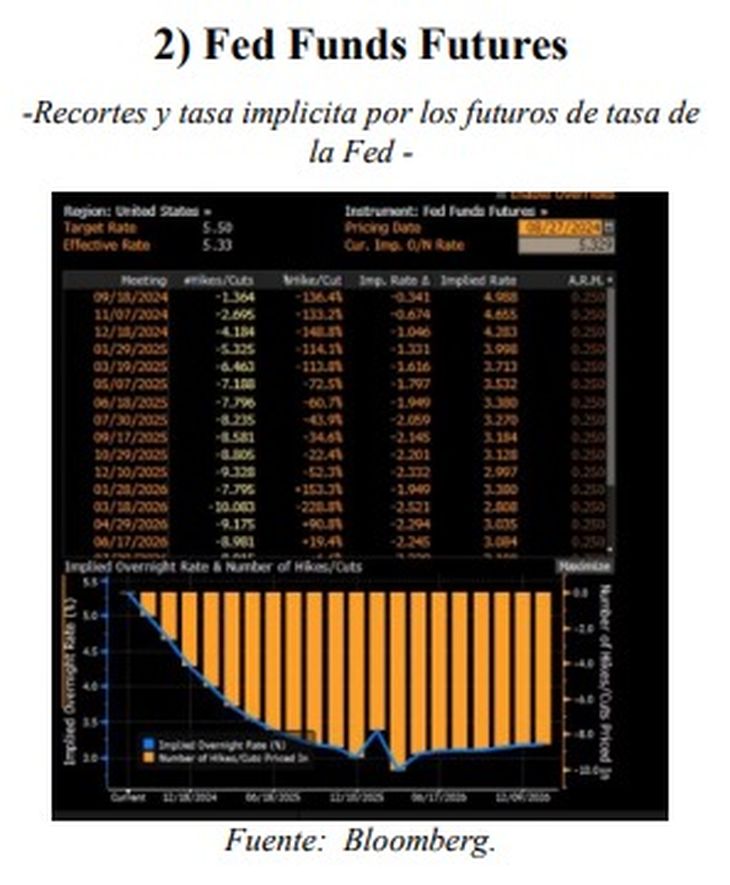

This is because the interest rate futures market anticipates Fed cuts “more aggressively than the Fed’s projections indicate.” “Dot-Plot” from the US central bank itself. The Dot-Plot is the graphical tool that shows the individual projections of the members of the Federal Open Market Committee (FOMC) on future interest rates..

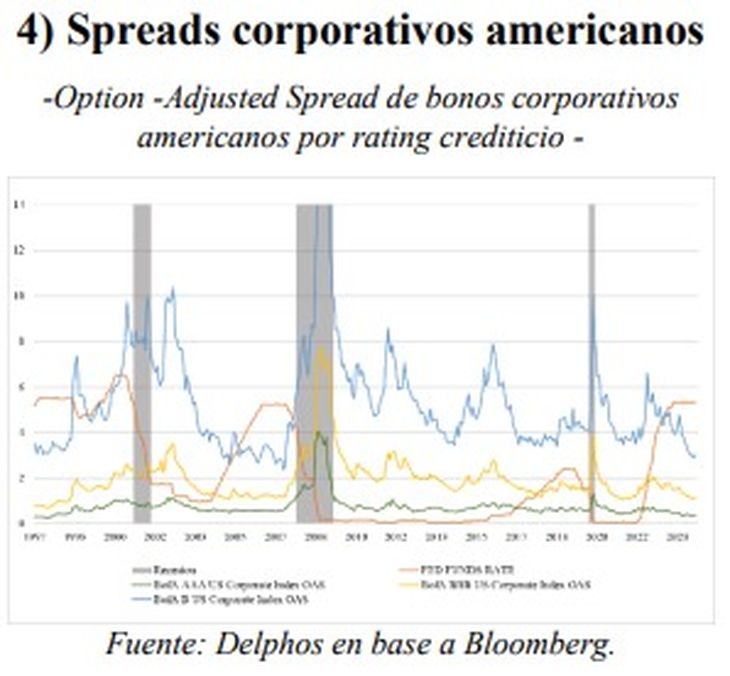

In addition, Delphos argues that “credit spreads in the corporate market, which are close to historic lows, reinforce the view that a recession is not imminent.” However, optimism in the two mentioned metrics appears excessive, which No It does not mean that they discount an unlikely scenario, but that the margin of error has more chances to play against than in favor.

