After years of growth, payment provider Sumup is switching to profitability. Despite the good results, the question remains: is the company still worth $8 billion?

This is original content from the Capital brand. This article will be available for ten days on stern.de. After that, you will find it exclusively on capital.de. Capital, like the star to RTL Germany.

A few days ago, important figures from the German fintech world took to the stage at the banking summit in Frankfurt to talk about the situation. N26 boss Valentin Stalf announced the first profitable month, Scalable founder Erik Podzuweit explained how things are going with the neobrokers. But one founder, whose name many don’t even know, was missing: Marc-Alexander Christ.

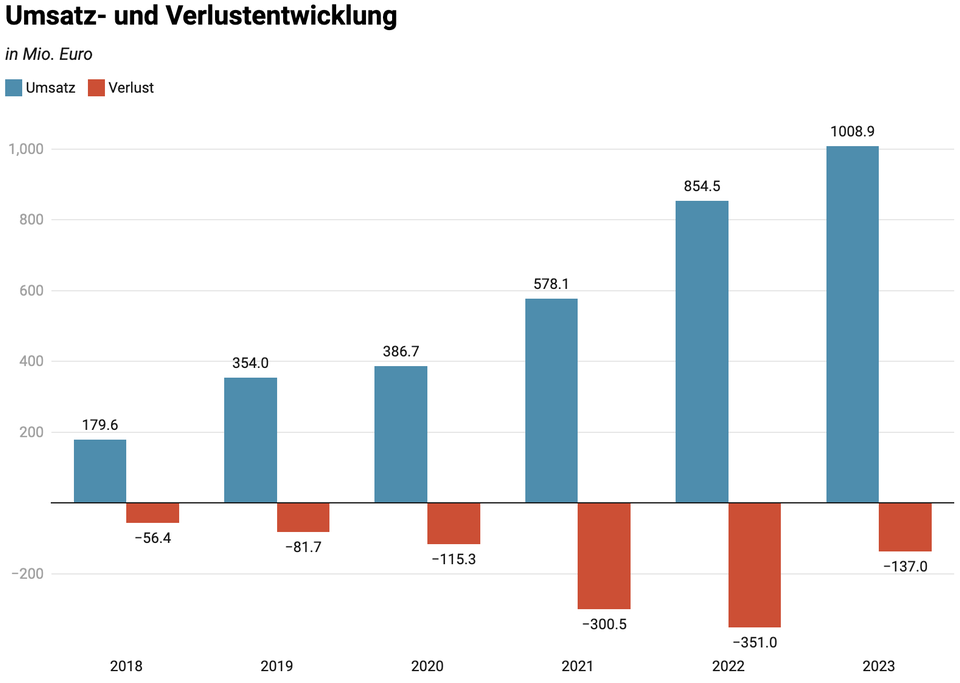

Christ has helped build up the payment provider Sumup in recent years. One of the company’s most important locations is Berlin, even though the fintech is now globally positioned. The fintech generated around 1 billion euros in sales last year, making it significantly larger than the other major fintech players. This is shown in Sumup’s annual report for 2023, which was recently published.

For comparison: Neobank N26 is likely to generate roughly a third of the revenue. Sumup has another special feature: the company’s earnings before interest, taxes, depreciation and amortization were almost 100 million euros. Sumup is one of the few fintech players to have managed to achieve a positive result.

No more “growth at any price”

So the hidden champion of the German fintech scene? The numbers look like this. The company has grown strongly in recent years, as is reflected in the numbers. But it also says that Sumup was early on concerned with a change in strategy “from ‘growth at any price’ to ‘profitable growth’, (…) achieved very respectable EBITDA margins, while [das Unternehmen] while maintaining considerable growth momentum”.

