In the stock markets, the S&P 500 and companies in that country had an upward momentum, as a result of the expectation that under Trump’s presidency companies will benefit from lower taxes and progress in terms of deregulation. The index of the main companies in that country even broke the barrier of 6,000 points, as investors integrated into their forecasts a more favorable program for American corporations. Historically, Republican presidencies with control of Congress, as in the current scenario, have been beneficial for the stock market.

On the other hand, the dollar also reflected this movement, appreciating in the following days. Now, the expectation is that the Federal Reserve could moderate its recent process of cutting interest rates, which began just a few months ago.

The dollar appreciates strongly against other currencies after the election

image.png

Source: Bloomberg

In this sense, this process of revaluation of the dollar and a more gradual process than previously expected for the rate cut in the United States could be a headache for emerging assets, which, with the exception of Argentina, have generally shown a pessimistic bias in the days after the election.

In the United States, the rise of artificial intelligence and onshoring, along with a robust economy, are factors driving risk assets in that country. However, the fiscal front poses a challenge, with an estimated deficit for this year of around 6.7% of GDP.

A positive stimulus to the US economy is anticipated under the administration of the president-elect, thanks to higher nominal growth and an increase in corporate profits, which would have a favorable impact on risk assets.

In Argentina, the upcoming agenda

Unlike their regional peers, Argentine stocks and bonds have had a notable performance in recent weeks, with significant gains in dollars for both sovereign debt and national companies.

Without a doubt, the political affinity of the Argentine president with the new administration opens the possibility of resounding support in future negotiations with the IMF, but a good part of this relative improvement seems to be due to internal issues, rather than to factors clearly associated with the United States election. In particular, the improvement in the price of sovereign bonds, which are already trading on average at $70 parity, can be largely attributed to expectations of fiscal order.

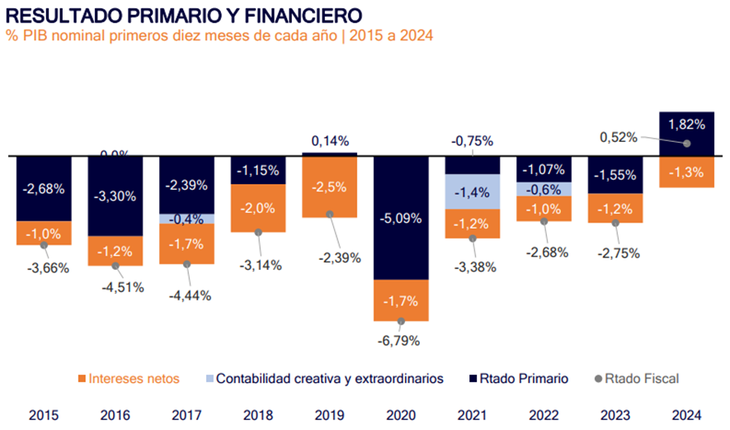

The government’s economic policy with a fiscal “anchor” achieved a financial surplus in the first ten months of the year of 0.5% of GDP and 1.8% of primary surplus, which contrasts notably with previous administrations and the magnitude deficits that , in practice, affected the perceived repayment capacity of the sovereign.

Primary result: the fiscal anchor of the program

image.png

Source: Outlier

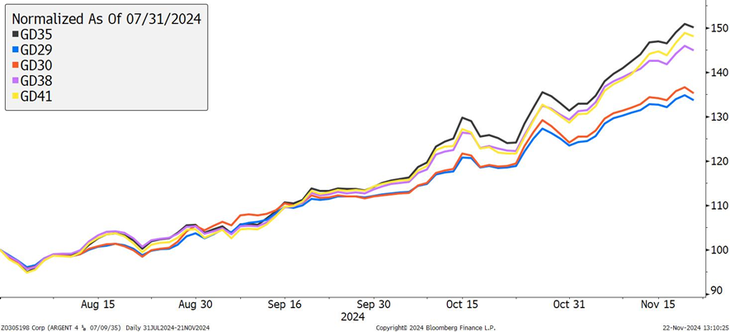

Sovereign bonds in dollars respond to the rise

image.png

Globales total return index in dollars (base 100 daily series as of 7/31/24)

Source: Bloomberg

Likewise, with the success achieved so far in the anti-inflation programstrengthens the credibility of the plan among economic agents. This leads them to begin to consolidate lower inflation in their future scenarios, a factor that can open the way to an improvement in income and a reactivation of credit as drivers of the recovery of activity, thus maintaining at a high level the popular support for the government.

This strengthens the other anchor of the program: credibility in the scheme of “crawling peg”, and relaxes the urgency to get out of the stocks to obtain foreign currency, which facilitates the process of inflationary convergence towards the objective of the level “induced by the exchange rate scheme” (2.5% monthly). The implicit devaluation rates in the futures market also account for this scenario, maintaining the exchange anchor with rates below 2%, for contracts for the second quarter of 2025.

The market’s concern about the recomposition of international reserves in the Central Bank, one of the main challenges of the administration, found a response in the successful laundering that flooded the banks’ balance sheets with dollars, reaching a new record of deposits in this currency.

Credit in dollars, which has been growing rapidly since September, is presented as the key link that connects laundering with the BCRA reserves, generating a notable “raid.” of foreign currency purchases by the BCRA and a “rally” of Argentine assets, suitable as a destination to avoid paying fines for the cash declared in this disclosure.

However, thinking beyond the short term, Trump’s proposed growth agenda for the US economy suggests a priori, a higher rate differential in the United States, a stronger dollar and, as a counterpart, a potential weakness in the prices of raw materials that Argentina sells to the world. This scenario, added to the weakness of the Chinese economy, creates a challenging context for emerging countries.

Therefore, while political expectations dominate the short term, reducing uncertainty and boosting local asset prices, The risk (in addition to the political one) could be configured by an adverse global context, where the program is exposed to some external “shock.” Thus, the challenge of implementing structural reforms in time will be key to guaranteeing exchange rate sustainability.

What are the best investment recommendations?

We continue to see value in Global bonds 2035 and 2041.

The country’s credit normalization, an event that seems more likely after recent events, keeps the risk-return relationship of these assets favorable.

By evaluating sovereign debt under different assumptions and scenarios, we continue to identify value in the longer part of the sovereign curve, with the GD35 and GD41 emerging as the most attractive options.

Director Asset Management of Criteria.

Source: Ambito