Although month by month it advances gradual relaxations of specific aspects of the exchange regulations, the economic team maintains a wide range of restrictions that make up the dollar stocks are still in force. Javier Milei and Luis Caputo promised to lift exchange control during 2025 and they outlined a set of requirements to carry it out. At the Central Bank (BCRA) affirm that there were important advances, but that there is still There are at least two factors to resolvewhich concentrate a potential risky currency demand in the event of an eventual the lifting of the stocks: the dividends and the debt of the companies multinationals with their parent companies.

Thus, officials speak of a layered lifting of the different restrictions. However, economic agents speculate about when the process will end. The President, throughout his administration, added new conditions to open the stocks as the exchange rate anchor (appreciation through) gained ground as one of the pillars of the official plan to slow down inflation.

In the last few days, Milei spoke of three requirements: the convergence of inflation with the pace of devaluation set by the exchange rate table (which is expected to slow down in the coming months), that of the broad monetary base (also includes Treasury deposits in the BCRA and banks’ LEFI holdings) align with the traditional monetary base and solve stock problems (potential demand for foreign currency).

Caputo, for his part, said that an additional injection of reserves is needed to avoid a disruptive exit. It happens that the net reserves are still in very negative territory and in the last month they fell almost US$1.2 billion despite the Central purchases, according to calculations by Portfolio Personal Inversiones (PPI).

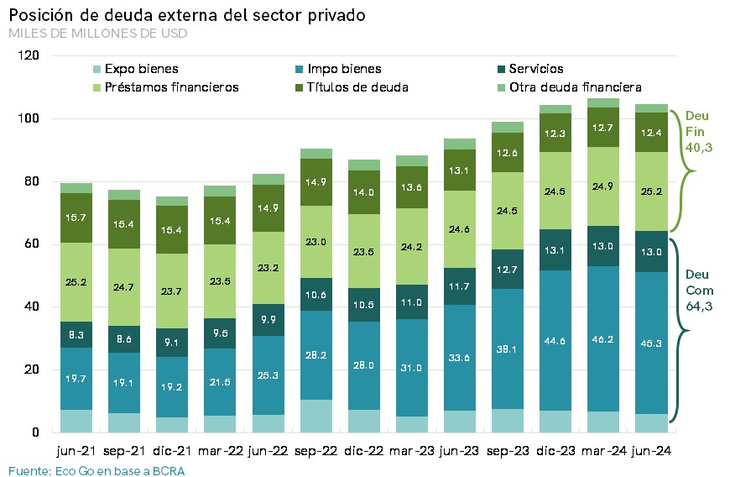

The monetary authority pays special attention to stocks that are still “trapped” by exchange control and that, in the event of an opening, could put pressure on the dollar.. There are two factors in particular that Reconquista 266 considers risky: unpaid profits and dividends and intra-company debt. In both cases, they accumulated in recent years due to restrictions on transferring foreign currency abroad.

image.png

Dollar stocks: the view of Santiago Bausili

Days ago, the president of the BCRA, Santiago Bausiligave details about his plans for exchange control during a talk at the Córdoba Stock Exchange moderated by Guido Sandleris, former head of the entity during the government of Mauricio Macri, of which Bausili was also an official.

Some economists point out that, today, the compression of the gap, the reduction in country risk and the result of money laundering open a more favorable scenario for removing exchange restrictions. Others highlight the risks of a reversal of the “carry trade” cycle. In that framework, Bausili He argued about why they maintain the controls: “We have the stocks for two reasons. At first, for a matter of flows; that part is working. The risk is the stocks. That is the most relevant impediment to removing the stocks today.”

The president of the BCRA stated that the stocks went from being “a barrier to contain the exit to a barrier to contain the entry” of capital. “Financial investors are not aggressively entering Argentina because they know they cannot leave,” He stated and predicted that, in a monetary scheme in which the peso is scarce, it is “very likely” that the lifting of restrictions “will be a source of liquidity”, that is, that more capital will enter than leave.

For Bausili, today there are no significant “exchange imbalances” in the supply and demand of foreign currency by individuals or SMEs (which did not consume all the available quota of access to the official market to pay off commercial liabilities). He said that he is not worried about the flow of import debt from the rest of the companies, since he considered that it was being channeled.

However, he acknowledged that there are still “two or three pockets affected by the stocks that represent a stock risk.” And he listed: “The stock of inter-company financial debt with multinationals and dividends, which have not been paid since 2019. These are pockets where there is clearly latent demand.” In other words, if the restrictions were removed today, companies could quickly ask the BCRA for those dollars (which they do not have today) to transfer them abroad.

Regarding the debt between related companies, the official mentioned the mechanics with which he hopes it will be progressively regularized: “Inter-company financing was prohibited from being repaid but, a few months ago, we released a Central regulation that allows, if it is refinanced over two years, they can repay. So, that wheel is turning.”

Stocks and repressed demand

Regardless of whether they are actually the only means of potential pressure on the exchange market, What magnitude is the latent demand for the two concepts mentioned by Bausili? It is difficult to determine, since there is no updated official data. When consulted by this medium, sources from the monetary authority did not provide details at the closing of this note.

image.png

In dialogue with Scopethe director of the consulting firm Eco Go, Sebastian Menescaldiprovided some elements to estimate this potential demand. The economist compared the balance of payments of profits and dividends for the period 2020-2023 (US$22,587 million) and exchange balance for this concept for the same period (only US$949 million) with the average percentage of reinvested profits between 2016 and 2019, years without stocks almost entirely, ( 37%) and calculated that his release could imply a potential expenditure of US$6,941 million. Although he pointed out that, today, it could be somewhat less due to the US$1.2 billion in dividends that were channeled via Bopreal.

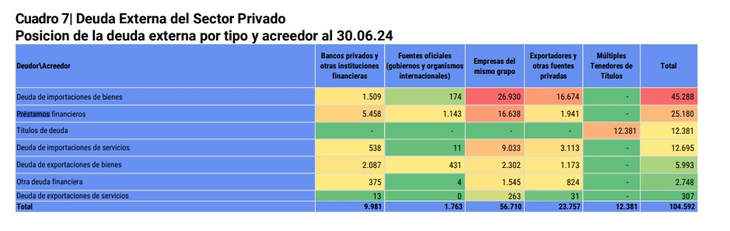

As to inter-company debtupdated BCRA data to June 30 this year show that the stocks of private liabilities with companies of the same group amounted to US$56,710 million. Of that total, the majority corresponded to debt for imports of goods (US$26,930 million). Secondly, there were financial loans (US$16,638 million)those to which Bausili alluded.

Menescaldi compared that stock with what was in 2022before the tightening of exchange restrictions for the payment of imports, among other aspects. In that period, The financial debt between companies of the same group increased by US$4,326 million. However, For the economist, we must not only consider “financial loans but also commercial debt.”

In that period, total private debt increased by US$17,185 million, of which US$15,557 million corresponded to intra-company liabilities.Menescaldi calculated. Most of the increase in inter-company debt was linked to commercial liabilities (US$11,231 million), even despite the issuance of Bopreal. For the analyst, although this incremental stock could have been reduced a little during the second semester, the decrease would not have been significant based on the data from the BCRA’s exchange balance.

image.png

Source: Ambito