Menu

Travel insurance: should you take it out once or annually?

Categories

Most Read

Prime Deal Days 2025: Overview of the best Amazon deals

October 7, 2025

No Comments

Prices at the pump: Expensive East, cheaper West: Fuel prices vary

October 7, 2025

No Comments

A veggie schnitzel ban would be a bad joke

October 7, 2025

No Comments

Resignation of the Prime Minister: Permanent crisis in Paris – how endangered is the euro zone?

October 7, 2025

No Comments

We work to promote macroeconomic stability and growth

October 7, 2025

No Comments

Latest Posts

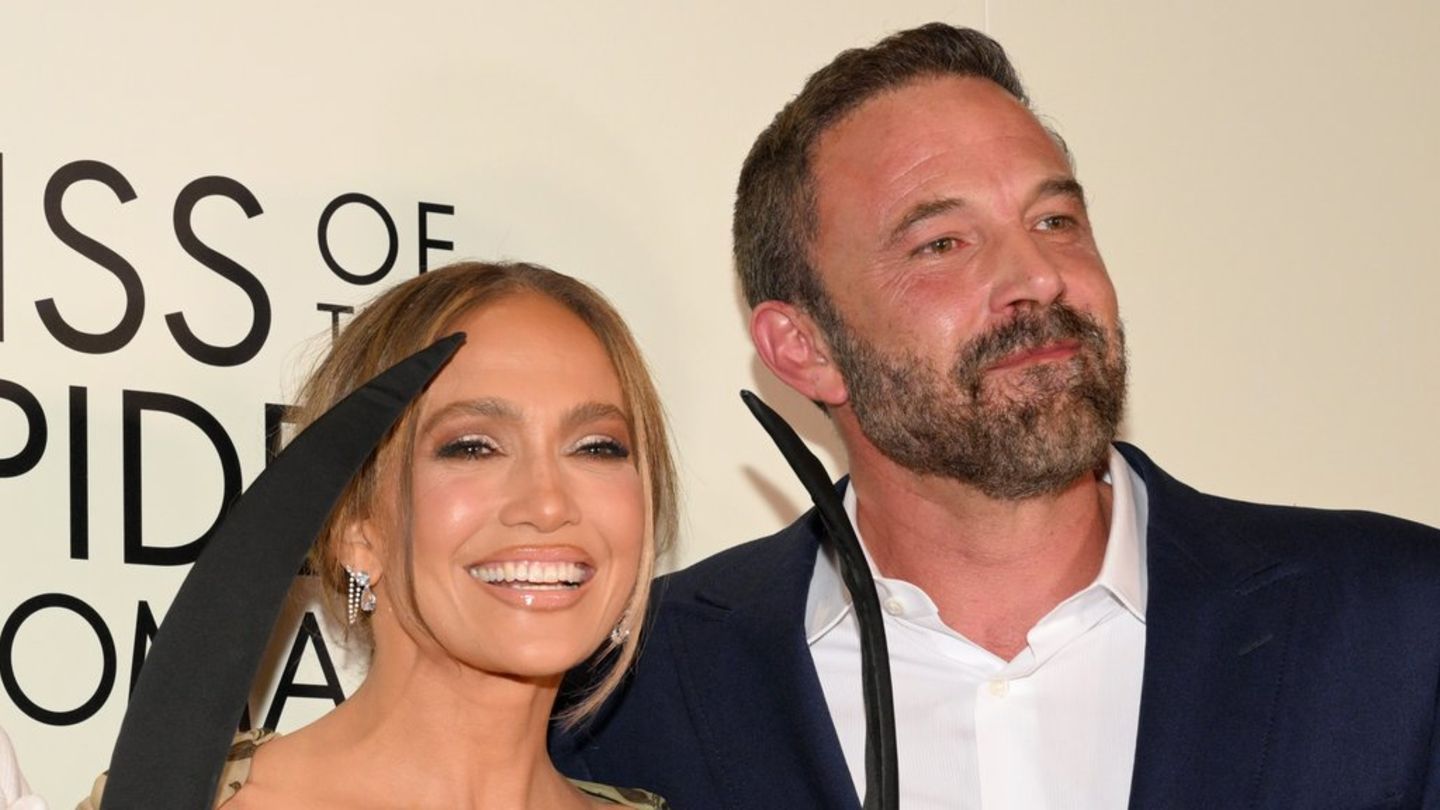

Jennifer Lopez and Ben Affleck: Comeback on the red carpet

October 7, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

Shoes stink, what to do? This is how you fight dirt and sweat

October 7, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

Strong Prime Deal: Hansgrohe shower head with a 52 percent discount!

October 7, 2025

No Comments

Prime Deal Days Water -saving shower head today 52 percent cheaper Listen article Copy the current link Add to the memorial list Those who shower

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.