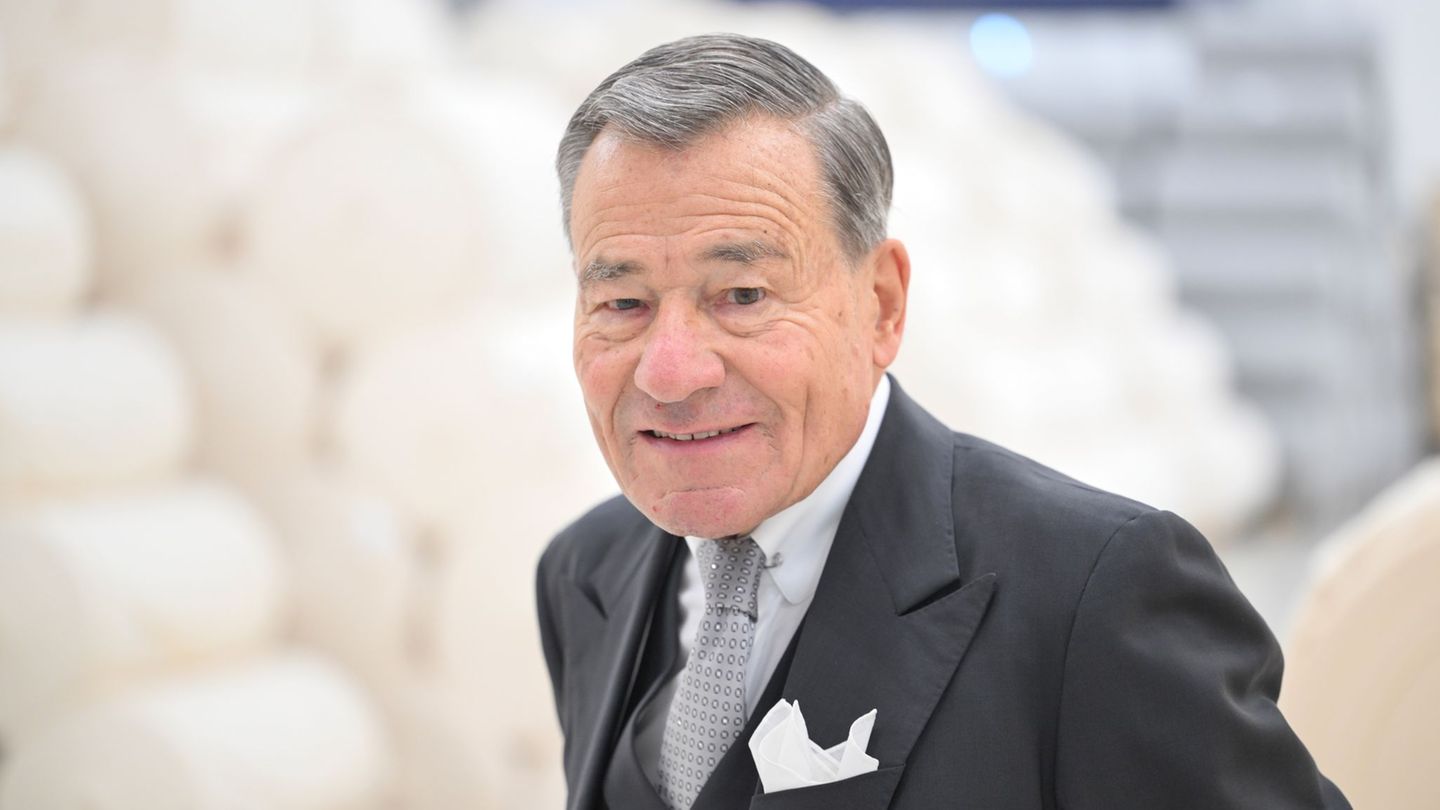

The announcement of the displacement of the Western Hemisphere director, Rodrigo Valdesas an interlocutor of the International Monetary Fund (IMF) with Argentina would not imply a change in the demands of the organization with our country, according to the vision of the former member of the entity Claudio Loserwho was there for 30 years and served eight as Western Hemisphere director.

The government is optimistic about the possibility of closing an agreement with the International Monetary Fund (IMF) before the end of the year. Although negotiations are just beginning and no formal request has been made, information is already circulating in Washington, indicating that both parties are willing to evaluate the conditions of a new financial agreement.

In this context, the recent replacement of Rodrigo Valdés as IMF representative for Argentina, in favor of Luis Cubeddu, will not change the organization’s demands, according to Claudio Loser. Although Argentine President Javier Milei criticized Valdés for being a “leftist,” Loser emphasizes that the IMF’s policy is structural and not personalistic.so the change of interlocutor does not imply a modification in the conditions that the Fund will require from the country..

“It is not common for the organization to announce so loudly that someone is leaving the negotiations. It is normal for people to change, but it is very unusual for this type of announcement to be made; I think it is much less important than Milei thinks,” said Loser in an interview with Radio con Vos.

And he added: “The Fund is a vertical organization. Obviously, the head of the Fund [por Kristalina Georgieva] It is important. But the work is done as a team. And the fact that Valdés, whom I know and respect a lot, says ‘I’m stepping aside’ It doesn’t mean that it will be different for Argentina. Cubeddu will not be softer, the Fund will not be softer, nor will it ask for different things. The only thing that will happen is a little less tension initially.“.

“He’s not going to tell you [al Gobierno]: ‘Listen to me, I’ll only give you money when you change these things.’ What I think is that the Fund will tell him: ‘You have a plan, tell me how you’re going to do it and then we’ll talk.’ But it’s not an issue that depends on the alleged leftism of Valdés or any of his people,” he said.

Loser’s words

Despite the criticism, Loser says the IMF is willing to lend money to Argentina because of the fiscal adjustment implemented by the libertarian administration. However, he warns that the amount requested by the government, which could reach US$20 billion, is unlikely to be granted. Loser’s calculation places a more realistic figure between US$5 and US$7 billion, on the condition that the government advances in other key economic reforms, such as lifting the exchange rate restrictions.

The former IMF official also believes that a possible victory of Donald Trump in the US presidential elections will not significantly affect the negotiations with the IMF, despite the ideological affinity between Trump and Milei. According to Loser, US economic policy does not have the influence to guarantee large sums of money to Argentina, and although Trump could show sympathy for the country, his priority will not be to secure large disbursements from the IMF.

Claudio Loser. (Photo by Ignacio Petunchi).

The Argentine government is facing negotiations with the IMF, which, although they are moving forward with a new interlocutor, will not change the organization’s demands.

Loser also recalls that the record loan granted to Argentina during Mauricio Macri’s term was facilitated by Trump’s political support at the time, but stresses that the IMF learned from that experience and is now more cautious with the size of the loans it grants, especially when there is a significant debt like the one Argentina has with the organization.

Finally, the expert acknowledges that, although the economic plan of the libertarian government has solid fiscal and monetary aspects, important challenges still persist, such as the maintenance of the currency controls and the dual exchange rate, which must be addressed to improve the country’s economic situation.

Source: Ambito