The monetary base grew 1.2% in real terms without seasonality in November. The main expansion factor was the dollar purchases that the Central Bank made throughout the month, together with the increase determined by the BCRA in the reserve requirement rate on demand deposits of money market mutual investment funds (FCI) and passive stock market guarantees. Besides, coincided with an uptick in the demand for moneyaccording to data published this Friday by the monetary authority.

Specifically, In November, the monetary base registered an increase between balances at the end of the month of $1.1 trillion. In its Monthly Monetary Report, the Central Bank indicated that part of this variation was linked to the increase of 5 percentage points (pp) in the reserve ratio on the balances in FCI money market demand accounts and passive stock market guarantees of the banks. “This led financial entities to increase the current account balance at the BCRA to comply with this regulation,” the official report explained.

Monetary base expansion factors

How is expansive behavior explained? The main factor of money creation was the purchase of foreign currency by the BCRAwhich has as its counterpart the issuance of pesos. According to the report, this variable implied a net injection of $1.6 billion (without considering the sale of dollars to the Treasury to guarantee foreign debt payments).

For its part, Public sector operations were also expansive by $0.8 trillion for the payment of a debt maturity in pesos, made with funds from the account that the Government has in the Central Bank. Towards the end of the month, the monetary authority sold dollars to the Treasury, which will be used to pay the Bonares and Globales in January. “The operation was carried out with funds from the Treasury account in pesos at the BCRA, so the monetary effect of these operations was neutral,” the official report clarified.

image.png

As a counterpart, a portion of the money issued due to these factors was sterilized through the placement of Liquidity Tax Letters (LEFI) to the banks. This allowed to reabsorb $1.3 billion. Thus, the monetary base expanded by $1.1 trillion.

BCRA: demand for money recovers

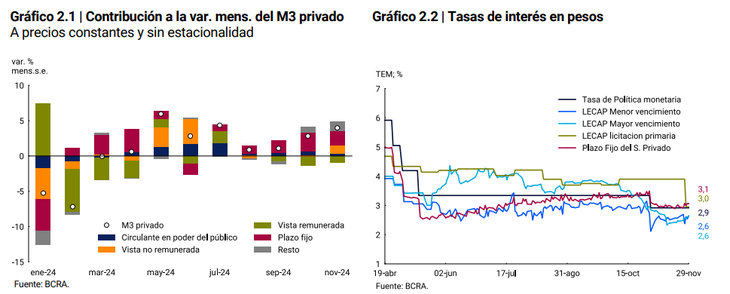

This coincided with a new month of recovery of demand for moneyhighlighted the entity chaired by Santiago Bausili. The report indicated that the broad monetary aggregate, private M3 (which includes currency held by the public and deposits in pesos at sight, time and others), recorded a 4% monthly increase at constant prices and adjusted for seasonality, a growth rate “higher than that of previous months.”

“In this way, the process of recovery of the demand for money from historical lows is strengthened, in a context of continuous decline in the inflation rate and recovery of income,” argued the BCRA and pointed out that, as a percentage of GDP , would have been 12.3%, that is, 0.3 pp above the previous month, although still 2.1 pp below the same month last year.

Regarding the components of the demand for money, growth was observed in both the paid and unpaid segments. Within the first, the increase was driven by fixed-term deposits (5.2% real without seasonality). The Central highlighted that The interest rate paid for this type of deposits was located throughout the month around the monetary policy ratewhich implies that the banks accompanied the cut in yields determined by the BCRA (from 40% to 35% nominal annual for the reference rate).

Meanwhile, the interest-bearing demand deposits they experienced a new contraction for the fourth consecutive month: fell 7.2% without seasonality in real terms compared to October. “This decrease was explained by the rebalancing of the money market FCI portfolios in favor of other assets, such as term placements and sureties. This dynamic was impacted by the interest rate differential in favor of the latter,” the monetary authority noted.

image.png

Finally, within the unpaid segment, demand deposits expanded 3.9% seasonally adjusted and at constant prices. In that sense, they were the second explanatory factor for the growth in the demand for money. The currency in the hands of the public increased by 2%.

It is expected that, in December, as a result of the high seasonality, the demand for pesos will continue to rise due to the collection of the half bonus, the holidays and the beginning of the vacation period.

Loans to the private sector grow

In addition, Loans in pesos to the private sector registered an increase close to $4.1 billion in November. This implied a monthly increase of 5.7% real without seasonality and 27.6% year-on-year. “In this way, they have accumulated eight consecutive months of growth and a real increase of 77.5% compared to the minimum recorded in January 2024,” highlighted the BCRA report and specified that, in terms of GDP, credit to the private sector would have rose to 6.6%, which implies an increase of more than 2 points of GDP from March 2024.

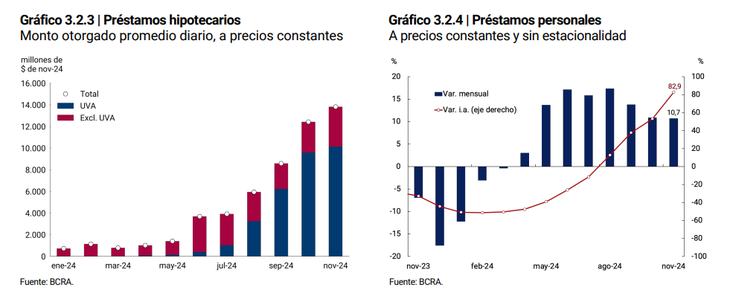

Although the increase in loans was generalized in all lines, the evolution of mortgage loans stood out, which, as in the last three months, grew at double-digit monthly rates.

image.png

“Loans with real guarantee (mortgage and collateral) were once again the most dynamic, with a real increase of 11.5% without monthly seasonality. Mortgage credit grew 19.7% at constant prices, although they are still 6.8% below the November 2023 level. The boost to mortgage loans came again from the lines adjustable by Purchasing Value Unit (UVA). For their part, collateral loans increased 7.8% in real terms and are 21.8% higher than the figure from a year ago,” the BCRA broke down.

Regarding financing for consumption, there was an increase of 7.9% monthly at constant prices (35.8% year-on-year). The personal loans increased 10.7% compared to October and 82.9% year-on-year. While the credit card financing They had a monthly advance of 6.1% and 16.2% year-on-year in real terms.

Finally, commercial loans continued to rise, although more moderately. Monthly growth was 2.4% in real terms. Among them, documents rose 3% monthly and 22.3% year-on-year, while current account advances increased 1.5% monthly and 27.1% year-on-year. By type of debtor, commercial credit destined for large companies rose 4.3% in real terms compared to October and 49.2% year-on-year, while that destined for SMEs increased in a smaller amount (0.7% monthly and 6.7% year-on-year ).

Source: Ambito