Menu

Steel industry: Major shareholder considers takeover offer for Salzgitter

Categories

Most Read

Lager beer “Bud” is available again in Germany after more than ten years

October 22, 2025

No Comments

ChatGPT: OpenAi introduces new browser with AI bot

October 22, 2025

No Comments

Housing: Rent increases on real estate portals are slowing down

October 22, 2025

No Comments

Beer brand: World’s largest brewer sells “Bud” again in Germany

October 22, 2025

No Comments

Survey: Many people buy Advent calendars for themselves

October 22, 2025

No Comments

Latest Posts

Automotive supplier: Rescue plan for Webasto in the clear

October 22, 2025

No Comments

Auto supplier Rescue plan for Webasto in the clear Copy the current link Add to watchlist The supplier, known for its car roofs and parking

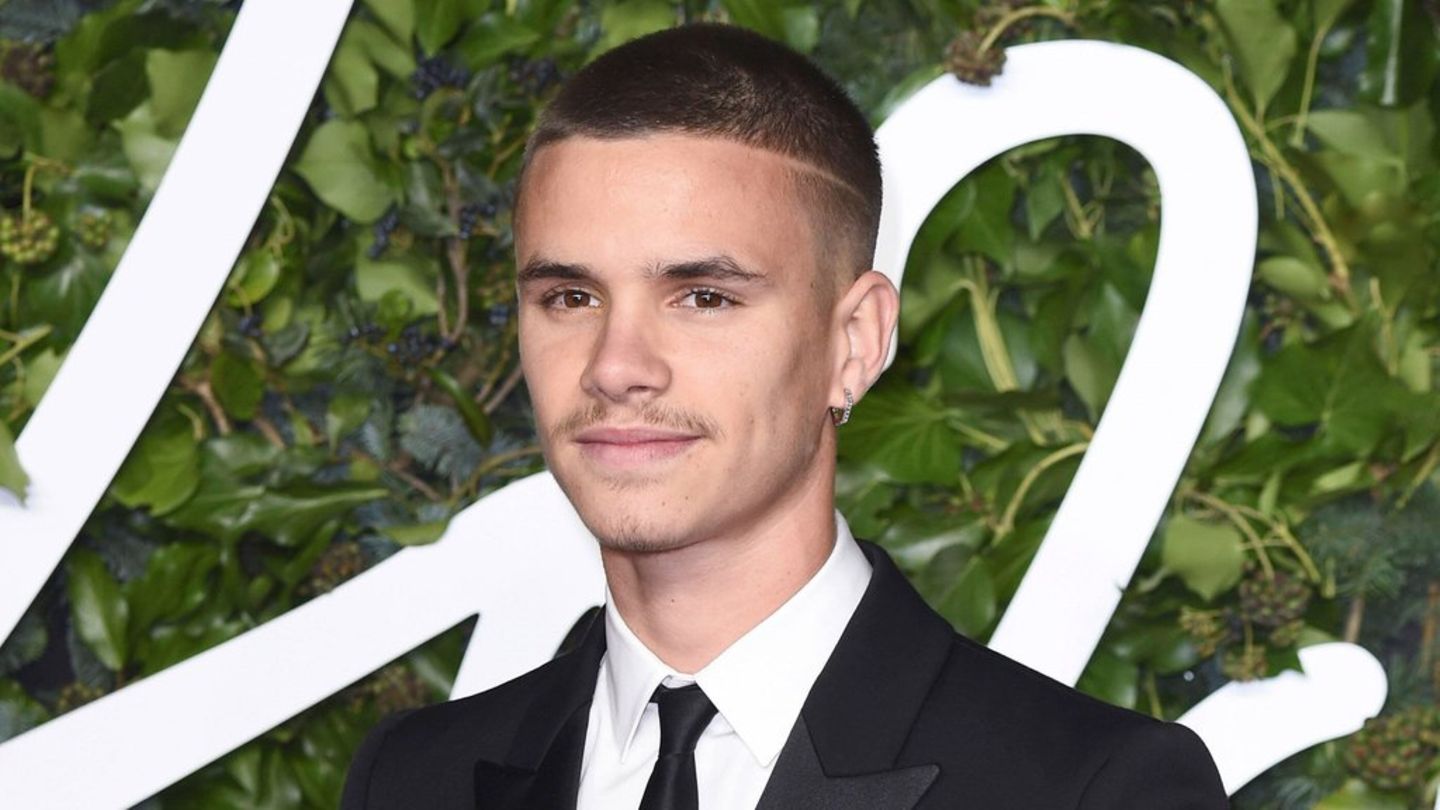

Romeo Beckham: Is he back together with Kim Turnbull?

October 22, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

War against Ukraine: Parts of Ukraine without power after Russian airstrike

October 22, 2025

No Comments

IvanI have been working in the news industry for over 6 years, first as a reporter and now as an editor. I have covered politics

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.