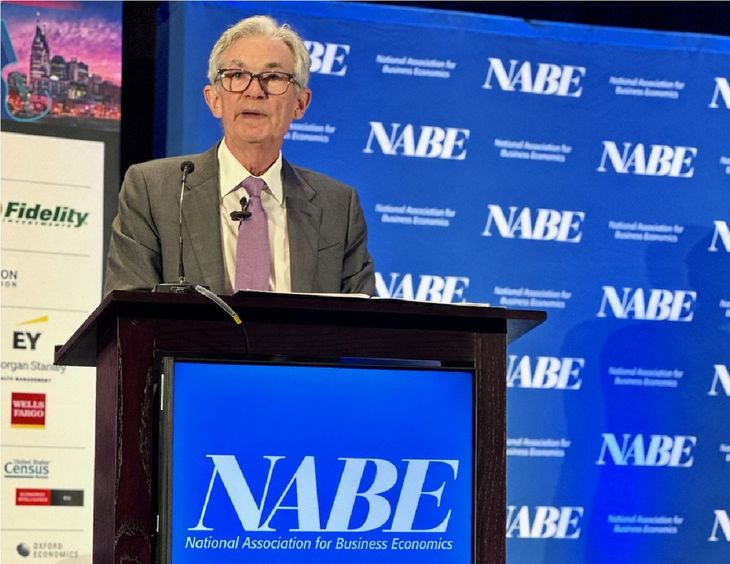

Investors react to Jerome Powell’s speech, who clarified that the Federal Reserve is “in no rush” on broad rate reductions.

He global dollar rose widely on Tuesday after the president of the United States Federal Reserve (Fed), Jerome Powellrejected bets on more large interest rate cuts.

The content you want to access is exclusive to subscribers.

He dollar index rose 0.4% to 101.11, marking a one-week high, after having posted a third consecutive monthly drop on Monday, with a drop of almost 1% in September, Reuters reported.

The dollar rose 0.1% to 143.57 yen, having ranged from a high of 146.495 yen on Friday to a low of 141.65 yen on Monday.

He euromeanwhile, was trading at $1.1085, near one-week lows after a drop in German inflation to the lowest level since early 2021, fueling speculation about another rate cut this month by the European Central Bank (ECB).

An unhurried Fed seeks to contain the market

In the United States, Powell adopted a more aggressive tone in his speech at a conference in Tennesseesaying the world’s largest central bank will likely stick with interest rate cuts of a quarter of a percentage point from now on. “This is not a committee that is in a rush to cut rates quickly,” he said.

Jerome Powell Fed

The president of the United States Federal Reserve (Fed).

Photo: @FederalReserve

Operators remain confident that the Fed will cut rates again at the next monetary policy meeting in November, but they reduced the possibility of the reduction being 50 bp from 53.3% to 35.4%, according to the tool FedWatch from CME Group.

“The door hasn’t been closed on a 50 basis point cut, because if the economic data falls, then it’s justified. But Powell clearly thinks markets are overenthusiastic,” said Matt Simpson, senior market analyst at City Index.

The speech of the president of the Fed It came ahead of a busy week of US data, including the Institute for Supply Management’s manufacturing index this Tuesday and the non-manufacturing report on Thursday, followed by potentially crucial monthly jobs numbers on Friday.

Source: Ambito