Opinion

One can criticize and complain about a lot about the planned retirement savings account – but the project would still be a big step in the right direction.

Once a year we at Capital publish a list that many readers and readers have been waiting for: the 50 stocks for life. Together with the well-known stock investor Christian W. Röhl, we filter out from 1,800 companies worldwide those 50 that have been growing continuously for many years and reliably allow their shareholders to participate in their economic success.

This is original Capital branded content. This article is available for ten days on stern.de. You will then find it again exclusively on capital.de. Capital belongs like that star to RTL Germany.

When I was talking to one of my new neighbors shortly after moving a few years ago and he found out that I worked at Capital, he said: “You always make this list of stocks for life. I look at it every year .” And when I asked whether he would also invest afterwards, he waved me off and said: “No, I’ll just see what I’ve got from it. And then I’ll be happy.”

Every time we make this list, I think of my neighbor (he no longer works and has moved to South Africa). We at Capital really like his attitude towards investing in stocks for the long term. We don’t see the latest list of our 50 stocks as a simple shopping list that needs to be ticked off, but rather as an inspiration to deal with the topic at all: long-term investment in stocks for the systematic accumulation of wealth. The titles from this list will most likely not go through the roof like Nvidia, and there is no artificial intelligence in them, at least at first glance. But we are very confident that the companies and their shares will continue to increase in value and also pay dividends.

Is the retirement savings deposit coming?

If you like, with the list we have provided the template for the legislative proposal that at least the liberal part of the current federal government wants to pass before the next federal election and which was semi-officially announced this week: the retirement savings account, from cunning consultants and PR-savvy people Journalists have already called it the “Lindner Depot” – which should be an urgent warning to the current minister after the Hartz and Riester reforms. We therefore prefer to stick with the bureaucratic name and hope that the “retirement provision portfolio” has more chances of success. Because what was agreed at least between the Ministry of Finance, Labor and Economics as well as the Chancellery in the form of a draft bill has the potential to actually significantly change private pension provision in Germany.

After a tough struggle, the SPD, FDP and Greens have agreed to put private pension provision on a new foundation. In the future, the complicated and relatively unattractive Riester insurance policies, of which there are now more than 15 million contracts, but which are often no longer saved at all, are to be replaced by a much broader system with more options to choose from – and above all with the possibility of investing your own money for old age on the stock market through funds, ETFs and individual stocks. For a society that largely still considers the stock market to be a gambling den and in which the traumatic experiences of the Telekom IPO in the mid-1990s and the hype on the Neuer Markt continue to have an impact, the project is close to a cultural revolution.

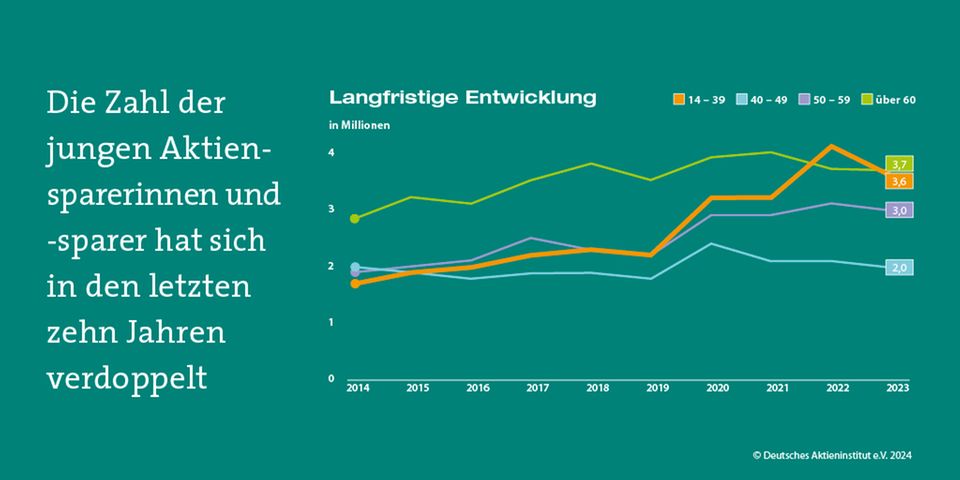

At least that’s what you have to believe when you look at the figures that the German Stock Institute regularly collects. – with a total of around twelve million people, only about one in seven people in this country has stocks or stock funds in their portfolio. After all, young people in particular have discovered stocks as a normal part of building wealth – that’s a good sign! But in relation to the country’s economic strength, also a figure from the German Stock Institute, the value of funded pension provision in Germany is still just seven percent. In Italy it is at least 27 percent, in socialist Sweden 99 percent, in the USA 134 percent and in Norway – of course, thanks to the lavish oil revenues and the sovereign wealth fund – even 191 percent.

Historical success is possible

We don’t necessarily have to compete with Norway, nor with the USA – but even jumping to Italy’s level would be a huge step forward for Germany; 20 percent of Germany’s GDP means around 800 billion euros. This would not be so much progress because the funded or share-based pension would be safer than the pay-as-you-go system of the statutory pension. But because the long-term returns on the capital market are significantly higher than the general wage and salary increases. Widely spread across the world and in all sectors, conservatively calculated, there is a five to six percent increase in value every year, some even calculate at eight percent – and that makes a huge difference over the course of 20, 30 or 40 years.

Now, of course, you can complain and criticize a lot. For example, that the liberal finance minister’s ideas are clientelism and that poor people cannot raise money to save on stocks. This is how the social associations reacted this week. That’s not completely wrong – however, the draft law does provide for higher state subsidies for low-income earners. And what’s more: We will hardly be able to solve the problem of low pensions for low-income earners via the stock market – but conversely, it would be absurd to allow large parts of the middle class, who can currently afford to invest in stocks, bonds and funds, to do so. It’s just that you don’t really dare to withhold it permanently. Direct participation in the world’s productive assets has so far been a privilege of the wealthy in Germany – this could finally break the retirement savings account.

However, the quick warning from consumer advocates about shady financial advisors and hypocrites, which also emerged this week, is justified. Charlatans, greed and irrational exaggerations are always and everywhere in the financial sector – even the best regulation cannot completely rule them out. The most effective way for people to immunize themselves against false advice is through self-sufficient, comprehensive and independent information – through financial education, which we do at Capital and through cover stories like the one about the 50 stocks for life.

You can criticize this traffic light coalition for many things – but if it gets the pension fund in place before the next federal election, it would actually have achieved a historic success.

Source: Stern