The lack of foreign currency and the large foreign currency maturities of 2025 are the main factors of concern for economic agents on the macro front, even within the framework of the exchange and financial calm of recent days. After the publication last Monday of DNU 846, which extended the possibility of making exchanges Without going through Congress or meeting the requirements of the Financial Administration Law, the city began to draw up scenarios for a possible operation of this type regarding foreign debt.. In parallel, there emerged a hypothesis: what if, supported by money laundering, the Letes return in dollars that Luis Caputo already placed during the government of Mauricio Macri?

The Government insists that it will maintain its exchange rate scheme and does not provide details on a roadmap for the disarmament of the stocks, which the market sees moving away. The key is the scarcity of foreign currency: Net reserves are negative by more than US$5 billionare located below the accumulation goal agreed with the International Monetary Fund for the end of the third quarter and the bleach (now extended) appears as the lifeline that the economic team relies on to get through the seasonally most difficult months. By this way, Deposits in dollars have already grown by US$8.4 billion.

A report of the CP consulting stated that, after the July shock, the Government managed to chain a financial spring leveraged on better international conditions and money laundering. But what going forward “the exchange market threatens to become tense.” A scenario that the economic team will try to mitigate by “recycling the dollars contributed by money laundering” via bank credit. However, their projections anticipate “BCRA sales in the market and falls in net reserves during the next three months.”

image.png

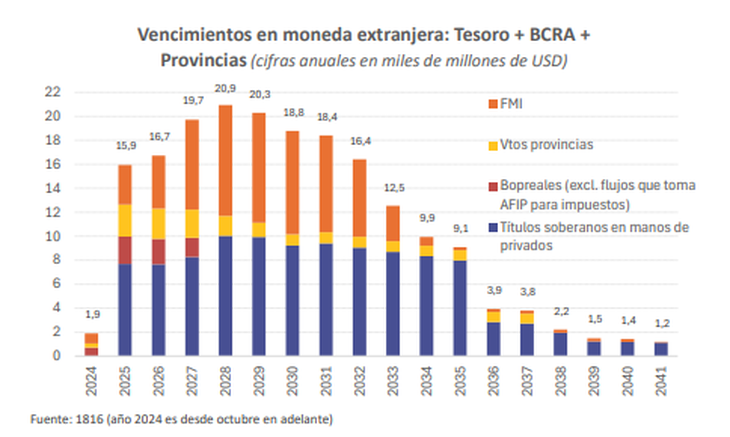

Although the focus is, above all, on next year. “Beyond December, Sustaining the exchange rate scheme seems very unlikely. Turning the entire trade surplus into the financial markets (80-20 of exports) and facing a growing external debt payment schedule results in a shortfall that is difficult to finance under current conditions (US$19.7 billion by 2025). Going through an election year with these prospects seems risky,” CP said.

In a similar sense, the consultant Vector He highlighted that “the money laundering and the lowering of the FED rate provided a much-needed spring for the Government after the months of June and July, when the markets and gaps were unstable.” But he warned that, Once the flow of dollars from capital regularization stops, “tensions are likely to be revived in the exchange market.”with a BCRA that continues without purchasing reserves and debt maturities increasingly closer.”

Prospects for an eventual foreign debt swap

Although the rally in dollar bonds made country risk decline during the last rounds, the indicator remains around 1,300 basis points, a level still far from what is considered necessary to regain access to international markets. Thus, while the Government negotiates with foreign banks for a repo (which would eventually materialize through the Central Bank) to meet the January maturities, In the city, the perspectives on a possible foreign debt exchange have already begun to be analyzed.

The trigger was the publication of DNU with which the Government gave Caputo free rein to carry out liability management operations under more flexible conditions, not only with debt in pesos but also with securities in dollars. Specifically, it allows you avoid the authorization of Congress and exempts it from achieve the provisions of the Financial Administration Law (LAF), which provides that an exchange must comply with at least two of the following three conditions: lengthen terms, reduce the interest rate and/or reduce the capital owed.

