He supplementary annual salaryknown as bonus, It is a remuneration that will be paid in 2 (two) installments:

The first in June and the second in the month of December.

The complementary annual salary, better known as bonus, consists of the payment of fifty percent (50%) of the highest remuneration earned (gross) for all concepts within the semester.

The months included in its calculation are the following in complete periods.

- 01/01 to 06/30 first semester

- 07/01 to 12/30 second semester.

We remember that Law No. 27,073, which came into force on 1/20/2015, modified article 122 of the Employment Contract Law, providing as the date of payment of the second installment of the complementary annual salary, the 18th of December of each year.

Art. 122 – The complementary annual salary will be paid in two (2) installments: the first due on June 30 and the second due on December 18 of each year.

Let’s get to what matters, how the bonus is calculated and how much employees in a dependency relationship will receive.

Follow these teachings and calculate your Christmas bonus for the end of the year!!

Important: The Bonus is collected on December 18, which is why the month of December is not taken as a basis NOWbut if December turns out to be the best month, the difference is paid in JANUARY with the December salary

bonus chiesa 1.jpg

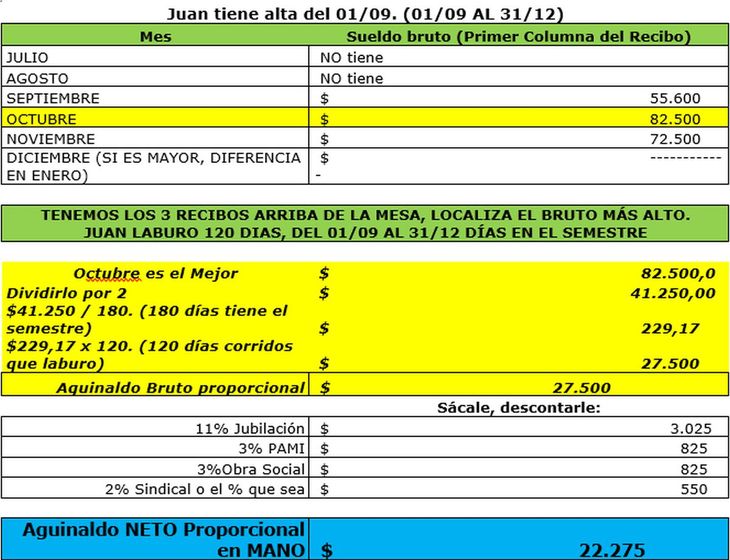

But what happens if Juan doesn’t have 5 receipts because he started working IN AUGUST AND HE DOESN’T HAVE 180 DAYS FROM 07/01 TO 12/31. YOUR INCOME IS FOR EXAMPLE ON 01/09

Look!!!

bonus chiesa 2.jpg

Watch the video

Embed – #bonus 2nd. Best gross from July to Nov / 2 and less 17% of law + union #aguinaldos aguina

Lawyer Specialist in Labor Law. President of APREEA

Source: Ambito