Strategists at the Wall Street giant argue that the S&P 500 will face significantly lower returns in the next decade, prompting investors to diversify their portfolios in search of better opportunities in other assets.

However, the S&P 500 is on track to outperform the rest of the world in eight of the last 10 years.

U.S. stocks likely “won’t sustain” their above-average performance of the past decade as investors turn their attention to other assets, including bonds, in search of better returnsnoted the analysts of Goldman Sachs.

The content you want to access is exclusive to subscribers.

The index is expected S&P 500 post an annualized nominal total return of just 3% over the next 10 years, according to an analysis by strategists including David Kostin. This compares to 13% over the past decade and a long-term average of 11%. They also see a roughly 72% chance of the benchmark index lagging Treasuries.and a 33% probability that they will not be able to overcome inflation until 2034.

“Investors should be prepared for stock returns over the next decade that are at the lower end of their typical performance distribution“the team wrote in a note dated October 18.

What’s behind this analysis

U.S. stocks rallied in the wake of the global financial crisis, first driven by near-zero interest rates and then by bets on resilient economic growth. According to data collected by Bloomberg, The S&P 500 is on track to outperform the rest of the world in eight of the last 10 years.

Still, this year’s 23% rebound has been concentrated in a handful of the biggest tech stocks. Goldman strategists said they expect returns to diversify and the equal-weighted S&P 500 to outperform the market-cap-weighted index over the next decade.

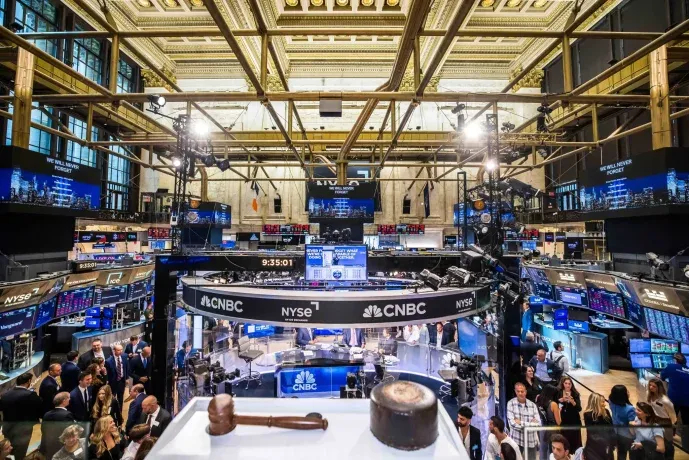

wall street markets NYSE.jpg

US stocks have risen in the wake of the global financial crisis.

NYSE

Even if the rally remained concentrated, the S&P 500 would post below-average returns of approximately 7%, they pointed out. The latest Bloomberg Markets Live Pulse survey showed that investors expect the US stock market rally to extend into the latter part of 2024.

The strength of U.S. companies’ results is seen as more crucial to stock market performance thanwho wins the US presidential election or even the trajectory of the Federal Reserve’s policy.

Source: Ambito