Although projections from various consulting firms and economists indicate a probable slowdown in inflation in September, doubts persist about the sustainability of this trend.

However, this projection was made before knowing the inflation data for August, which exceeded the expectations of most of the market.

Mariano Fuchila

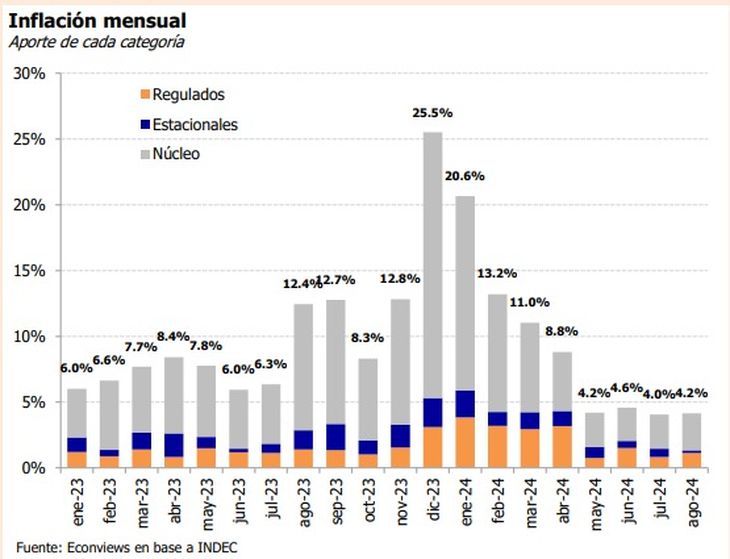

With the inflation data for August in hand (4.2%), the market is already projecting the September figure. It turns out that the eighth month of the year surprised the market and did not go down well with the Government. This month there seem to be favorable conditions for a significant drop in inflation, which could even bring the index to less than 3.5%, which would be the lowest level of Javier Milei’s management.

The content you want to access is exclusive for subscribers.

In its latest report, following the publication of the National Consumer Price Index (CPI) by INDEC, JP Morgan noted that the reduction of the PAIS Tax, from 17.5% to 7.5%, would contribute to a one-off drop in inflation between 0.6% and 0.7%. This forecast is in line with estimates by local economists such as Fernando Marullwho also anticipate a slowdown.

Based on these expectations, JP Morgan estimates that September inflation could be around 3.4%. Similarly, the consulting firm EcoGo, led by Marina Dal Poggetto, projects a similar index, arguing that the slowdown in food prices, the reduction of the PAIS tax, exchange rate stability and a recessionary economic environment will contribute to this decline. In August, the same consultancy had anticipated inflation of over 4%, almost correctly predicting the final figure.

Other projections

For its part, Econviewsdirected by Miguel Kiguelalso foresees a relative calm in prices for September, reinforced by the effect of the reduction of the PAIS tax on tradable goods. However, they warn that inflation data for the coming months could be higher, potentially affected by the elimination of exchange controls.

Inflation- Econviews.jpeg

Although all indications are that the trend will decline considerably in September, uncertainty remains over the sustainability of this trend, given that the tax cut has a one-off impact.

In August, two factors raised concerns: the rise in the headline index and core inflation, which reached 4.1%. Nevertheless, alternative estimates have emerged that provide some relief. Although everything points to a considerable decline in September, uncertainty remains about the sustainability of this trend, given that the tax cut has a one-off impact.

The consultant Balance The central bank also expects a significant fall in inflation in September, estimating a level close to 3.2%. This forecast is based on the initial data for the month, which showed a reduction in prices for products such as cars, televisions, cameras and cell phones, a direct result of the reduction in the import tax. However, this projection was made before knowing the inflation data for August, which exceeded the expectations of most of the market.

Source: Ambito