Prices

Olaf Scholz wants to reduce VAT on food – is that wise?

Copy the current link

Five instead of seven percent VAT on supermarket purchases: In a TV interview, Chancellor Scholz suddenly suggests relief. Just an election campaign or a good measure?

Tuesday evening, daily topics. It’s actually about Syria, Ukraine and the early elections, for which Olaf Scholz is clearing the way today with a letter to the President of the Bundestag. Moderator Jessy Wellmer questions the Chancellor and speaks of the “uncertainty among people” in view of the current crises. Then Scholz suddenly becomes unexpectedly specific: “Today we see that inflation is even higher for those who have to calculate precisely – especially when it comes to food or something similar.” That’s why he wants to reduce the VAT on food from the current seven to five percent. “That would help a lot of people who earn little money. And it wouldn’t be an excessive burden on the federal budget.”

And suddenly the SPD opens a tax debate. Pure campaign bells and whistles? Or is there something to it? One thing is clear: the SPD is far behind in surveys. It is therefore not unlikely that Scholz will leave the election campaign not as Chancellor, but as Finance Minister. But the idea is not entirely absurd: the federal government had already reduced the VAT rate during Corona. The measure can be implemented quickly. But would it really relieve the burden on the little people? A little check.

How much does the proposal cost?

It would cost around five billion euros to reduce VAT on food by two percentage points. This is unanimously explained by tax experts from the economic institutes IfW and DIW. Converted to German citizens, that would be an average of around 60 euros more per person in their pockets.

That could certainly be financed, but the sluggish economy is currently tearing new holes in the budget. After all, the public sector also saves by reducing VAT. The measure will ultimately cost four billion euros.

Will the reduction be felt by consumers?

During Corona, VAT was already reduced – even if only temporarily. Until then, economists were concerned that a small reduction in VAT would simply be withheld by retailers or only a small portion would be passed on to customers. At the time, the Ifo Institute monitored 60,000 prices to test the thesis. The surprising result: the tax cut was even “completely” passed on by the supermarkets.

Chocolate muesli from Kölln: less in it – so a fifth more expensive

Kölln Original chocolate oat muesli

Kölln writes “new size” on his chocolate muesli, the classic of the not really healthy, but delicious types of muesli. That’s at least a hint, but why doesn’t it say: “Smaller size, therefore 20 percent more expensive, because cocoa is that expensive on the world market right now”? Customers would have understood this without having to scan a QR code. Yes, cocoa prices have risen significantly. A smaller package remains cheating. Alternative: You honestly increase the price. Hand on heart: Kölln’s product managers also know this

© Hamburg Consumer Center / New installation stern

Back

Further

Does less VAT really help the common people?

When people talk about tax reforms and easing the burden on citizens, they usually talk about income tax. However, relief there does not reach those with low incomes at all. Things are completely different with VAT. 2016 calculated how the type of tax burden depends on income. (For details, see “The Whale in the Bathtub” below.)

The result, to put it simply: the less you earn, the more of your income goes to VAT. Households in the lower income quarter pay more than 10 percent of their income in VAT. Income tax is less than 1.5 percent. Even middle-income households pay more taxes on their purchases than on their salaries. Only those whose salary belongs to the top third of incomes pay more in income tax than in VAT.

Therefore, if you reduce income tax or social security contributions, it will not affect low-income households. If you want to quickly relieve the burden on those who earn less without a lot of bureaucratic effort, VAT is the right choice. “Everyone benefits here,” says economic researcher Stefan Bach, “but relatively much goes to the little people.”

Do wealthy people have more of it?

The truth is of course: High earners also shop in the supermarket and save by reducing VAT on food. As an older calculation from DIW illustrated by Stefan Bach today, the very rich would, in absolute terms, save about twice as much money as the very poor. When it comes to middle incomes, however, the differences are no longer so great.

Is there a better solution?

