According to the BCRA, loans in pesos rose again in monthly terms. Financing in dollars also showed increases.

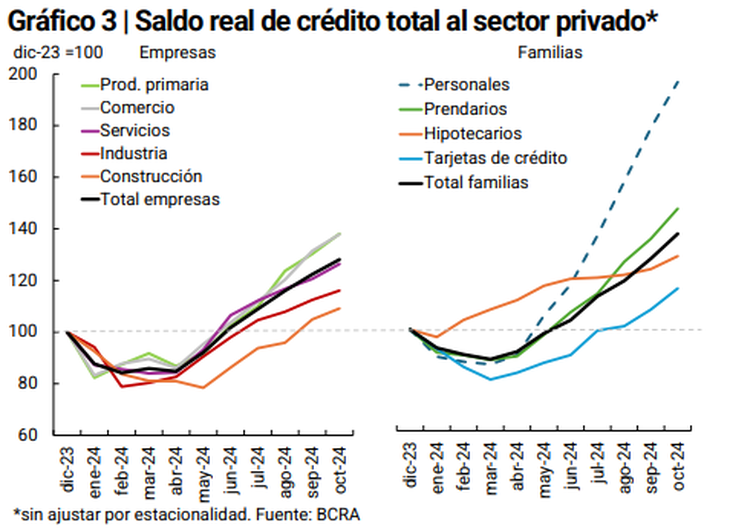

Loans in pesos to the private sector grew 6.9% monthly in October, in real terms, and accumulated an increase of 58.9% since April. Loans in dollars also showed an increase, in this case of 11.6% compared to September.

The content you want to access is exclusive to subscribers.

This was reported by the Central Bank (BCRA) in your “Report on banks”published this Thursday. The monetary authority explained that, in the tenth month of the year, the performance of credit in local currency was fundamentally driven by consumer linesinfluenced in part by the seasonality in credit card financing.

In the case of credit in “hard” currency, the driving force was the commercial segment, particularly export prefinancing and documents.

In the aggregate, the balance of financing to private individuals increased 7.5% real, with increases in both the business and family segments. In interannual terms, the advance was 15.8%.

image.png

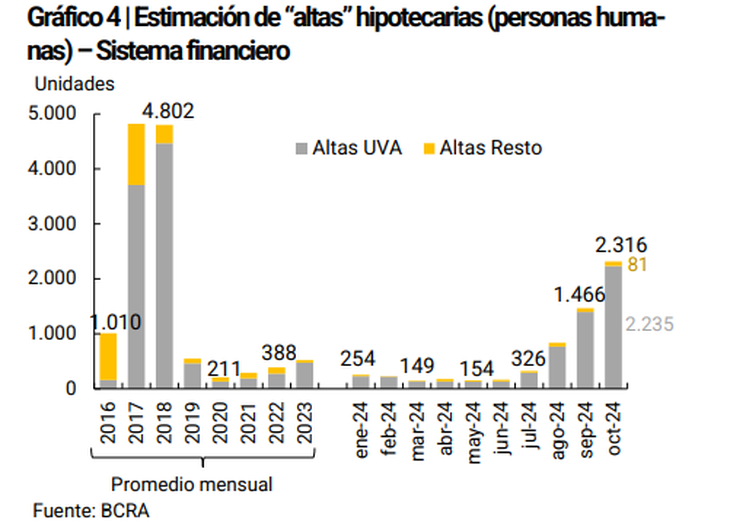

Mortgage loans continued to gradually accelerate their growth rate monthly, increasing 4.7% versus September. The BCRA estimated that the group of financial entities incorporated more than 2,300 new mortgage debtors in the month of analysis, far exceeding the “additions” that, on a monthly average, were registered in the last five years. Almost all of them were arranged at UVA.

image.png

The Central report showed that the dynamism of financing was possible, in part, thanks to the fact that deposits in banks rose 3.7%, mainly highlighting a 7.6% increase in traditional fixed terms.

“Within the framework of the Asset Regularization Regime (also called laundering) in October the balance of foreign currency deposits in the private sector increased 9.8% (in currency of origin). Based on the performance of the last two months, in October the balance of deposits in foreign currency doubled that of a year ago. The balance of total deposits (all sectors and currencies) increased 4% in real terms in the period,” detailed the institution led by Santiago Bausili.

Source: Ambito