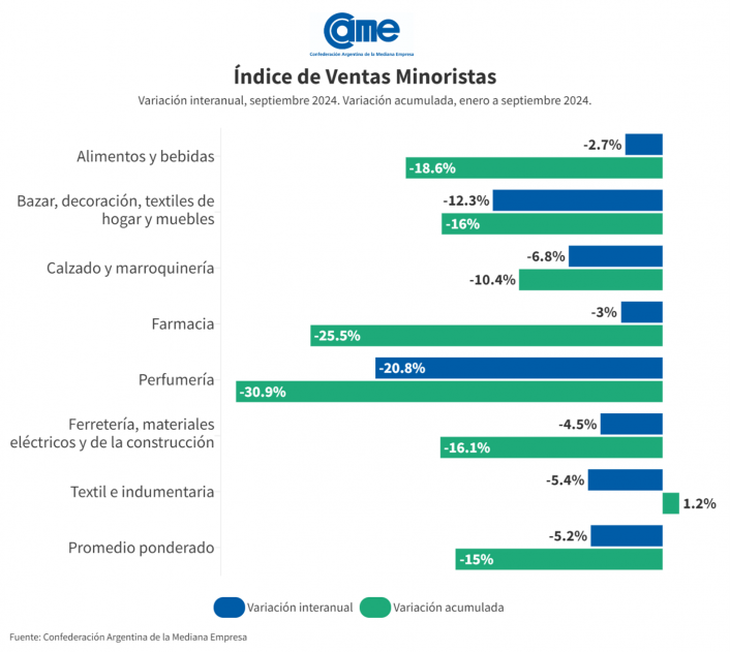

The SME retail sales decreased 5.2% year-on-year in September, at constant prices, and They accumulate a decline of 15% in the first nine months of the year. Meanwhile, in the seasonally adjusted monthly comparison they fell 0.5%; smaller decrease than the previous month (1.6%). In addition, A decrease is confirmed for the third consecutive month, in the percentages of fall: from the 21.9% decline in June, to 17.7% in July, 10.5% in August, to the current 5.2% in September, affirms the Argentine Confederation of Medium Enterprises (CAME).

SME commerce once again had a month with little movement, there were even days with almost no movement of people. Price stability made it possible to plan very aggressive liquidations in some items such as footwear, clothing and home textiles, and long-term installments contributed to the completion of operations in other sectors such as appliances, electronics, computers and furniture.

67027c9787480_706x425.png

SME commerce once again had a month with little movement, there were even days with almost no movement of people.

Sector analysis

In September, the seven items surveyed recorded year-on-year decreases in sales. The largest annual decline was detected in Perfumeries (-20.8%), followed by Bazaar, decoration, home textiles (-12.3%). In the accumulated figure for the year, the biggest decrease was also recorded by Perfumeries (-30.9%) and Pharmacies (-25.5%).

Food and drinks

Sales decreased 2.7% year-on-year in September, at constant prices and accumulated a drop of 18.6% in the first nine months of the year compared to the same period in 2023. However, in the month-on-month comparison they grew 0.1%.

Although the sector is going through a contraction phase, the monthly data could be indicating that a floor to the decline has been found and be closer to the beginning of a recovery path.

Bazaar, decoration, home textiles and furniture

Sales fell 12.3% in September, always at constant prices, and amounted to a reduction of 16% in the first nine months of the year compared to the same period in 2023. In the month-on-month comparison they fell 0.3%.

In the businesses surveyed they expressed that the situation of the month was very difficult and that even the quotas and promotions no longer generated enthusiasm in the month. For October there are better prospects for Mother’s Day, which always promotes giving and this area is strong in that theme.

Footwear and leather goods

A decrease of 6.8% year-on-year was recorded in September and a decline of 10.4% has accumulated in the first nine months compared to last year. In the inter-monthly contrast they fell 0.5%.

Shop windows were renewed, prices were lowered, especially the premises most in need of liquidity. Likewise, operations were stopped. What sold the most was children’s sports shoes.

Pharmacy

There was a 3% decrease in September, which adds up to a 25.5% decline in the nine-month segment compared to last year. Meanwhile, in the month-on-month comparison it improved 0.1%.

It was a bad month for the sector, not only due to low levels of operations but also due to the drop in profit margins. The slight improvement compared to August only showed some peace of mind in businesses that sales could pick up in the coming months. From the measured businesses they observed that, in medicines, people asked for the cheapest brand.

Perfumery

Sales fell 20.8% year-on-year, at constant prices, with an accumulated decrease of 30.9%, compared to the same nine months of 2023. Compared to the month-on-month period, there was an increase of 3%.

There was more demand for personal care products than in previous months and perfumes, which was what boosted activity during the month. The businesses increased the variety of products to attract sales, but they still observed that although the output is more stable, there is no way to grow.

Hardware, electrical materials and construction materials

Sales decreased 4.5% in the month, and accumulated a drop of 16.1% until September, always compared to the same period in 2023. In the month-on-month comparison they rose 0.6%.

In the stores surveyed they indicated that people consult, but for large purchases they wait until the last minute. There were delays in deliveries of imported products and that harmed the sector. The measured companies were optimistic about what the final months of the end of the year could be like.

Textile and clothing

Sales decreased 5.4% year-on-year in September, at constant prices, but still accumulated an increase of 1.2% in the first nine months of the year, compared to the same period last year. In the month-on-month comparison they fell 3.2%.

What was necessary was purchased, the offers had little appeal despite being very generous. There was little willingness to purchase products outside of the most urgent needs.

Claims, obstacles and accommodations

The tax burden continued to be one of the biggest burdens for commerce in September. Thus, among the main policies that respondents would expect from the government, 29.2% referred to a reduction in national taxes. The reduction of provincial taxes accounted for 22.8% of the responses, and 15.1% pointed to the decrease in municipal taxes.

Leaving this topic aside, the demand for measures that strengthen internal demand (13.1% of responses) and that incentives be generated for hiring personnel (5.9%) stood out.

67027c978ea89_706x631.png

In September, the seven items surveyed recorded year-on-year decreases in sales.

The problems that businessmen point out

When mentioning the obstacles that SMEs face today, 55.4% mentioned the lack of sales, which remains the main difficulty of the activity and remains in first place. Meanwhile, 30.2% ranked high production and logistics costs next, 6.5% the obstacles to accessing credit and 3.5% collection problems, which remains in last place.

To alleviate the current situation, 34.3% of the companies consulted incorporated new products and another 29.5% reduced their operating costs.

Source: Ambito