And the yield on the 10-year Treasury bond (^TNX) is close to 4.2% after having marked a day of strong gains on Monday, which propelled them above that level for the first time since july. In this regard, Barclays assured that, in the last few hours, the funds that operate “Treasuries” registered strong inflows of more than US$13,000 million in the last five days. This exceeds the average of the previous four weeks which was US$10,300 millions.

In a note dated Monday, the London-based financial giant’s team also mentioned that the banks were net buyers again and the vast majority added Treasury bonds to their securities portfolios.

Demand for the dollar increases

For its part, JP Morgan also reported a sharp increase in demand for the dollar as the US elections approach. The Wall Street giant maintains in a document that demand for the greenback increased last week, as investors are betting on a rebound before November 5th “and these purchases are likely to continue,” strategists say.

The bank also flagged an increase in euro selling, with some puts betting that the eurozone currency will depreciate to parity against the dollar. “The risk of the euro falling to parity increases as the presidential candidate Donald Trump threatens to expand US tariffs beyond China to Europe if he wins the election“, which explains the movement of investors.

A survey of Goldman Sachs traders

A document from the GS US Rates Salesa division of Goldman Sachs (GS), exposes the uncertainty that exists in the market before the elections. He concludes that “market positioning tends toward expressions of a Trump victory.” Although the analysts consulted by the financial giant internally suggest different scenarios.

For example, Anshul Sehgal, Co-Head of Trading, Global Interest Rate Products, responds that he “does not have strong opinions or a robust framework on the elections.” For the strategist it is a binary event, and it is not clear what the implications of either outcome will be. And it highlights that rates have been and will continue to be volatile.

Presidential election.jpeg

Investors are divided between expectations of a possible victory for Trump, who has boosted sectors such as banks and energy, and an eventual victory for Harris.

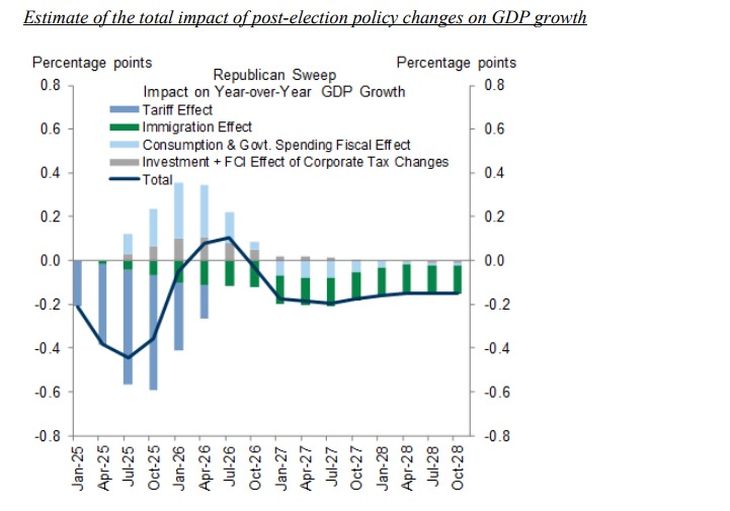

ensures that The market values a movement of 20 basis points (bp) for the electionswhich seems a little high, but not enough to be shorting that curve during the event. If a Republican sweep scenario occurs, on election night it will probably there will not be much movement in the market: “rates and risk assets would rise initially, especially because what would probably be expected is that Trump’s tax cuts are extended and there could be more fiscal stimulus,” he shoots.

Meanwhile, in the event of a Harris victory with a divided CongressSehgal expects the bond yield curve to steepen initially and risk assets to weaken, “which is an opportunity to establish short positions in the middle of the curve.”

About equities and the latest movements

So much Shawn Tutejaas Joseph ClyneEquities Derivatives Trading and Indices Trading at Goldman Sachs, respectively, ensure that “the increase in stocks, the collapse of implied volatilities and the better performance of the Russell 2000 (RUT) on the Nasdaq 100 (NDX) are due in part to the recent increase in the odds that Trump wins the election and a reversal of that movement could change the three trends,” they say. That is to say, in that case, Harris would have a better chance of reaching the White House.

Thus, the strategists state that, in general, they prefer “to have long positions in the S&P 500 (SPX) by the end of the year with an implied volatility of 12”, which they estimate can stay flat/positive during electionswhile maintaining positive exposure to volatility in any sustained rally.

Election 2.jpeg

Investors are divided between expectations of a possible victory for Trump, who has boosted sectors such as banks and energy, and an eventual victory for Harris

Finally, they comment that there are already some “2016 Trump operations” that work, since this last stretch of rise in the SPX has been driven by regional banks (KRE), large capitalization banks (XLF) and energy”, sectors that did very well in the last presidency of the Republican magnate.

“We have seen that This purchase has been at the expense of AI in the last week. Interestingly, in the last 24 hours we have received many questions from customers about the best ways to cover against a Republican sweepthinking that market probabilities and prices moved too far in that direction,” the strategists conclude.

Source: Ambito