In accordance with the regulations established by the Government for money laundering, The Special Asset Regularization Accounts (CERA) are outside the reach of any treasury, whether national or provincial, with one exception: 5% special tax for those who withdraw their money before the scheduled deadlines.

But it seems that the regulations on the matter have forgotten to order the financial system that when the money leaves the special accounts and move to a common savings accountas is the established procedure for withdrawal, these amounts are not reached either (because it involves movement between accounts of the same owner).

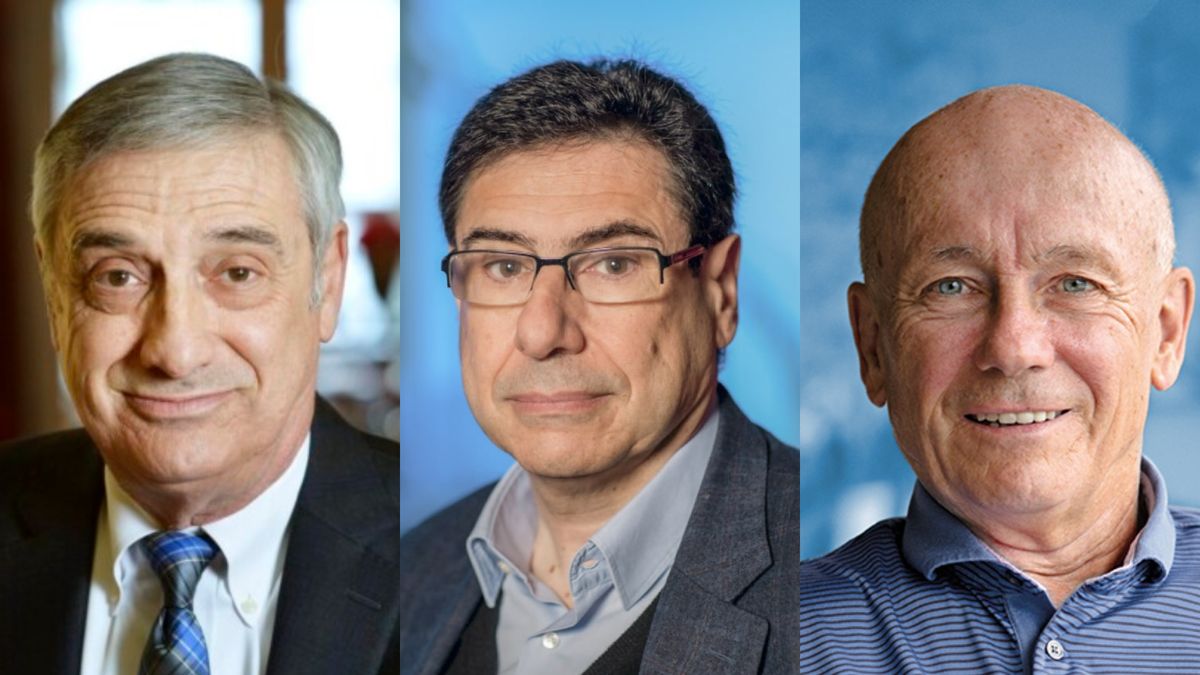

This is what happened to an accountant’s client. Julian Ruiz, who, beyond being a highly respected professional among his colleagues due to his knowledge of tax matters, was in the previous management for a short period, deputy director of Supervision of the Federal Administration of Public Revenues (AFIP).

Embed

BLEACHING | WAX

A client moved funds from their USD CERA account to their USD CA.

SIRCREB Withholding – City of BA@jorgemacri

This is what we are going to start to see, fasten your seat belts.

PS/ It is not a company, it is a professional human person.

— Julián Ruiz (@CPJulianRuiz) October 4, 2024

Having met the deadline set by law to withdraw, since he had deposited in September, on October 2 A person transferred US$90,000 from the CERA account to a savings accountand there the bank applied a discount through the SIRCREB system of $900which is established by the provinces to collect the Gross Income tax in advance.

Precisely, a few days ago, the Federal Tax Commission, which is the body that regulates the SIRCREB rules, had warned banks that CERA accounts were excluded from any discount. But no one gave an order about the common accounts.

Screenshot_2024-10-04_15-11-13.png

By reporting what happened, Ruiz noted on his X network account: “This is what we are going to start seeing, fasten your seat belts.” by clarifying that “it is not a company account but that of a human person.” He also points out in the post that banks “are simply not complying with the rules.”

According to the opinion of the lawyer Diego Fraga, who specializes in tax issues, even though the money has been transferred to a common savings account in dollars, in that case there should not be a SIRCREB discount either because “accounts in dollars are not reached, nor when it comes to movements between own accounts.”

Fraga considers that “the banks are not collaborating” with the laundering process, stating that for any issue related to procedures “it almost depends on each bank and each branch” in terms of what is asked of clients.

What is SIRCREB?

He Bank Accreditation Collection and Control System (SIRCREB) Its objective is to harmonize the collection regimes applicable to credits made in bank accounts in financial entities, as established by the Tax collection regimes. on the Gross Income created by the participating jurisdictions.

The withholdings applied to taxpayers are un payment on account of the aforementioned tax. The system manages the collection, control and jurisdictional attribution of the amounts received.

Reaches at business and professional accounts that, although they are registered in one jurisdiction for the payment of Gross Income, they are required to pay the same tax in another jurisdiction where they have a client whom they have invoiced.

Source: Ambito