The Ministry of Economy will carry out the last debt tender in November pesos this Wednesday. The main unknown that the city had has already been cleared up: finally, after two absentee auctions, The Lecap and the Boncap will return. These are fixed rate securities, which the Luis Caputo had decided to exclude from the latest placements with the aim of reinforcing bearish expectations for yields.

The operation will be carried out this wednesdaybetween 10 a.m. and 3 p.m., and will be settled on Friday. On this occasion, the Ministry of Finance, which leads Pablo Quirno, will face maturities of $5.2 billionsomewhat larger than in the last tenders.

As he told Scopeuntil this weekend there was expectation among investors regarding what the composition of the menu would be of instruments defined by the economic team. While some voices indicated that officials felt comfortable with the strategy of only placing bonds tied to inflation (Boncer) and letting the market make the rate adjustment, others expected that after the strong compression of the yield curve experienced during Last month the Lecap and the Boncap will return.

Finally, the second thing happened. The call for bids, issued after the close of trading on Monday, confirmed the reappearance of fixed rate securities.

Debt tender in pesos: menu details

Specifically, Finance will offer five instruments this Wednesday, three of them at a fixed rate capitalizable. On the one hand, the issuance of the Lecap will reopen in May 2025. On the other hand, two Boncaps will be put on the table: the one that expires in October 2025 will be reopened and a new one will be issued in February 2026.

In addition, the tender will have two inflation-indexed bonds with 0% coupon. These are the Boncers maturing in March (TZXM6) and October (TZXO6) 2026.

image.png

At the city tables they considered that one of the factors in favor of the possibility of the Government once again including fixed rate securities in the tender was the increase in bank liquidity that was registered in recent weeks.

He SBS Group He put it this way: “Considering the increase in LEFI stock (Liquidity Fiscal Letters) of the banks of the last rounds (they went from approximately $9.5 billion to $15.5 billion from November 4 to November 22), we believe that “Bank liquidity is such that it would not require banks not to renew debt to obtain pesos.”.

Thus, the expectation is that this time we may once again see a renewal percentage of maturities closer to 100%. In the two previous auctions, in which only Boncer was offered, Economía barely sold a little more than half of what was due.

Personal Investment Portfolio (PPI) He also considered that there were “various factors” that indicated that this time “the Treasury would once again tender a fixed rate on its menu.” And he mentioned: “On the one hand, the maturities of $5.2 billion (mainly amortizations of the Lecap S29N4 and the TG25) look more challenging than those of the last tender ($2.8 billion), although there is no concern that the refinancing ratio be less than 1x (in the last tender it was 0.5x) given that the Treasury still has deposits of $9.8 trillion.”

“On the other hand, The Treasury reaches this tender in a context of ample liquidity in the banking system. The stock of LEFI in financial entities is $15.3 billion as of November 25, which represents an increase of 37% compared to a month ago. In turn, breakeven inflation remains at 1.8% for the next 12 months and the TEM (monthly effective rates) of Lecap and Boncap in the range of 2.5/3%, which gave us the guideline that “This time the Treasury could feel more comfortable offering a menu with fixed rate instruments, after the strong compression of rates that we observed in the last month”PPI added.

Movements in the run-up to the tender

Once you know the menu, this Tuesday, the Lecap and the Boncap sellers operated. They fell 0.1% in the short section and 0.5% in the long section of the curve. At PPI they anticipated downward pressure on these instruments “given the expectation that the Treasury will pay some premium with respect to the secondary market, as it did the last two times it offered fixed rate instruments (approximately 15 basis points more).”

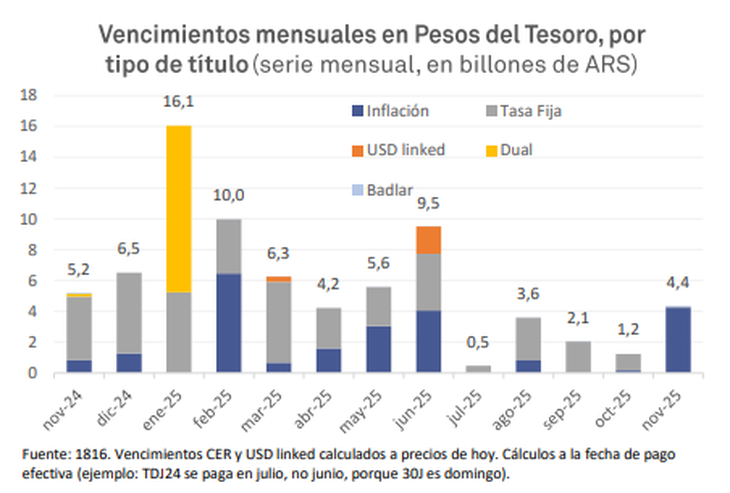

The placement of debt in pesos this Wednesday will be the penultimate of the year. In December, when about $6.5 billion expires, there is only one auction scheduled (on Wednesday the 11th). The Government has not yet released the bidding schedule for the first months of 2025. Next year will begin with a first two-month period full of deadlines: $16.1 billion in January and $10 billion in February.

image.png

Source: Ambito