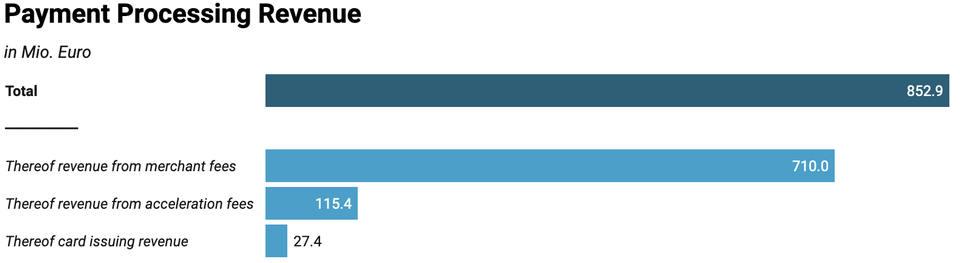

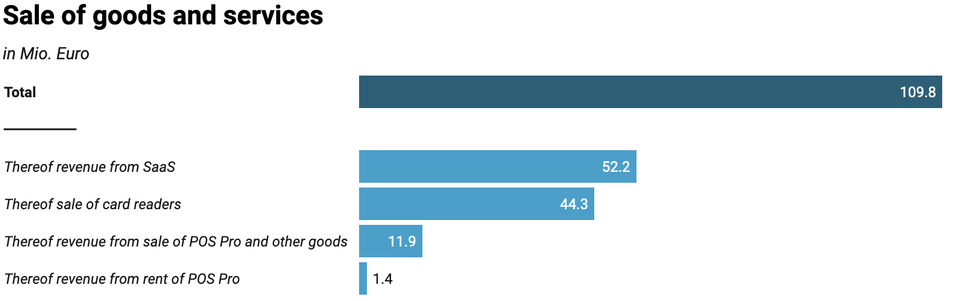

To better understand the business, you have to look at the individual sources of income: Sumup’s earnings are divided into three areas. Firstly, the payment business, which still accounts for a large part of the turnover. In addition, there is the sale of card devices, software sales and other income, such as interest income.

The transaction business makes up the largest part (see graphic). Sumup grew by 17 percent there in 2023. If you exclude the so-called acceleration fees, it even grew by 19 percent. In Brazil – an important market for Sumup – merchants have to wait a long time for their money. But they can speed this up with acceleration fees. This fee accounted for around 14 percent of sales last year, but is no longer growing. Since these are specific fees for a market, investors will be more likely to look at the fees that affect all markets when it comes to growth.

The other segment, “Sale of goods and services,” includes the rental and sale of the readers, as well as software revenues. In this business area, Sumup has made massive acquisitions over the past few years, including companies such as Tiller Systems, Fivestars Loyalty and Goodtill. The strategy behind this was to gain a foothold further in the value chain and not only sell the card reader, but also offer the entire cash register system and software. Founder Marc-Alexander Christ says that many of the software offers are free and are intended to help increase payment sales, which is why they cannot be seen in the figures. The vision is to provide an ecosystem of services for retailers.

It is positive that sales have grown, even though revenues from card readers have actually fallen by two percent. Existing customers therefore appear to be growing and generating more sales through the Sumup systems.

Sumup pays extra for card readers

But how does Sumup compare to the market? Adyen’s transaction volume increased by 26 percent last year – but the Dutch tech company also addresses another customer segment, namely large companies such as Meta. Sumup can best be compared with Square, which belongs to Block, and Lightspeed, which is itself listed on the stock exchange. Square had transaction revenue growth of eleven percent in 2023, while Lightspeed came in at 37 percent. Sumup is therefore in the middle of the pack.

Sumup is also in the middle in terms of revenue distribution when you look at the three areas of card device providers: hardware, transaction fees and software such as the cash register system. It is noticeable that the hardware is a loss-maker, at least for Lightspeed and Sumup. Sumup sold card readers for 44 million euros last year. However, the company itself paid 76 million euros for them.

Money is earned through transaction fees and software solutions. At Sumup, transaction fees account for 89 percent of sales. This is followed by software solutions and hardware products, at five percent and six percent respectively. By comparison, Square has 83 percent transaction sales, 15 percent software subscriptions and two percent hardware.

