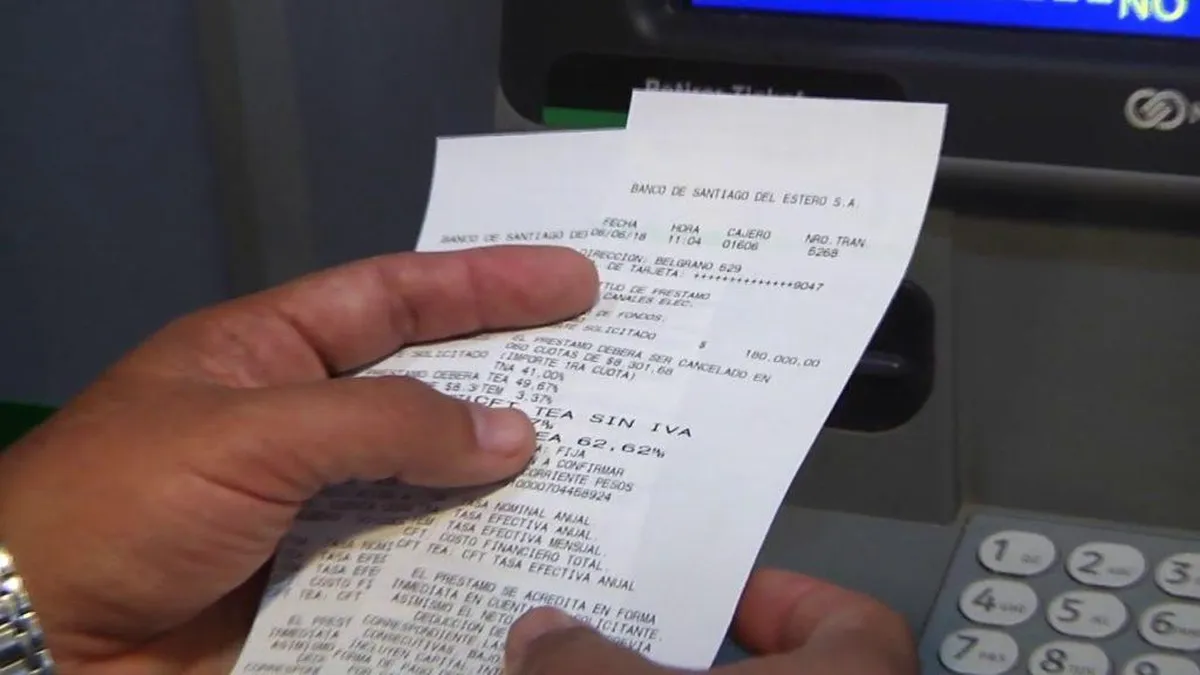

This is the paper provided by the summary of the transaction. However, they recommend not printing it.

Experts recommend do not print the ticket at ATMs that provides the information with the transaction summary and remaining balance in the account. This same one is offered after withdraw money from the machinesunder the offer of a option to print it.

The content you want to access is exclusive to subscribers.

The problem with these receipts is that they contain a lot personal informationwhich can be used later to scams, fraud and theft. The thing is that the data from the card can even be extracted from it.

On the other hand, if you decide to print it, the recommendation is destroy it completely before throwing it awaysince there is a possibility that someone else recovers it and uses the data that it contains for your benefit, harming the owner of the account.

In this way, they can reach empty user’s bank accounts that prints the ticket. Therefore, it is important to keep receipts to minimize this risk.

The increase in scams

Bank scams are common in Argentina and the world. The Specialized Fiscal Unit in Cybercrime (UFECI) indicated that in the years 2023 and 2024, complaints increased by 45% and they reached more than 35,000 cases.

Precisely, one of the most common scams is facilitated by the users themselves with these printed receipts that clients throw in the trash once the operation is completed. The following data appears on the paper: last digits of the card, the time of the transaction, the amount withdrawn, the account balance and the transaction number.

Bank security measures to avoid scams

- It is recommended do not share keys with anyone. Additionally, no person can ask you to enter your passwords or Security Token number through email, social networks, WhatsApp chains or by SMS.

- Do not provide complete information about your cards or accounts. It must be taken into account that no bank operator can request these complete credit or debit card details while acting as a guide at an ATM.

- Do not make payments or provide passwords through telephone operations.

- Always identify the sender and confirm its security. To do this, verify the validation check marks and that the bank’s URL is HTTPS and has a lock.

- Always have the consumption alerts activatedto know what expenses and movements are made with the cards.

- Finally, if you receive a call, email or message from another company requesting your card information, it is preferably recommended cut the call and contact to the telephone numbers on the back.

Source: Ambito