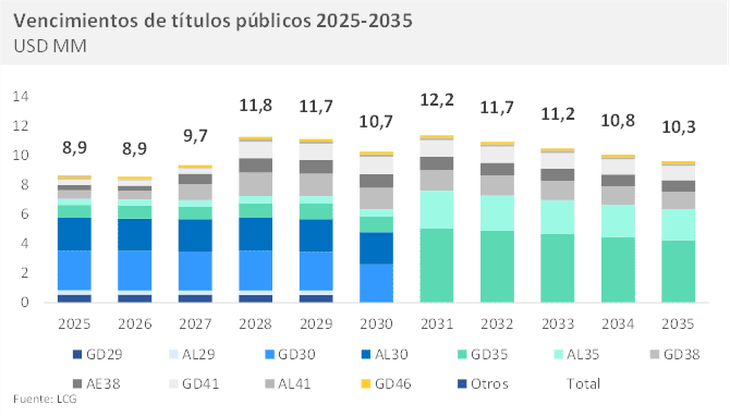

“We believe that the intention is to have a legal umbrella to facilitate liability management, enabling the withdrawal of securities from the market that are not very required due to their low interest rates (basically Bonares and Globales), and take advantage of them to extend terms with other instruments with a ‘sweeter design’ in view of investors. Probably for holders to enter into a voluntary exchange, the sweetener must set aside capital reductions (reduction of amounts), so the extension of the term on par with a highest coupon generates the need to skip article 65 of the LAF,” he considered. the LCG consultancy in a report sent to their clients.

image.png

LCG’s hypothesis is based on the fact that in 2025 nearly US$9 billion between principal and interest on the bonds in foreign currency mature, half in January and half in July. And he states that, not having access to the debt market, the objective would be to exchange the portion of the maturities that are not covered by the repo that is under negotiation.

In dialogue with Scope, Ramiro Tosi (former Undersecretary of Financing and Director of Finance of the consulting firm Suramericana Visión) considered that “the most likely thing is that they want to have the tool available to use it in the second part of 2025, when the dollar account will be more complex, and that they want undertake a liability management operation that involves an exchange but with limited application and not generalized”. This hypothesis could imply, for example, a conversion of AL30 and GD30 for another existing instrument (AL/GD38) or a new one to be issued in the exchange.

The consultant 1816 It has a somewhat more restrictive interpretation. Consider that the DNU enables this type of more “flexible” exchanges only for bonds under local legislation (the ALs) and that another law or decree would be required to extend it to the Globals.

However, there are operators who welcome the possibility of a limited rescheduling with more beneficial conditions for creditors. In any case, they will closely follow the political fight: a part of the opposition prepares to discuss in Congress the possibility of annulling this DNUas already happened with the decree that expanded the funds reserved for the SIDE. The thing is The other side of the favor to bondholders would be a greater cost for the State: for example, in current market conditions (and despite the lack of time), the rates those that the Treasury would face exceed 15% annually in dollars.

Are Letes returning in dollars?

In parallel, The growth of dollar deposits through money laundering raises hypotheses about possible ways to recycle these currencies. It is that those funds they begin to gradually impact gross reserves to the extent that the banks send the regularized banknotes to the BCRA as reserves, which at first they had kept almost entirely in their branches. However, the impact on the strangled net reserves will not be such, unless certain conditions are met.

The consultant 1816 mentioned three ways: what is paid fine for regularization (a large amount is not expected due to the wide possibilities of doing it at zero cost), what the banks derive dollar loans to companies (these credits must be settled in the MULC) and hypothesized about an eventual reappearance of placements of Treasury Bills (Letes) in dollarsin this case to refinance part of the large external debt maturities of 2025, which total US$15.9 billion between sovereign and provincial bonds, IMF and Bopreales, according to their estimates.

image.png

The economists of 1816 considered that “although so far they are not part of the Treasury’s financial strategy, it is easy to think that there could be appetite among local investors by Letes (Short-term Treasury or BCRA Bills subscribed with and payable in MEP dollar) at relatively low rates” due to the logic of the special money laundering accounts (CERA) and the cross restriction established by the exchange rate between the dollar official and the CCL “which generates a universe of ‘captive’ investors in argentollars.”

However, the consultant raised objections that “It is not clear whether the market would be willing to buy instruments maturing in 2026 (or later)” under an assumption in which there may be no stocks (or at least cross restrictions), in addition to the fact that by that time the permanence periods established in the money laundering would have expired to avoid the fine (December 31, 2025) The legislative elections will have already passed. And he pointed out that another option would be to issue Letes in dollars even at a shorter term, with maturity in 2025, but he warned that in such case the net reserves could be evaluated by discounting the balance of these instruments.

Although there were no messages from the Government in this regard, speculation about a return of the Letes in dollars It began to circulate on tables in the city a few days ago. For now, They were an instrument widely used by Caputo as Macri’s secretary and finance minister. starting in 2016. First they were a destination for dollars that banks received from depositors and then the possibility of subscribing them with pesos was enabled and they were used by retail investors as a way to dollarize.

But, within the framework of the external mega-debt cycle, The creation of short-term foreign currency debt did not have a happy ending: first came the closure of international markets in 2018, the run and return to the IMF, which caused Letes rates in dollars to jump from 4% to 8% annually; then, ended up reprofiled in 2019in the times of Hernán Lacunza in charge of the Treasury Palace.

Source: Ambito