JP Morgan bank He once again ratified his optimistic position for the national economy this Monday. In its latest report, the financial giant assured that the “recession in Argentina is already over” thanks to a very solid rebound in September, so its projection that “activity would recover sequentially in the third quarter“.

The giant of Wall Street assures that “although activity decreased during the month, the quarter ended with a very solid reboundmarking the end of the recession that the economy suffered since August 2023, or March 2023, if we exclude the months of recovery driven by the fiscal plan known as the silver plan.

The bank’s view coincides with that of other local consulting firms, although not as optimistic as that of the financial institution. In his latest weekly report, Econviews analyzes that the third quarter went from showing a growth from 1.9% to 3.4% quarter on quarter (q/q). “The level of activity that was estimated in August was 1.7% higher in the end. With these corrections, we improve our projection of the Gross Domestic Product (GDP) for 2024. We expect a drop of around 2.9%, leaving a drag of 2.3% by 2025 and a growth that could exceed 5%,” says the consulting firm that directs Miguel Kiguel.

Argentine economy: September data

It is worth remembering that the economic activity index showed a downward figure in September. Activity fell 0.3% monthly, according to the INDEC estimator. The interannual variation was -3.3%, and so far this year it has accumulated a contraction of 3.1%.

It is for this reason that the JP Morgan indicates that, after this slight drop in real activity in September, the quarter closed “very solid”, since the economy rebounded more than 14.3% q/q annualized. “Following revisions, activity at the end of the third quarter showed a recovery of almost 4% compared to the cyclical low seen in April, and is now +1.0% above the December 2023 level,” indicates.

JP Morgan.png

“In other words, the recession is over; and activity is recovering at an annualized rate of 9.7% since April“, concluded the bank.

He highlights that the sectors that have led the recovery since April include manufacture (+6.3% seasonally adjusted, JP Morgan seasonally adjusted), construction (+5.2%), trade (+4.3%), Tourism (+4.9%) and financial intermediation (+11.3%). On the other hand, public administration, transportation and other sectors contracted during this period.

The document concludes that, by incorporating the revisions of the monthly series, and while waiting for the quarterly national accounts report, “the projections for 2024 and 2025 are adjusted to -3.0% y/y and +5.2% y/y, respectively”, online with the Kiguel consultancy. “We highlight that the risk of the forecast for 2025 remains biased upwards, due to the speed of recovery observed since April (+9.7% annualized).”

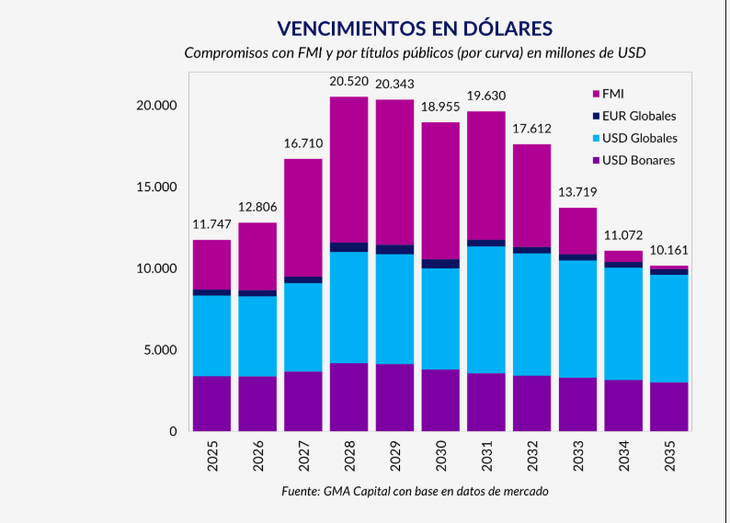

Are there enough dollars for 2025?

Although all the reports circulating in the city highlight the excellent financial situation, some raise doubts such as, for example, if the dollars and the bonanza reach to face the year that starts in less than a month. The specialists are kept in “alarm mode” by the large debt maturities, despite the fact that Treasury dollar deposits in the Central Bank account increased by US$2,812 million and reached US$2,932 million. with which Economy It already has the dollars for the January 2025 capital payment for US$2,817 millionsince – it should be remembered – the interests They already transferred to BONY in October.

A document from the Capital Foundation It raises the question of how dollar dynamics will evolve in the future. Although he shortcuts and points out that, “everything seems to indicate that the dollar bridge necessary to navigate the next 11 months is available.”

Debt Maturities GMA.png

After the bleach, repos, voluntary public debt swaps and even new sovereign issues are much “more viable,” he indicates. Furthermore, on the horizon there are also options such as the end or reduction of the dollar blendas well as a possible new agreement with the International Monetary Fund (IMF).

“This panorama makes the economic scenario of disinflation proposed by the authorities increasingly more likely, with a 60% probability of it materializing”says the Foundation document. However, this process “does not“is free of risk factors that must be closely monitored.

However, despite the favorable outlook, doubts persist about the availability of dollars, which could put to the test the economic stability achieved so far and so applauded from abroad. In this sense, fiscal adjustment, financing mechanisms such as swaps and a possible agreement with the IMF play a fundamental role for the economic team’s plans. “Although disinflation is a plausible scenario, the risk associated with debt management and dollar flows remains a critical factor to monitor,” the Foundation concludes.

Source: Ambito