In the secondary market, the yields of capitalized fixed rate bills and bonds (Lecap and Boncap) have compressed since the last auction of the Treasury, held on October 9. That day, the Secretary of Finance, Pablo Quirno, validated monthly effective rates (TEM) of around 3.9% for securities maturing between January and December 2025, somewhat above the rates that were in force at that time. the market to guarantee the placement of additional debt at maturity. This Wednesday, TEMs were operated between 3.4% and 3.5% on a curve in pesos that was slightly inverted during the last wheels.

image.png

Debt in pesos: what will the Treasury do with the rates?

The mystery arises, in addition to the movements in the secondary market, because the Treasury’s maturities burden will be somewhat lower in the last part of the year compared to September: About $1.6 trillion expires at the end of October; in November, $8 billion; and in December, $6.4 billionaccording to data from the Congressional Budget Office (CPO).

Based on this, the consulting firm LCG wondered if the Treasury “will take advantage of this situation to validate a reduction in rates and enable more liquidity in the market.” In this regard, in recent weeks we have seen how banks came out to take active repos with the BCRA in a significant amount due to liquidity needs.

Damian Palaisfinancial advisor Cocos Capitalin dialogue with Scope He pointed out that today the real interest rate of Lecap and Boncap is positive, which is combined with financial dollars that have fallen in recent months. “This enhances the attractiveness of the fixed rate in pesos to carry out ‘carry trade’. This scenario could give the Treasury the possibility of continuing to lower the interest rate in the next calls for bids. when rolling future Lecaps maturities,” he considered.

Likewise, Palais stated that The increase in the reserve rate established by the BCRA and that will come into effect on November 1 could be an incentive for the demand for Treasury instruments. “This measure fully affects the FCI Money Market and is estimated to generate a drop of between 2 and 3 percentage points in their returns. Therefore, a Money Market yielding around 35% TNA since November vs an FCI that invests in Lecap/Boncap (or investing directly in bills and bonds) would be providing a difference of 10% at current prices. In summary, we see that the demand for the fixed rate curve in pesos could grow due to the increase in the reserve requirement rate,” he said.

Leonardo Chialvapartner of Delphos Investmentwas confident that Finance would make a quick move. “The Government has been validating market rates and, With this collapse in long rates, it is 100% likely that yields will drop in the next Treasury auction”, he analyzed in conversation with this medium. Along the same lines, Bull Market, the Marra family broker, maintained that “the Government is preparing for a reduction in the rate, in line with the market, on short-term peso bills.”

On the other hand, Chialva considered that the situation of the BCRAwhich “must wait for the October inflation data to begin a gradual but persistent process of lowering the short rate.” “It’s going to be more data dependent”he added.

Also in dialogue with Ámbito, Javier Casabalfixed income strategist at Adcapexpressed a different view on the rate policy of the Ministry of Economy. “I think that, to see lower rates, we first need to see that the 4% inflation level is completely abandoned and we begin to move decisively towards breaking 3%,” he stated and emphasized that “It is possible that the Government will first seek to strengthen the secondary market for the longest fixed-rate securitiesWhat good liquidity, and then, with more information about inflation expectations, go for the steepest rate cut.”

“I think they have to be careful”he warned Casabal. His reading is that The economic team does not want to risk pausing bets on the “carry trade”. “I don’t think the dollar is bouncing strong now to start getting scared, but it is a very sensitive variable, which responds too quickly. So, The message that the Government should try to send to those who are carrying today is that the dollar remains stable. If the dollar jumps $100 or $200 overnight, you lose what you earned in three months. If it remains stable or even rises very little, the ‘carry’ continues,” he remarked.

The analyst said that, when the financial dollar was at $1,200, they asked him how far it could go and he thought it would not give way beyond $1,150. “Before reaching that level, the CCL began to rebound. So, there are already many wondering when it is time to leave. That’s why I think they will give the feeling of stability and not the opposite.”

Rates and the “carry trade”

The bets on the “carry trade”popularly known as the “financial bicycle”, regained strength in recent monthswhen the rate in pesos left the clearly negative territory and the financial dollars surpassed the shock of the middle of the year, due to Caputo’s insistence on sustaining his exchange rate scheme and the supply provided by both the blend dollar scheme, the interventions of the BCRA and the tax moratorium window and the special regime for Personal Assets.

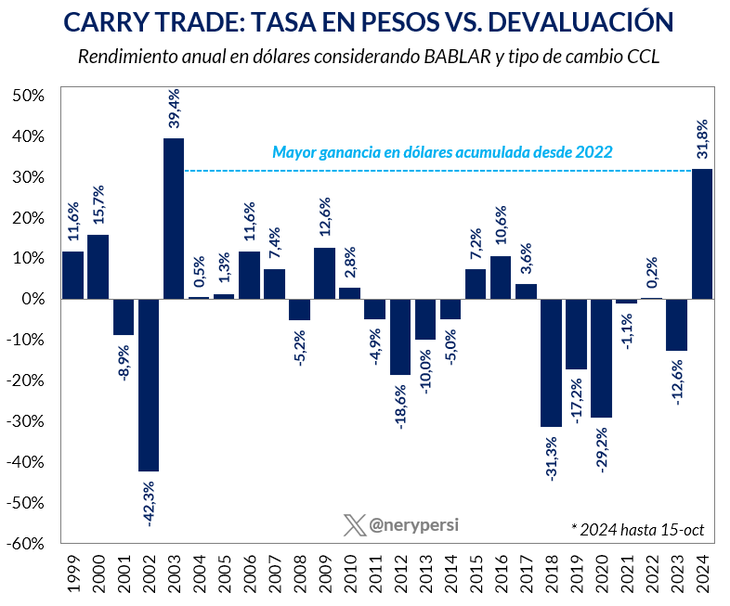

The “carry” consists of selling assets in dollars to place instruments in pesos that pay a rate higher than the exchange rate movement and dollarize again to ensure profits before the CCL price jumps. According to economist calculations Nery Persichiniin the first half of October the “bicycle” left a return in dollars of more than 6%. AND who decided to pedal at the beginning of this year It already obtained 31.8% in hard currency, the highest return in 21 years.

image.png

Guaranteeing the “carry trade” is one of Caputo’s bets within the framework of the bridge that it wants to build to go through a period of net reserves in the red without any problems. LCG maintained, in a recent report, that the perception of a profitable “carry” is influencing the gap and that it also impacts the currency front: “Expected rates in pesos higher than those in dollars can promote the liquidation of exports or the possibility of taking loans in dollars to invest in pesos.”

“Regarding carry, we know that it is a speculative scheme that feeds on itself: Bringing dollars to position oneself in pesos causes positive short-term profitability, which in turn stimulates new capital inflows. “Everything works until eventual exchange rate movements make it stop working, and a contrary dynamic begins that also feeds on itself.”noted the consulting firm and clarified that “at the moment it is difficult to see how robust or fragile the financial structure is that is favoring the purchase of assets in pesos” to evaluate whether the current dynamics present risks similar to those that arose in 2017.

For now, the positive rates (also measured in dollars) that the Treasury pays for its debt in pesos are not reflected in fiscal accounting as a higher interest expense. As Caputo chose to issue capitalizable securities, their characteristic is that, upon maturity, the interest increases the capital owed. Aurum Values calculated, based on information from the OPC, The amount of interest capitalized by Lecap is now equivalent to 1.3% of GDP.

Source: Ambito