Lightspeed, on the other hand, is a software provider by nature and generates 35 percent of its revenue from software subscriptions – 60 percent from transaction fees and five percent from hardware.

Since Block does not publish its data for Square in such detail, from the gross profit perspective you can only compare Lightspeed and Sumup.

Healthy business model

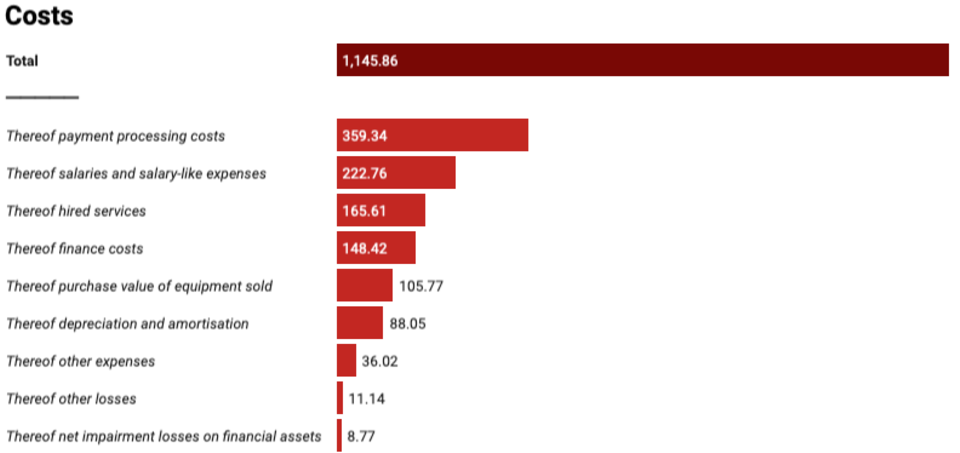

Both have a fundamentally healthy business model. After deducting transaction costs and the costs of the devices, Sumup has a gross margin of around 38 percent. Lightspeed is at 42 percent – which is because they generate a higher proportion of high-margin software sales.

Sumup is, however, much more efficient in terms of operating expenses. In 2023, they were able to reduce these from 510 million euros to just 444 million euros. Sumup does not report exactly how much they spend on which areas. But they do state how much they pay to external service providers – so-called “hired services” – and they have reduced marketing and PR expenses from 143 million euros in 2022 to 48 million euros in 2023.

This means that Sumup has a profit before taxes and interest of eleven million euros.

Lightspeed also significantly reduced costs (from $682 million to $588 million), but still ended up with an operating loss of around $200 million. The higher expenses ($234 million for marketing alone) also explain Lightspeed’s stronger growth.

However, Lightspeed is debt-free. Sumup has financed itself partly through borrowed capital and has a total of around 1.2 billion euros in loans. As a result, the company had to pay 148 million euros in interest last year, which then caused profit before taxes to slip sharply into the red again.

What would Sumup be worth on the stock market?

To answer the question, you can go by the classic financing round. Sumup was valued at eight billion euros in the penultimate round in June 2022. In the last round in December 2023, around 300 million euros were raised again and, according to Sumup, the valuation was even higher, as a company spokesperson told CNBC.

A look at Lightspeed, however, raises some questions. The competitor has a similar turnover (around 820 million euros in 2023 compared to Sumup’s 1 billion euros) and is growing even faster, but is also less profitable. Lightspeed is currently valued at 1.8 billion euros – 2.2 times the turnover. Sumup is aiming for a valuation of eight times. The bottom line is that either Lightspeed is significantly undervalued – or Sumup is significantly overvalued. Founder Christ is relaxed and is not commenting on the valuation. They have shown time and again in recent months that they have good access to new money.

This text first appeared at the magazine for the new financial world, which is created in cooperation between Capital and OMR.

Source: Stern