If you want to relieve the burden equally on everyone or even just those on low incomes, other paths would have to be taken. A solution like the idea of climate money would be conceivable: a flat rate that is paid to everyone in the same amount. The traffic light government had actually planned to create the technical conditions for such steps – it is unlikely that this will happen before the election. However, there is no quick solution. If this existed, it would be possible to abolish the reduced VAT rate – and then pay the additional income back to everyone as a flat rate. This would only relieve the burden on small incomes – and abolish bureaucracy. Bach made a suggestion like this years ago, the so-called .

Why is the SPD suggesting this?

Such a VAT bonus would probably go too far for the SPD. Because she is probably quite happy that a reduction in the reduced VAT rate from seven to five percent would ultimately relieve everyone. The message is: Yes, we understand. Inflation is harsh. After all, that was one of the reasons that brought Donald Trump victory in the US presidential election. According to a current Forsa survey for consumer advice centers, a quarter of consumers say they will have to resort to savings or the overdraft next year in view of the increased costs. The topic is also burning in people’s minds in Germany.

The SPD also has to look to the left – to the Sahra Wagenknecht alliance. There the price increases are directly linked to support for Ukraine. Olaf Scholz said it directly: “If we have to support Ukraine, if we have to spend more on security, then that must not be at the expense of cohesion and modernization. And suddenly we have less money for pensions or health or care or streets.” This is the SPD’s central election message.

For experts: “The whale in the bathtub”

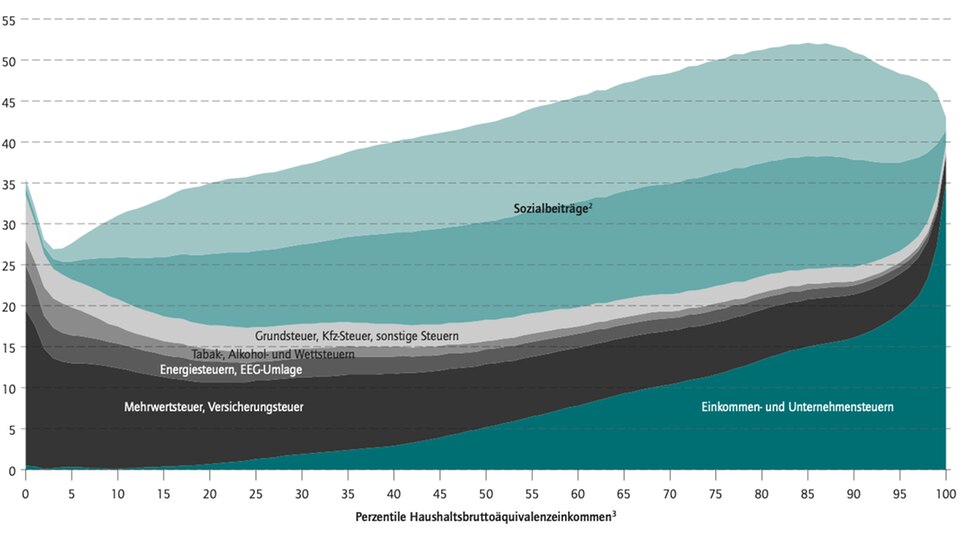

Anyone who wants to have a say in tax debates should know the following graphic. It is known among economists as “The Whale in the Bathtub.” As described above, DIW researcher Stefan Bach and colleagues calculated how high the share of taxes and social security contributions is in household income. The incomes are plotted on the x-axis, sorted in percent by level: on the left are the lowest incomes, on the right are the highest incomes. The average German household income is plotted at 50. The y-axis (upward) shows what percentage of income must be paid in taxes and duties.

The black area shows the VAT (plus insurance tax, as the VAT on insurance products is called). Income taxes are dark green. Together with the other direct taxes, they form the “bathtub”. The “whale” is the social security contributions.

As the graphic clearly shows, tax progression is not as pronounced as many believe. The share of income tax increases sharply with salary. Conversely, people with little income have a much higher direct tax burden. The calculation of this graphic is very complex, which is why it is not updated regularly. For example, although there is no longer an EEG levy, in principle the graphic still reflects the current situation in tax law.

Source: Stern