How to build an international fixed-income portfolio

For this reason, in an international fixed-income portfolio, Delphos considers it prudent to shorten the duration and take positions in good quality credits. However, credit spreads on emerging sovereign bonds are less extreme, so, “If things go well, they could be targeted by risk-prone investors and with an appetite for attractive returns“.

And he explains that, the last five times the Treasury curve inverted a recession in the US economy was predicted, it is not appropriate to automatically conclude that the current inversion will lead to a recession. On this occasion, The rate-cutting cycle could develop without triggering a “risk-off” environment“.

The downward-sloping US sovereign yield curve is usually an atypical situation and tends to anticipate a recession when it returns to its natural shape motivated by an abrupt rate cut by the Fed. “And, these events were always accompanied by a significant increase in subsidy applications “for unemployment,” the document states.

Fed Found Futures.jpeg

Delphos points out that this time “it may be half different” given that, although these requests are growing, they are starting from extremely low levels and the upturn in the metric could simply be associated with a normalization. “more than a case of recessionn”. The curve’s inversion could therefore be explained by a Fed willing to start a rate-cutting cycle after having achieved a balance in its two terms.

He also notes that the US rate futures market is pricing in “more than nine cuts by December 2025, equivalent to 225 basis points.” This is significantly above the 100 basis points suggested by Fed members in the Dot-Plot presented at their last meeting. Consequently, For those managing a dynamic portfolio of Treasuries, we recommend looking for higher yields on the short end of the curve and waiting for the long end to adjust..

Delphos then states that positioning oneself in the long part of the curve is a riskier alternative because the market is very aggressive with the cycle of cuts and therefore does not leave much room for improvement in this section.Historically, such abrupt cuts (more than 200 basis points in twelve months) tend to occur during times of recession in the US.”.

However, at its last meeting, the Fed estimated output growth of 2% for 2025 and an unemployment rate of around 4.3%. Without taking these predictions as absolute certainties, “it is important to mention the evident decoupling between market expectations and what the members of the US central bank suggest.”

And indeed, 225 basis points of cuts over the next eleven meetings would imply a reduction at each meeting. In any case, if the scenario that the market is discounting materializes and inflation falls to 2%, as the Fed estimates, The actual rate would be close to its historical average, so it is a scenario that does not sound far-fetched.

US corporate bonds: another attractive option?

In the US corporate bond market, Delphos suggests positioning in good credit ratings given that the optionality-adjusted spreads (OAS) of the US corporate bonds are very close to the lowest levels of the last three decades leaving little room for further compression.

“These low OASs suggest that investors perceive minimal credit risk in companies, reflecting high confidence in corporate solvency,” the paper said. However, such narrow spreads could also indicate excessive optimism in the market. If investors underestimate underlying risks, the market could become vulnerable if economic conditions deteriorate unexpectedly.

And while not the most likely scenario, a recession could widen these spreads, especially for companies with lower credit ratings, where the expansion would be more pronounced during recessions.

Similarly, the OAS of emerging corporate bonds are between the minimum and the median of the last twenty years, while those of sovereign bonds are close to the average. Therefore, in a favorable scenario, Emerging sovereign bonds could attract more demand, broker says.

Corporate spreads.jpeg

“In particular, spreads are very compressed in Asia and EMEA (Europe, Middle East and Africa). In Latin America, although they are also below average, they are not as close to the minimum,” says Delphos. In addition, the J PMorgan Global Emerging Sovereign Bond Spread Index (JPEIDISP Index) is close to the average of the last twenty-five years.

In that case, if a scenario of strong rate cuts materializes, as the market anticipates, without a global “risk-off” sentiment, it is likely that “There will be a greater appetite for attractive yields, which would benefit emerging sovereign bonds“. However, it is crucial to note that these bonds are sensitive to recessions in the United States, which can cause a significant expansion of spreads during episodes of “flight to quality“.

In conclusion, Treasury bond yields remain attractive because they remain above the average of historical real rates. Furthermore, for those who manage a dynamic portfolio of Treasuries, if a scenario closer to that proposed by the Fed materializesit would be more prudent to look for yields in the short end of the curve and avoid extending the duration.

On the other hand, although it is not the predominant scenario, a recession is a plausible risk, so we do not consider it advisable to purchase corporate bonds with low credit ratings (High Yield). Finally, such an aggressive rate cut, without a “flight to quality” episode, could benefit emerging sovereign bonds.

Source: Ambito