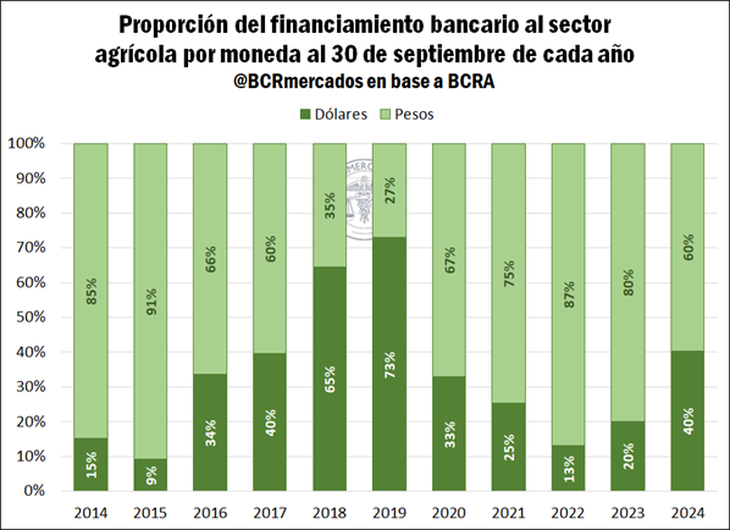

Despite the fall in international prices, agriculture was one of the main drivers of the economy this year. Along these lines, loans in dollars to the agricultural sector represented 40% of the total loans granted, according to the BCRA.

He financing for the agricultural sector In foreign currency it registered an increase of 87% compared to 2023, according to data published by the Central Bank of the Argentine Republic until September. This growth reflects greater demand from the field, reaching the highest proportion since 2019.

The content you want to access is exclusive to subscribers.

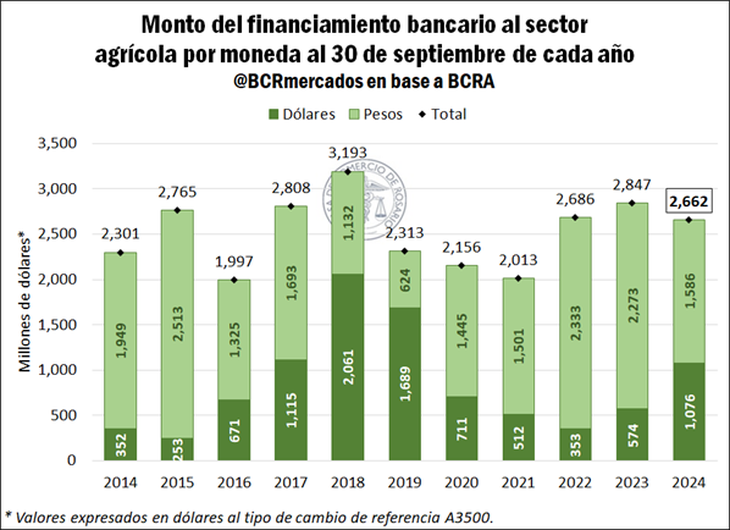

A report of the Rosario Stock Exchange (BCR) He pointed out that the total loans granted by banking entities amount to US$2,662 million. This amount includes financing in both foreign currency and pesos, converted to its equivalent in dollars at the official exchange rate.

bank_financing_1.png

“The accumulated stock of loans granted by financial entities covers various instruments, such as current account advances, document purchases, single-signature documents, discounted documents, mortgage loans, pledges, personal loans, financing to credit card holders and any other type of cash loan”, details the report.

Of the total US$2,662 million, US$1,586 million correspond to loans in pesos converted to dollars, while the remaining US$1,076 million were financing in foreign currency.

Financing to the agricultural sector

Analysis of the total volume of financing to the countryside reveals a decrease of 7% compared to the same period of the previous year. According to the Rosario Stock Exchange (BCR), this drop is due to a 30% contraction in loans granted in pesos, while loans in dollars showed a notable year-on-year increase of 87%.

Credits in foreign currency

According to data from the Central Bank, Dollar loans to the agricultural sector represented 40% of the total during the period from January to September 2024, marking the highest proportion recorded in the last five years.

“The dynamics of this growth respond to several factors, including: the increase in dollar deposits driven by the recent money laundering program, the gradual flexibility of the exchange market, the reduction of requirements for local banks to grant financing in foreign currency, the exchange rate stability observed in recent months and expectations of a possible decrease in the pace of exchange rate adjustment (currently 2% monthly),” the BCR noted.

As a resultfinancing in dollars has grown both in absolute terms and in its relative participation within the total.

bank_financing_2.png

Source: Ambito