The prices for residential property in Frankfurt and Munich have recently fallen significantly. Now, according to UBS, the market could pick up again. Is the risk of a bubble now increasing?

According to a report from the major bank UBS, the decline in the price of residential property in Munich and Frankfurt is likely to have ended. “Falling interest rates will shift the cost advantage for potential buyers more clearly towards purchasing real estate,” says Tobias Vogel, CEO of UBS Europe SE, in which the Swiss institute has pooled its business in the Eurozone based in Frankfurt.

The European Central Bank (ECB) has already cut interest rates twice this summer, and the next downward step is expected in October or December. As key interest rates go down, mortgage interest rates also fall. Vogel said better affordability could encourage first-time buyers to return to the market. The current market environment suggests that prices in European cities could soon rise again.

This is original Capital branded content. This article is available for ten days on stern.de. You will then find it again exclusively on capital.de. Capital belongs like that star to RTL Germany.

Every year, UBS analyzes residential property prices in 25 cities worldwide and uses this to calculate the Global Real Estate Index. In Germany, Frankfurt and Munich are considered.

In particular, the sharp increase in construction costs and the now high interest rates have recently put the construction industry in a precarious situation. New construction activity has therefore largely come to a standstill. The lack of new buildings and the constant population growth of around one percent per year in Frankfurt and Munich result in an increasingly scarce supply of housing. A further increase in rental prices is therefore expected. The price increase in this country could be dampened by the weak economic development.

One of the largest mansions in the USA

This is what it’s like to live in “The One”

Declining risk of a real estate bubble

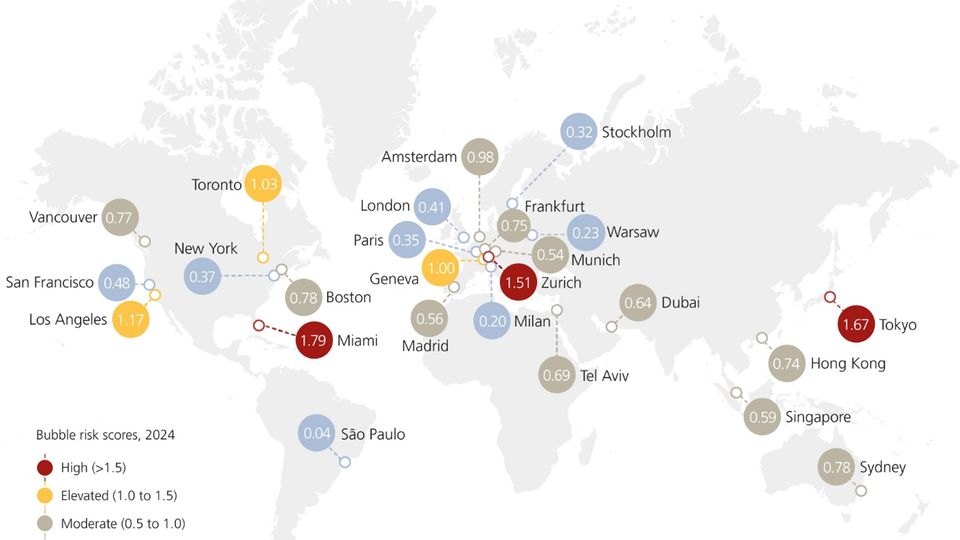

However, UBS believes that the prospect of rising property prices and rents will not trigger a bubble. The corresponding risk has actually fallen significantly. Based on the UBS risk indicator, Frankfurt and Munich are in the middle of the field in an international comparison of 25 cities and are classified as moderate. In 2022, Frankfurt (2.21) and Munich (1.78) still had a high risk of a real estate bubble. The value for Frankfurt is currently only 0.75 and for Munich 0.54.

The risk is assessed using a score system. For the calculation, several key figures, such as price and rent, are put into relation. A score below 0.5 represents low risk, while a score above 1.5 represents high risk.

But the risk of a real estate bubble has fallen not only in the two German cities under consideration. UBS has determined lower values in the bubble index across cities. The reason for this is falling demand due to increased mortgage interest rates. This caused prices to fall around 20 percent below their maximum prices.

An exception to the development of real estate prices are Miami and Dubai among the 25 cities examined. In Dubai, prices rose by 17 percent last year alone, and have even increased by over 40 percent since 2020. A key reason for this is primarily speculative investments in properties that have not yet been completed. Miami recorded a comparatively lower growth of seven percent last year, but is particularly notable for its price increase of 50 percent since 2019.

According to the UBS index, Zurich and Tokyo are also currently in the acute bubble risk zone. Los Angeles, Toronto and Geneva are also considered high risk.

Buying a home remains difficult

Despite the recent price decline, property prices in Frankfurt and Munich are still significantly higher than ten years ago. In Frankfurt the average price is around 90 percent higher than a decade ago. This has consequences for affordability: According to the report, a skilled worker can currently afford 40 percent less housing than in 2021, before the global rise in interest rates.

Source: Stern