The board of directors of the National Securities Commission met with representatives of MAE and Matba Rofex to announce when the market will begin to operate in an integrated manner.

The directory of the National Securities Commission (CNV) presented A3 Mercados, the merger of MAE and Matba Rofex and confirmed the launch date, which will begin to work in an integrated manner in the first quarter of 2025.

The content you want to access is exclusive to subscribers.

Dr. Roberto Silva highlighted that “from the CNV, we have supported this merger from the beginning, because we believe that the integration of these entities will give greater development to the Argentine capital market, with cutting-edge technology and new opportunities” and added that “all initiatives that tend to ensure that we have a broad and efficient capital market will be accompanied by this board.”

The merger of Mercado Abierto Electrónico SA (MAE) and Matba Rofex SA (Matba Rofex) was approved in last November by the shareholders of both firmsand will be chaired by Robert Olsen and the vice-presidency by Andrés Ponte. The authorities promise a more robust, transparent and efficient market, with international projection.

A3 Markets: what benefits will it offer for investors

The new market will offer a comprehensive menu of products, which includes agricultural and financial items in both cash and futures and options trading, registration of bilateral and OTC (over-the-counter) operations.

A3 has its origin in three companies originating from the city of Santa Fe that is consolidated as a financial center, MAE, Matba and Rofex.

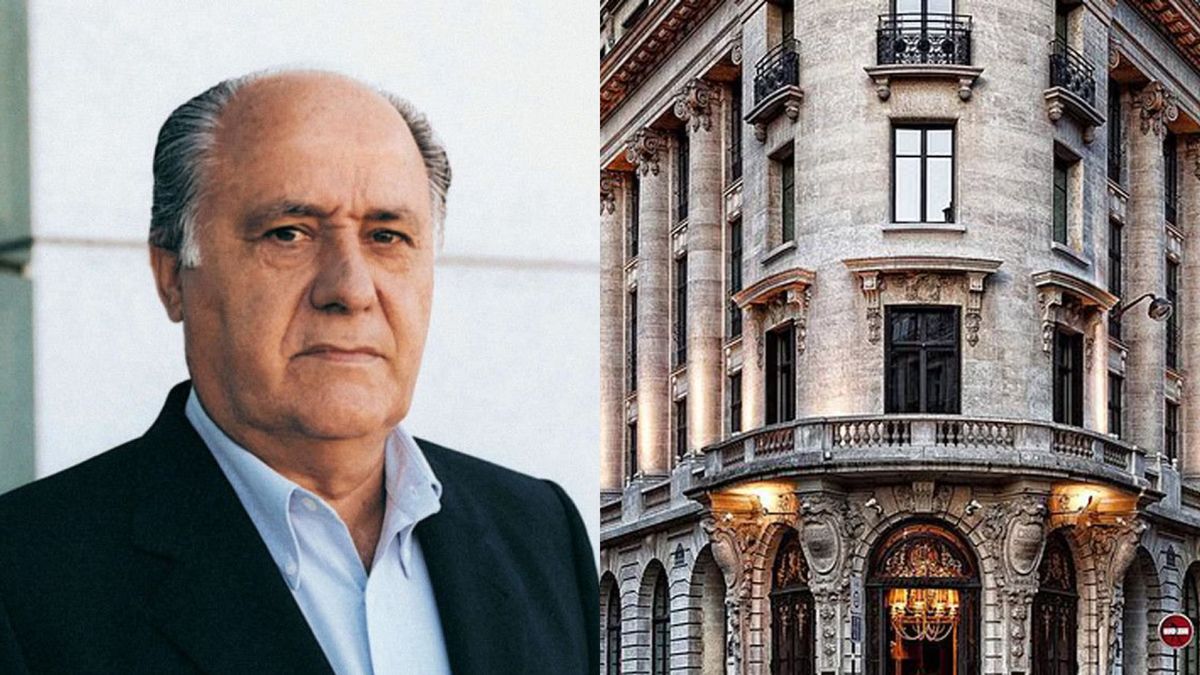

mae2.png

Representatives of the CNV, Matba Rofex and MAE together

Source: Ambito