Moody’s says some provinces are experiencing problems due to high levels of debt in dollars. However, most provinces are “stable.”

A recent report from the risk rating agency Moody’s He assured that sub-sovereign bonds presented positive and even higher operating margins compared to 2023, but still present liquidity challenges to meet debt payments.

The content you want to access is exclusive for subscribers.

In particular, Moody’s says that the most complicated cases will be those that have debt issued in international markets, which represent a “significant” proportion of their debt and are therefore “exposed to foreign currency debt.”

Improvement in sub-sovereign debt

According to the local team of analysts, the spending adjustments carried out by the provinces forced by the cut in Transfers made by the national Government, contributed to the improvement of the performance and provided an optimistic perspective for the future: “We hope that these values will gradually stabilize based on the evolution of economic activity and as the macroeconomic context stabilizes.”

For Moody’s, the expected drop in revenue was offset by a reduction in expenses in the first part of the year. Two relevant aspects have influenced the offsetting of the expected deterioration in fiscal results during the year.

first half of the year: (i) the fall in current expenditure measured in real terms; and (ii) a decrease and/or postponement of certain capital expenditures. High levels of inflation during the first quarter of 2024 implied a considerable decrease in current expenditure in real terms, coupled with the fact that certain capital expenditures were significantly reduced compared to the same period of the previous year. “Both factors are transitory in nature and we expect a recovery over the next 12 months, Assuming that inflation continues on a path of progressive deceleration as has been observed since the second quarter,” they said.

moodys2.PNG

What factors improved the performance of sub-sovereign debt?

What factors influenced provincial income?

The main factors that affected the revenues of Local and Regional Governments (LRG) during the first half of 2024 are:

- Co-participation: The accumulated revenue from shared taxes between January and July decreased by 9.9% in real terms compared to the same period in 2023. On average, for the provinces rated by Moody’s, these revenues represented 50.2% of current revenues in 2023.

- Provincial tax collection: Provincial tax revenue fell by 5.9% year-on-year in the first quarter of the year. This item is mainly made up of the Gross Income Tax (IIBB), which showed a fall in real terms compared to the previous year, in line with the evolution of economic activity.

- Non-automatic transfers: Although this concept represents a minor component of income, in the short term they do not expect a recomposition of these shipments by the national government to the provinces.

As of July 2024, non-automatic transfers showed a real decline of 83.1% year-over-year. For MLA-rated provinces, current transfers accounted for 4.2% of total revenue in 2023, while capital transfers were 2.5%.

- Current expenses: Current expenditures decreased in real terms during the first half of 2024, more than offsetting the aforementioned deterioration in revenues. In this regard, the real reduction in personnel expenditure items stands out, which, on average, represented 51.6% of the current expenditures of the MLA-rated jurisdictions in 2023. “As the recovery of economic activity materializes along with the consolidation of the disinflation path, we expect real wages to recover and expenditures for this concept to increase, in line with the expected increase in LRG revenues,” they predicted.

- Capital expenditures: This item has been sharply reduced, from representing an average of 13.0% of total expenditure between 2019 and 2023 to 7.0% in the first quarter of 2024 (MLA-rated jurisdictions). “We expect this situation to be temporary and for capital expenditure levels to return to their historical levels, although the sources of financing could change, either through greater use of own resources, through the local capital market, multilateral organizations, among other alternatives,” they concluded.

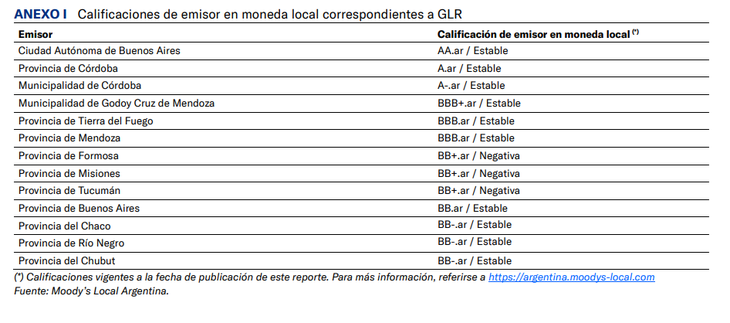

Moody’s rating of sub-sovereigns: the provinces with the best and worst debt rating

moodys1.PNG

There are three provinces that suffer problems in their debt rating

Source: Ambito