In the ninth month of 2024, the stock of gross debt amounted to a total amount equivalent to US$460,068 million, of which US$457,587 million were is in a normal payment situation. But the most outstanding fact is that in nine months, the stock of gross debt increased by US$89,395.

In turn, in September 2024, the increase in gross debt was equivalent to US$1,661 million compared to the previous month, detailed the Secretary of Finance which depends on the Ministry of Economy, in a recent report.

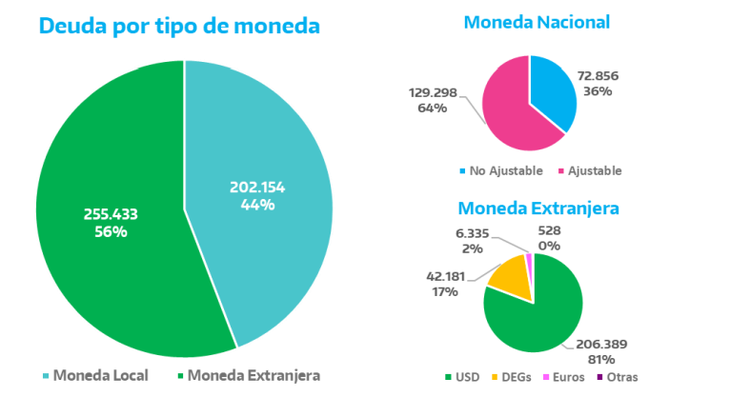

44% of the debt in a normal payment situation is payable in local currency while the remaining 56% is payable in foreign currency, which is why there were no variations in this percentage compared to last month.

The variation is explained by the effect of the exchange differences with respect to the inflation rate that raises the debt in national currency adjustable by CER in a proportion higher than the crawling peg rate (3.5% and 2%, respectively), and the deterioration of the dollar in the world with respect to the main currencies. This effect was equivalent to an increase of US$4,714 million.

Compared to the previous month, The debt in a normal payment situation increased by the equivalent of US$1,652 million, representing a monthly growth of 0.36% – lower than last month, which had represented an increase of 1.41%. The variation is explained by the increase in debt in foreign currency by US$187 million and the increase in debt in local currency for an equivalent amount in dollars of US$1,465 million.

debt1.PNG

Debt composition

81.0% of the gross debt in a normal payment situation corresponds to National Treasury Securities and Bills, 17.2% to obligations with Official External Creditors, 0.9% corresponds to Transitory Advances and the remaining 0.9% to other instruments.

During the last 12 months, the stock of gross debt in a normal payment situation increased by the equivalent of US$53,110 million, due to the decrease in debt in foreign currency by US$11,845 million and the increase in debt in local currency for an amount equivalent to US$64,955 million. The interesting point of the report is linked to the significant percentage of debt at a fixed rate, above that adjusted by CER or per dollar.

coin1.PNG

Debt in pesos: how the Ministry of Economy fared in the last tender

The Ministry of Economy placed $5.9 billion in the first debt tender in pesos in October and this time it was able to refinance the almost $5.1 billion that was due. The result involved a turnaround with respect to the previous auction: not only because on that occasion he had barely managed to renew 67% of the expirationsbut also because the Government had celebrated that performance as a reflection of a greater demand for money.

For now, this Wednesday, in the first tender of October, the team of Luis Caputo It received offers for $6.32 billion, of which it awarded an effective value of $5.9 billion. Thus, he placed a extra debt over the payments to be made next Monday of $830,000 million.

The Secretary of Finance, Pablo Quirnoannounced that That surplus “will be deposited in the Treasury account at the BCRA”the liquidity cushion that functions as one of the ways of monetary expansion or contraction under the current scheme (the other is the stock of Fiscal Bills held by the banks).

Finance had presented investors with a menu of nine titles. Among them, four letters capitalizable at a fixed rate (Lecap) next January, April, May and August; two Boncap (similar to the Lecap but with a term of more than one year) to October and December 2025; two inflation-tied bonds (Boncer) to December 2025 and March 2026; and a dollar linked to December 2025.

The two most demanded instruments were the shorter Lecap ($1.65 billion were awarded) and the longer Boncap ($1.08 billion).

Between the two Boncers and the dollar linkedinstead, only $520,000 million were concentrated (8.8% of the total), which some read as an alignment of the city with the idea of continuity of the stocks for a long time. In fact, Javier Milei and Caputo confirmed, in an interview with the Financial Times, that the economy is not yet prepared for a lifting of exchange control. For its part, Felipe Nuneza member of the economic team, considered that “CER and dollar linked rates continue to show that the market continues to discount a real appreciation of the exchange rate”.

At the end of this month, on October 25, the Ministry of Economy will call for a new call.

Source: Ambito